But prices are still way too high, and automakers are not cutting them nearly enough.

By Wolf Richter for WOLF STREET.

Total new-vehicle sales in November – retail and fleet deliveries by dealers and automakers to end-users – jumped by 10% year-over-year to 1.40 million vehicles, with one extra selling day this November, according to the data from the Bureau of Economic Analysis today.

New-vehicle retail sales – excluding sales to fleets, such as rental fleets – also jumped by 10% year-over-year to 1.15 million units, according to J.D. Power estimates.

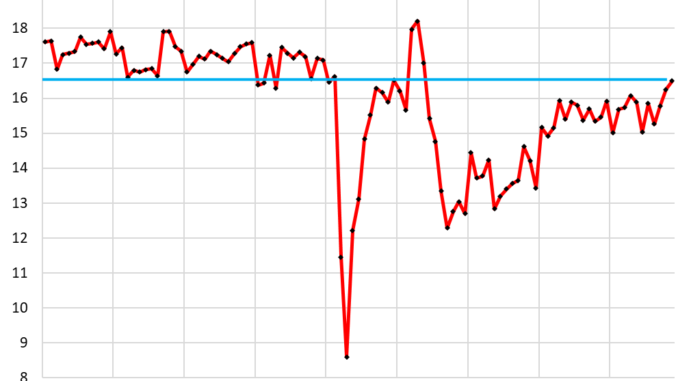

The seasonally adjusted annual rate of sales for retail and fleet units, which accounts for seasonal variations and the extra selling day in November, rose by 6.7% year-over-year, to an annual rate of 16.5 million vehicles, the highest since May 2021, when the collapse in new-vehicle inventories was in full swing amid the semiconductor shortages, which resulted in dealers running out of vehicles to sell, plunging sales, spiking prices, and the widespread appearance of odious addendum stickers. By now, inventories have more than doubled, and it’s price-cutting time.

Sales picked up momentum over the past two months as automakers rolled out big incentives and discounts and as dealers made deals on models they were heavily overstocked on. Inventories have surged this year because prices are too high after the price-spike during the pandemic. But some models remain in short supply.

With today’s sales figures, our projection for total sales in 2024 rises to 15.93 million vehicles, the highest since 2019, and just a hair below 1986, which was nearly 30 years ago.

The ugly long-term reality is that new-vehicle sales, in terms of the number of units sold, have been a no-growth business for 25 years, interrupted by deep plunges. Only price increases and moving models upscale have inflated dollar-revenues for automakers in total. So that’s for the US market overall.

But there are exceptions, such as Tesla and Hyundai-Kia whose sales have soared from record to record, eating market share from other automakers, whose sales have plunged (our volume charts by automaker through 2023; update for 2024 coming in a month).

Too-high prices have had the effect of strangling unit-sales during the good times and crashing unit-sales during bad times.

New-vehicle inventories on dealer lots and in transit surged to 3.04 million vehicles at the beginning of November, the highest since May 2020, according to data from Cox Automotive. Supply at the beginning of November rose to 85 days, with 60 days being considered healthy.

Incentive spending by automakers in November soared by 43% year-over-year to $3,291 per vehicle sold on average, amounting to 6.5% of MSRP, according to J.D. Power estimates. Leasing drove some of the incentive spending. J.D. Power estimates that leasing accounted for 23% of retail sales in November.

Incentives still have room to increase as inventories continue to pile up. In 2019, incentive spending reached 10% of MSRP.

Ford, for example, reported today a 14% year-over-year sales increase in November. Battery EV sales surged by 21% year-over-year. Ford is promoting aggressive lease payments, 0% financing on some models, cash rebates on some models, etc. And Ford dealers are throwing in big discounts.

In a sign of things to come, Ford also cut the MSRP of its 2025 model F-series that just went into production, with the base F-150 XLT getting a $2,025 lower MSRP than the 2024 model year, a 4.3% cut of the MSRP, which has never occurred in the history of our illustrious F-150 XLT and Camry LE price index going back to 1990.

Even Stellantis is getting the drift of too-high prices, after a dealer revolt about its pricing policies and mismanagement. Incentives and discounts started flowing. And a few days ago, CEO Carlos Tavares was forced to spend more time with his family. Ram and Jeep dealers, after drowning in overpriced inventory, made some headway with big incentives and discounts, and over the past two months, supply has been coming down from astronomical levels.

“Gradual improvements in more affordable vehicle availability are likely to sustain the momentum of new-vehicle sales, while transaction prices and profitability are projected to moderate slightly,” J.D. Power noted.

And we have seen that in the CPI for new vehicles, which has been edging down ever so slowly and reluctantly for the past two years, after the spike. But it has remained amazingly sticky (unlike used-vehicle prices, which plunged).

We give you energy news and help invest in energy projects too, click here to learn more