Energy News Beat Publishers Note: George Friedman’s group the Geopolitical Futures is a first-rate thought leadership pool of world politics and the potential outcomes. In my interview with George last year we covered his book “The Storm Before the Calm” and the cyclical nature of politics. There are many factors in the world right now and China is at the forefront of almost every discussion. Excellent article by Phillip on the GPF team.

In 1992, during a visit to Inner Mongolia, Chinese leader Deng Xiaoping quipped: “The Middle East has oil, China has rare earths,” referring to 17 elements on the southern end of the periodic table that are essential to the manufacturing of everything from light bulbs to smartphones to fighter jets. China indeed has rare earth metals, oxides and permanent magnets in spades, as well as a preponderance of the world’s rare earth refining operations. As recently as 2010, an estimated 97 percent of rare earths came from China. And Deng, who made rare earths a central part of his plans to turn China into a high-tech powerhouse beginning in the mid-1980s, saw this as “of extremely important strategic significance,” calling explicitly for China to fully exploit this advantage.

Subsequent Chinese governments in Beijing have never seemed quite sure of how to do so. But last week, the Financial Times reported that Chinese officials were investigating whether a ban on exports of certain rare earths could cripple U.S. production of F-35s and other weapons systems. A few days later, Bloomberg reported that Beijing was considering a ban on rare-earth refining technology. China’s hawkish state-owned Global Times then said something to the effect of, “We’re not threatening export controls, except maybe we are.” Curiously, on Friday, China announced a 27 percent increase in rare earths production quotas.

China has periodically threatened to weaponize its dominance over the rare earths industry by banning exports in such a manner. It’s rarely followed through, though, and its export controls have often backfired. But Beijing may be facing a “use it or lose it” moment since, one way or another, China’s stranglehold on the industry is coming to an end.

China’s Dominance

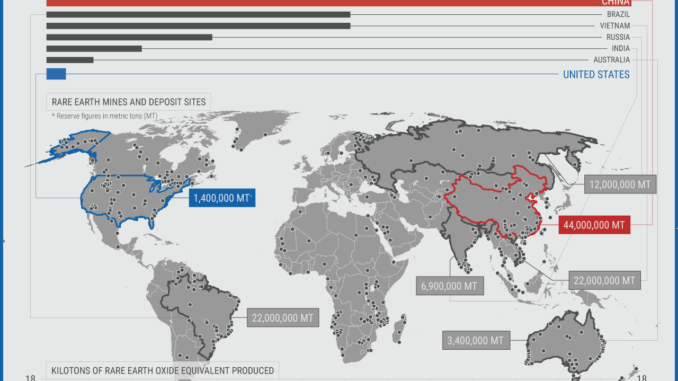

The first thing to understand about rare earth elements is that they’re not particularly rare. They can be found in vast quantities throughout the world, including in the countries most worried about Chinese dominance over the industry. The United States and Australia have more than enough untapped reserves to be self-sufficient. In a single deepwater discovery in 2013, Japan found enough rare earths to meet its needs for centuries (provided it can find a cost-effective way to extract them, anyway).

However, mining operations are exceedingly rare outside of China. Australia is the world’s second-largest producer, and it didn’t have an active mine until a decade ago. There’s only one operational mine in the U.S., and it’s been mothballed more often than not since the end of the Cold War.

Rarer still are rare earths processing operations. Refining rare earths is expensive, complicated and environmentally (and thus politically) problematic. The only major processing plant outside of China is a facility in Malaysia run by Australian rare-earth developer Lynas, and production there has routinely been bogged down by regulatory and political issues. When immense state support began to pay off in the form of Chinese vertical consolidation over the industry in the early 2000s, no one put up much of a fuss, in part, because no one wanted to deal with the headaches of trying to process rare earths themselves.

But rare earths play a role in nearly every aspect of geopolitical competition among modern-day powers. They’re used in hard drives, in telecoms infrastructure, in oil refining, in nuclear rods and wind turbines, and in missile guidance systems. A single F-35 requires some 920 pounds of rare earths elements, according to the Pentagon. An Ohio-class submarine is built with 9,200 pounds of them. China’s dominance over the REE supply chain was always going to generate alarm eventually.

For the rest of the article: Subscribe Geopolitical Futures:

2 Trackbacks / Pingbacks

Comments are closed.