“The market is at an interesting point with rising inventory and lower demand”: National Association of Realtors

By Wolf Richter for WOLF STREET.

We here in our little corner don’t normally more than glance at the “pending home sales” data by the National Association of Realtors. It’s a forward-looking indicator of “closed home sales” based on contract signings – on deals that haven’t closed yet and could still fall apart. But today’s release of pending sales was interesting for several reasons, including the NARs’ expectation that the collapsed demand along with rising inventories is going to cause home prices to “stabilize” in the second half of the year. So here we go.

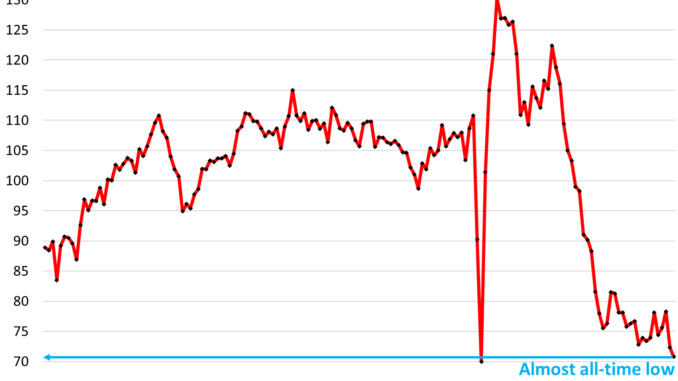

The index value of pending home sales in May dropped by 2.1% from April, and by 6.8% from a year ago, to 70.8 (seasonally adjusted annual rate), what headlines dubbed an “all-time low” or “record low” in the data going back to 2001, and that’s close enough. In the NAR data we have access to via YCharts, today’s reading was still a hair above the prior all-time low of April 2020 (index value of 70). But the idea is the same: demand has collapsed, even as inventories have risen.

The index value was set at 100 for contract signings in 2001. So today’s value of 70.8 is down 29% from the index average in 2001. Compared to the Mays in more recent years:

May 2022: -28%

May 2021: -39%

May 2020: -30%

May 2019: -33%.

And this sustained plunge in demand is occurring even as supply in May jumped to 3.7 months, the highest since June 2020, and as inventory for sale jumped by 18.5% year-over-year, to 1.28 million homes, according to NAR last week:

So here’s what NAR said about this situation:

“The market is at an interesting point with rising inventory and lower demand.”

“Supply and demand movements suggest easing home price appreciation in upcoming months.”

“In the second half of 2024, look for … stabilizing home prices.”

Oh, and praying for mortgage rates to “descend”:

“Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.”

“In the second half of 2024, look for moderately lower mortgage rates…”

But maybe they won’t descend by a lot or even enough – they’ve been around 7% for months:

“NAR predicts mortgage rates will remain above 6% in 2024 and 2025, even with the Federal Reserve cuts to the Fed Funds rate.”

What a bummer?

Take the Survey at https://survey.energynewsbeat.com/