The global seaborne trade in copper concentrates is surging to new highs, with fresh data from Ursa Shipbrokers and AXSMarine showing record-breaking shipments in the first half of 2025. Loadings reached 18.5m tonnes during the six-month period, a 6.3% year-on-year increase from 17.4 million tonnes in the same period last year.

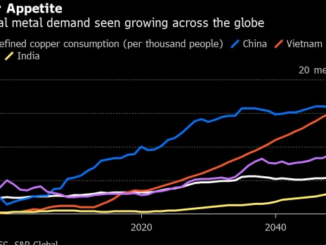

This growth marks the highest-ever first-half volume recorded in13 years of credible vessel tracking data, underscoring the increasing importance of copper in the global economy—particularly as demand for electrification, clean energy infrastructure, and electric vehicles accelerates.

Is Oil & Gas Right for Your Portfolio?

Much of the cargo growth originates from key copper-producing nations on the west coast of Latin America, especially Chile and Peru. These two countries continue to dominate global copper concentrate exports, shipping intermediate copper-rich materials to smelters in Asia, Europe, and beyond.

Once refined, copper is used in a broad range of industries, from renewable power networks and electronics to plumbing and automotive manufacturing, playing a crucial role in the global energy transition and digitalisation trends.

If the pace of exports continues, 2025 is poised to exceed last year’s all-time high of 35.5m tonnes of copper concentrate shipped by sea. That figure represented a modest 0.5% rise over 2023 volumes and capped four consecutive years of relative stability around the 35m tonne mark.

The year-on-year jump in H1 2025 represents 1.1mtonnes of additional cargo compared to the same period in 2024, a notable leap for a commodity market known for its cyclical nature.

Since 2015, the copper concentrate trade has expanded from 27.7m tonnes to 35.5m tonnes in 2024—an increase of over 28% in a decade. The sustained growth reflects not only the rising global demand for copper-intensive technologies but also continued investment in mining, processing, and logistics infrastructure in exporting regions.

However, a production bottleneck is emerging. Speaking at Geneva Dry, the world’s premier commodities shipping conference earlier this year, Karim Coumine, head of commercial shipping covering minor bulks for miner Anglo American, said that while there had been a significant rise in copper output from mines in Chile and Peru in recent years, a cap was coming as new production sites were taking time to emerge.

“Going forward, it’s difficult to see where the the new supply sources are going to be be coming from and if they’re still going to be in locations that are particularly difficult to mine,” Coumine said, adding: “Sooner or later the world is going to have to to to find new bigger sources of copper.”

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack