By Wolf Richter for WOLF STREET.

For well over a year, there has been somewhat of a puzzle: How financial conditions, as tracked by broad measures such as the Chicago Fed’s National Financial Conditions Index, have been getting looser since March 2023, and are now at the loosest level since November 2021, even though the Fed has hiked policy rates to 5.5% at the top end and engaged in $1.7 trillion in QT so far in order to tighten financial conditions. Powell has been pushed many times on this point during the FOMC press conferences.

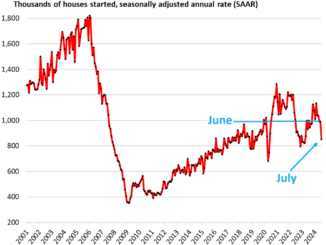

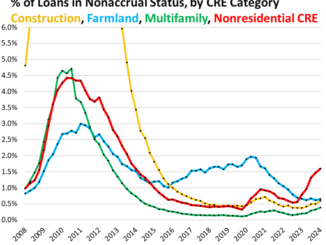

But financial conditions are not getting looser everywhere. Bankruptcy filings by larger corporations reached the highest level in 13 years. There is some trouble at the low end of the junk-bond market and the leveraged-loan market. And Commercial Real Estate is stewing in an epic mess, entailing countless defaults and massive losses for equity and debt investors and for banks, with the result that credit has tightened around its neck, so much that refinancing maturing loans got very difficult or impossible, leading to numerous repayment defaults, and many multifamily construction projects are now on hold because they cannot get financing.

But the higher end of junk bonds is in la-la-land. Spreads of BB-rated junk bonds have narrowed to just 1.75 percentage points as of Friday’s close, according to the ICE BofA BB US High Yield Index released today, the narrowest since 2007! BB-rated bonds are at the top end of the junk-bond spectrum (here’s our corporate bond ratings cheat sheet). In other words, BB-rated debt has moved even deeper into la-la-land, under massive demand from investors.

Lower end of junk bonds in purgatory. Credit spreads of CCC-and-lower-rated bonds, the low end of the junk-bond spectrum just above “default,” have narrowed since October 2022 to currently 9.3 percentage points over equivalent Treasury securities, according to the ICE BofA CCC-and-lower US High Yield Index. But that yield spread remains substantially wider than during the Good Times, as bankruptcies and threats of bankruptcies have been accelerating.

Corporate bankruptcy filings edged past the pandemic high, to 75 filings in June, the highest since 2010, by publicly traded companies, or by private companies with publicly traded debt, according to data by S&P Global. These levels of bankruptcy filings are still not high compared to the mayhem in 2008 and 2009, but they’re now higher than during any month during the intervening years.

We looked at two of the June filers, as part of our Imploded Stocks, both among the largest filers last month: Chicken Soup for the Soul and EV SPAC Fisker Group.

In the first half of the year, 346 companies filed for bankruptcy, also the highest for any first half since 2011, just a tad higher than in the first half of 2020.

Companies file for bankruptcy because they cannot get new funding to service their existing debts: Under the supervision of the court, the company is either liquidated, with creditors getting the proceeds from the asset sales; or is able to restructure its debts, which usually wipes out equity investors, transfers ownership to creditors, and leaves some creditors with haircuts. Growing bankruptcy filings are in part a result of tighter financial conditions, when investors lose some of their exuberant appetite for funding risky companies with more debt capital:

Leveraged loans: distressed debt exchanges surge. Leveraged loans are loans issued by junk-rated companies that banks originated but sold to investors, including to loan funds. Some of them are securitized into Collateralized Loan Obligations (CLOs). And they’re traded, and there are indices that track them. It’s a big market, roughly similar in size to the junk bond market.

PitchBook’s LCD produces a dual index of default rates for leveraged loans: one that covers hard defaults only; and the other that includes distressed debt exchanges that occur without defaults.

The issue here is that distressed companies, holding the bankruptcy gun to their lenders’ head, talk their lenders into the potentially lesser evil of restructuring those loans with a substantial haircut for the lenders, which reduces the company’s debt load. With a distressed debt exchange, the company bypasses default and bankruptcy, but with a potentially better and more controllable outcome.

Distressed debt exchanges are an alternative to restructuring unmanageable debts in a bankruptcy court; they’re a form of default but are not always included in default rates.

In June, the default rate of leveraged loans, excluding distressed debt exchanges, ticked down to 1.55% by issuer count, back down to roughly pre-pandemic levels (light blue line).

But the default rate that includes distressed debt exchanges was at 4.31% by issuer count, more than double the pre-pandemic levels. This indicates that companies at the low end of the corporate credit rating scale are having substantial difficulties, and also that lenders are willing to make lesser-evil deals to keep the companies out of bankruptcy court where lenders could fare worse (chart via PitchBook):

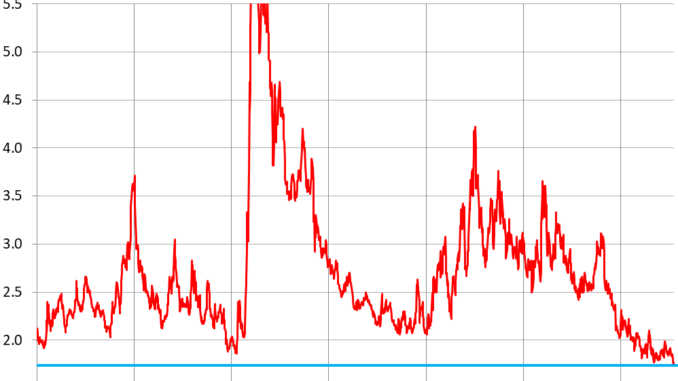

But broad measures of financial conditions move even deeper into la-la-land. Overall measures of financial conditions in money markets, debt markets, and equity markets have been loosening steadily since March 2023, and last week dropped to the loosest level since November 2021, when the Fed was still doing its near-0% policy and massive QE, according to the Chicago Fed’s National Financial Conditions Index (NFCI), which tracks over 100 data points.

In November 2021, the Fed had just started to talk about tightening its policies. That talk and then the first wave of rate hikes caused financial conditions to tighten, which peaked in October 2022, then wobbled along those levels till March 2023, after which they began to loosen again. This is the Chicago Fed’s NFCI, showing that overall financial conditions – despite the mayhem in some corners – are as loose as they had been before the pandemic.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/