By Wolf Richter for WOLF STREET.

Starting today, China’s stock exchanges stopped releasing daily data on fund flows from overseas investors. Fund flows are a key sentiment indicator, and the sentiment of foreign investors has been morose as China’s stock market has become an immense long-term money pit.

And foreign investors have yanked their money out of Chinese stocks, including Warren Buffett whose Berkshire Hathaway has sold over half of its stake in BYD. Year-to-date, fund flows from foreign investors in Chinese stock markets were negative as of Friday, according to Bloomberg. Obviously, in order to prop up the stock market, weak data must be obscured, and so this daily fund-flows data will not be forthcoming any longer.

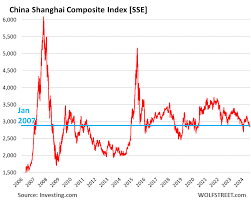

China’s stock markets have been a long-term horror show for foreign investors. Since the peak in October 2007, the Shanghai Composite Index has plunged 52.5%. Today, at 2,894, it’s back where it had first been in January 2007. Buy and hold forever?

“Beijing stopped the release because the data hasn’t been looking good, and it’s volatile,” Xin-Yao Ng, director of investment at abrdn Asia Ltd, told Bloomberg. “They probably don’t want the data to amplify capital outflows” but “it doesn’t solve the root of the problem.”

The remaining options to get insights on fund flows by foreign investors are now the quarterly reports on financial assets held by overseas investors released with a lag by the People’s Bank of China. In addition to the long lags, they also measure the value of outstanding equities held by foreigners through broader channels, rather than flows, Bloomberg said.

Chinese authorities have tried multiple times to prop up the stock markets in various ways by leveraging the “national team” of state-controlled institutional investors that would buy stocks and stop selling stocks. Authorities would warn against “malicious” short-selling and exhort companies to increase share buybacks. The PBOC would boost liquidity, etc.

These efforts played out again early this year, including with state-controlled funds purchasing an estimated $66 billion in ETFs, to stop yet another wave of selloffs that had started in mid-2023.

This stuff works, for a little while, as foreign speculators piled into it trying to make short-term gains. So the Shanghai Composite Index, upon all these efforts to prop up the market, spiked 17% (or by 469 points) from the February 4th low (2,702) to the May 19th high point (3,171).

But then foreign investors took their profits and yanked their money out, with fund flows from overseas investors having now turned negative for the year 2024.

And the Shanghai Composite Index has now given up 278 points, nearly 60% of the 469 points it had gained during the prop-up rally, in a replay of prior prop-up rallies. So it’s far better to obscure the sentiment index of foreign speculators, it seems.

Long-term investors are looking at one of the ugliest stock market charts around — see the chart above — that since 2007 has described a relentless money pit, with huge rallies followed by huge declines. And even success stories, such as BYD: Since Buffett started dumping the stock in 2022, the stock has dropped 33%.

Take the Survey at https://survey.energynewsbeat.com/