By George Lei, Bloomberg markets live reporter and analyst

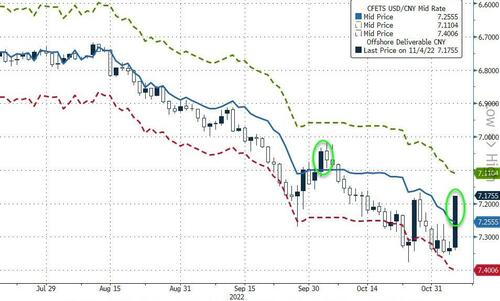

The Chinese yuan, trading both onshore and offshore, posted the biggest daily rally in decades. The offshore yuan advanced more than 2% versus the dollar at one point, the best day since August 2010, when trading first started, and is back above the CNY Fix for the first time since October 10th…

Its onshore counterpart jumped as much as 1.7%, a performance unseen since July 2005, when Beijing permitted the currency to appreciate 2% in a one-off move…

The offshore Yuan is the strongest relative to the fix since October 5th…

The confluence of several pieces of good news gave the yuan a strong boost: the US dollar fell more than 1%, lifting EM currencies across the board. And China-related equity indexes are among the world’s best performers this week amid speculation about reopening, also boosting sentiment.

On Friday, a few concrete developments added to market conviction that Beijing is taking concrete steps toward reopening: German chancellor Olaf Scholz, after meeting with Xi in Beijing, said China would make BioNTech’s Covid shots available to foreigners in the country, a potential first step toward wider offerings. Bloomberg also reported that officials are working on plans to end Covid flight suspensions. A similar mechanism for Hong Kong was halted in July and the city’s reopening sped up in the following months.

Despite the rallies, the offshore yuan is only trading at its highest since Oct. 27, which underscores the massive selloff over the past week. Friday’s session high for USD/CNH was 7.1777, and a breach of the Oct. 27 high at 7.1662 may open up path toward the 50-DMA at 7.1142.