-

Total Dark Fleet:

-

Combining oil and LNG tankers, the dark fleet likely ranges from 600 to over 1,600 vessels, depending on the source and definition (e.g., including “grey fleet” or only “black fleet”).

-

Russia’s shadow fleet is the largest component, with estimates of 600–1,649 vessels for oil and 9–19 vessels for LNG.

-

Other sanctioned countries (Iran, Venezuela) contribute smaller numbers, with Iran’s dark fleet estimated at 257 vessels in 2022.

-

A Finnish investigation in January 2025 uncovered a Dubai-based network managing 55 vessels (oil and LNG), with one UAE firm owning 24 sanctioned ships.

-

-

Opaque Operations: Dark fleet vessels frequently change ownership, flags, and names, complicating tracking. For example, vessels like Asya Energy and Pioneer were renamed and transferred to obscure firms in 2024.

-

Grey vs. Black Fleet: Windward distinguishes between “grey fleet” (suspicious but not fully illegal) and “black fleet” (clearly illegal), inflating total counts when combined.

-

Sanctions Evasion: The fleet’s size grows as Russia and others adapt to sanctions, with new methods like GNSS manipulation and STS transfers.

-

Data Variability: Estimates vary widely (e.g., 343 tracked ships vs. 1,600+ black fleet) due to differences in methodology, scope (Russia-only vs. global), and real-time tracking challenges.

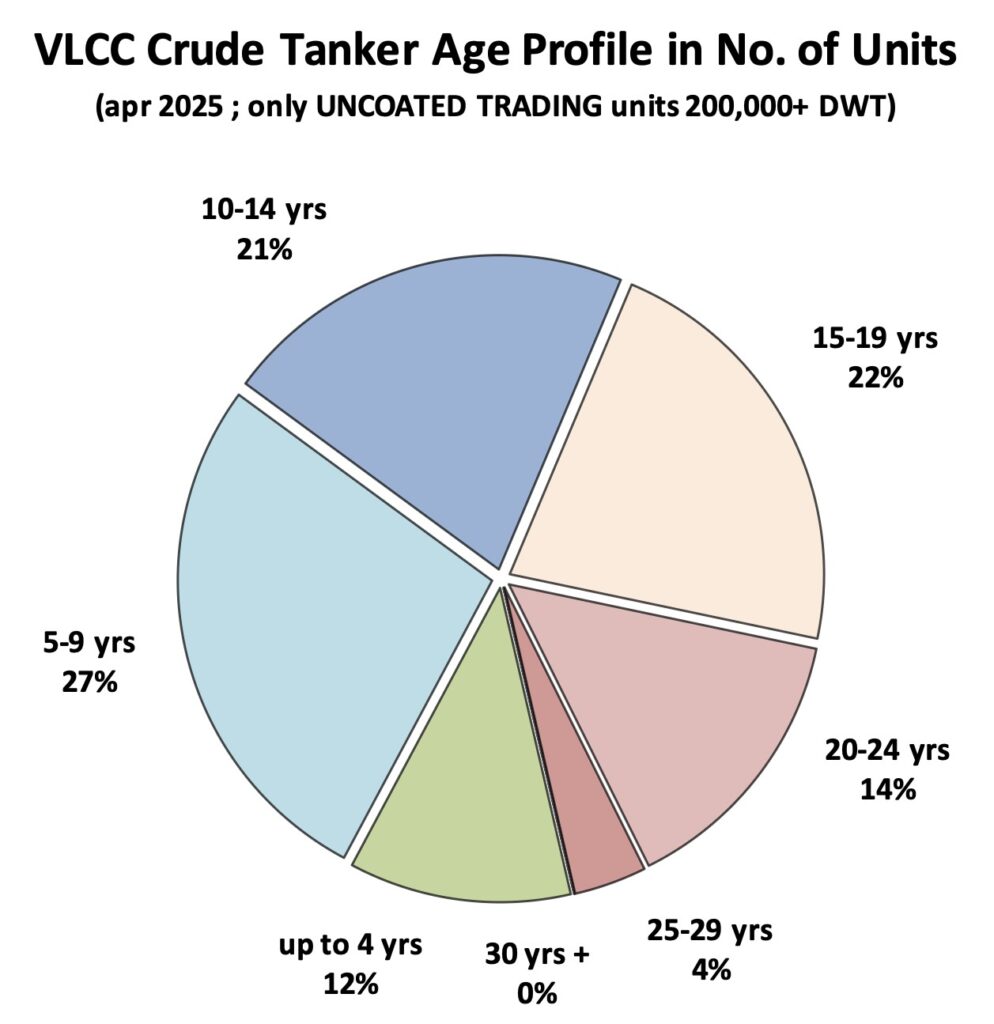

Today, there are around 130 VLCCs over 20 years old still trading, compared to fewer than 20 five years ago, according to data from Tankers International, which notes that around two-thirds of these vintage supertankers are engaged in moving sanctioned oil. Over the next four years, the number of vessels exceeding 20 years forecast by Tankers International to double, representing 21% of the trading fleet.

A very small orderbook points towards an ongoing deficit in terms of fleet replacement. Just one VLCC was delivered last year, and only five are scheduled for 2025.

Writing for Splash last month, Mette Frederiksen, head of research and insight at Tankers International, noted: The current landscape presents a paradox: while the fleet is growing in number, the effective supply remains stagnant or in decline. With shipowner indecision and shipyard bottlenecks delaying the next wave of newbuilds, and older vessels struggling with efficiency losses, the VLCC market faces a prolonged period of supply tightness.”

This supply tightness in terms of viable VLCCs able to trade worldwide has seen rates push up this month.

The TD3C route from the Middle East to Asia was up $2,100 a day to $55,000 a day yesterday.

“A shrinking list of available vessels is forcing charterers into swift action to avoid being left behind in this strengthening market,” noted a shipping report from SEB, a Swedish bank. “The gradual rate increases, unlike previous sharp spikes, are fueling owner optimism for sustained higher rates, a sentiment supported by the tighter vessel supply,” SEB added.

Source: Banchero Costa

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack