By Stuart Turley, Energy Podcast Host

As the world’s largest energy consumer, China’s advancements in oil and gas drilling technologies and programs have reached a point where they can meaningfully influence global markets. Over the past decade, China has invested heavily in enhancing domestic production through improved drilling techniques, such as horizontal drilling and hydraulic fracturing in shale formations, alongside state-backed exploration in mature fields like Daqing and Shengli. These efforts aim to bolster energy security amid rising demand and geopolitical uncertainties. By examining the last 10 years of production data versus imports for both oil and natural gas, we can assess how increases in domestic output could reshape global supply-demand dynamics, potentially supporting or pressuring prices in oil, gas, and LNG markets.

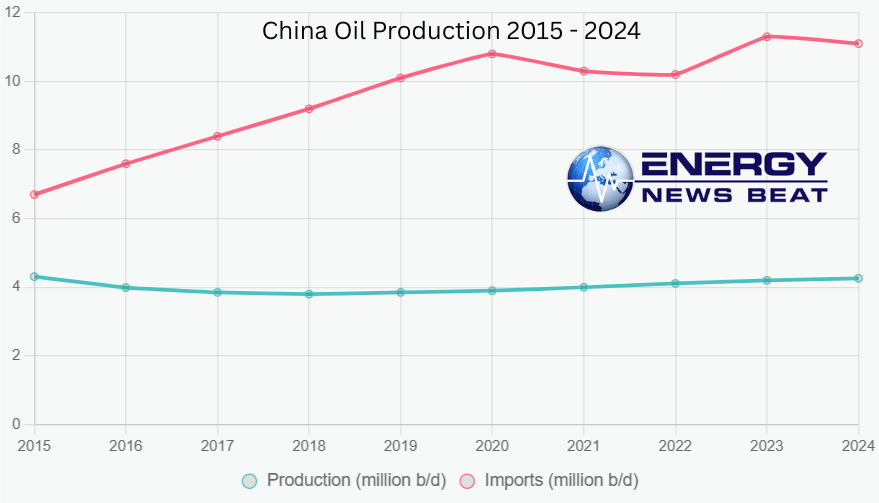

Oil Production and Imports:A Decade of Trends

China’s crude oil production experienced a dip in the mid-2010s due to maturing fields and cost-cutting measures but has rebounded strongly since 2019, driven by technological upgrades and policy incentives. Annual production fell from around 3,990 thousand barrels per day (bpd) in 2016 to a low of about 3,790 thousand bpd in 2018 before climbing steadily to an estimated 4,300 thousand bpd in 2025.

This represents a compound annual growth rate (CAGR) of approximately 0.8% over the decade, with sharper gains in recent years.In contrast, crude oil imports have surged to meet escalating demand from refining, transportation, and petrochemical sectors. Imports rose from 7,630 thousand bpd in 2016 to a peak of 11,450 thousand bpd in 2025, reflecting a CAGR of about 4.6%.

This growth has made China the world’s top oil importer, accounting for roughly 20-25% of global seaborne crude trade in recent years.The chart below illustrates these trends, highlighting how production gains have only modestly offset import reliance, with imports still comprising over 70% of total supply.

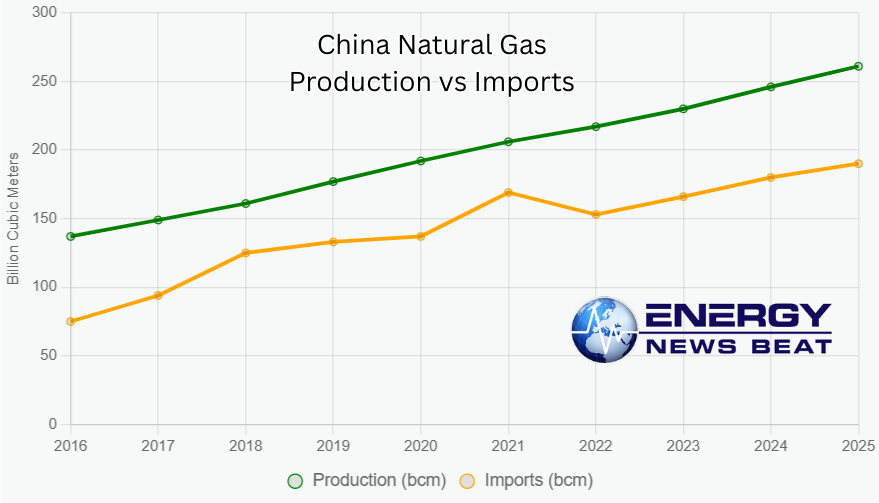

Natural Gas Production and Imports: Rapid Domestic Growth

Natural gas tells a similar but more accelerated story. China’s gas production has grown robustly, from 137 billion cubic meters (bcm) in 2016 to an estimated 261 bcm in 2025, a CAGR of about 7.4%.

This surge is fueled by developments in unconventional resources like shale gas in the Sichuan Basin and coalbed methane, supported by government targets for cleaner energy to combat air pollution.Imports, including pipeline gas and LNG, have expanded even faster to bridge the supply gap, rising from 75 bcm in 2016 to around 190 bcm in 2025, with a CAGR of approximately 10.8%.

LNG has been a key component, with China becoming the world’s largest importer, though pipeline supplies from Russia via Power of Siberia have diversified sources.The following chart shows the parallel growth, with production increases helping to temper import dependence, which still hovers around 40-45% of consumption.

Potential Impacts on Global Oil, Gas, and LNG MarketsChina’s drilling improvements—such as enhanced recovery rates and deeper offshore exploration—could accelerate domestic output growth beyond current trends. If oil production rises by an additional 200-300 thousand bpd over the next 5 years (a plausible scenario given recent investments), it could reduce import needs by a similar amount.

This would ease pressure on global oil demand, potentially capping price upside in a market already facing EV adoption headwinds. For instance, lower Chinese imports could hit suppliers like Russia, Saudi Arabia, and Angola hardest, leading to softer Brent crude prices, possibly stabilizing around $70-80 per barrel absent other disruptions.In natural gas, a 10-15% boost in annual production (to 300 bcm by 2030, as projected) would significantly curb LNG import growth.

China accounted for about 20% of global LNG trade in 2024; slower demand could flood the market, depressing Asian spot LNG prices and hurting exporters like Australia, Qatar, and the US. Pipeline imports might remain steady, but overall reduced demand could support lower global gas prices, benefiting importers elsewhere while challenging new LNG projects’ economics.However, these impacts hinge on demand trajectories. If China’s economy rebounds strongly, total consumption could outpace production gains, sustaining high imports. Conversely, energy efficiency and renewables growth might amplify the downward pressure on imports.

Overall, China’s evolving self-sufficiency is shifting it from a pure demand driver to a market balancer, with ripple effects on price volatility and investment in global upstream projects.In summary, while China’s oil and gas imports remain dominant, the upward trajectory in domestic production signals a maturing capability to influence markets.

We will be watching the Power of Siberia 2 pipeline expected to come on line in 4 years. It has the potential to change Russia and Chinas relationships, and provide finacial gains. The new pipeline will hold enough natural gas to replace the volumes that Russia used to sell to the EU.

This could foster more stable prices by moderating demand spikes, but it also underscores the need for exporters to diversify amid Beijing’s push for energy independence.

Check out theenergynewsbeat.substack.com.

Be the first to comment