With its formal restructuring announcement deadline less than 10 days away, Credit Suisse is reportedly working with a number of major banks on a potential capital increase.

Bloomberg reports that, according to people familiar with matter, the Zurich-based firm has lined up banks including the Canadian and US firms for the possible share sale.

A capital increase, under the name Project Ghana, could come after the bank’s formal restructuring announcement on Oct. 27.

If Credit Suisse were to pull the trigger on a capital increase, it would likely seek at least $2 billion – and possibly more – to cover restructuring and any operating losses over the next couple of years as it pivots the business.

Given its $12 billion market cap, that’s quite a dilution.

Credit Suisse has already reached out to the Qatar Investment Authority to gauge interest in a potential capital injection, along with other Middle Eastern funds, such as Abu Dhabi’s Mubadala Investment Co. and Saudi Arabia’s Public Investment fund.

A capital hike, while dilutive by its nature for shareholders is being welcomed by investors so far with CS stock up in the pre-market…

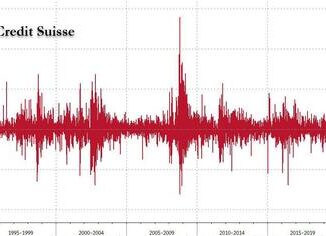

And Credit Suisse credit risk has tumbled notably…

Finally, according to the same people ‘who are familiar with the matter’, ahead of next week’s announcement, the bank is accelerating its plans on asset disposals, including the likely partial sale of its securitized products unit.