In a dramatic turn of events that has sent shockwaves through financial markets, President Donald Trump has fired Federal Reserve Governor Lisa Cook for cause, citing allegations of deceitful conduct related to mortgage loans.

This unprecedented move comes amid growing speculation about impending interest rate cuts, as signaled by Fed Chair Jerome Powell in his recent speech, and has contributed to a noticeable slide in the value of the U.S. dollar.

The Dollar’s Decline: Current Value and Market ReactionThe U.S. Dollar Index (DXY), which measures the greenback against a basket of major currencies, currently stands at approximately 98.24, reflecting a recent uptick of 0.72% in the past 24 hours but a broader downward trend from its 52-week high of 110.18 reached earlier this year.

Are you Paying High Taxes in New Jersey, New York, or California?

Analysts attribute the dollar’s slide to heightened expectations of looser monetary policy, exacerbated by the political turbulence at the Fed. Lower interest rates typically weaken the dollar by making U.S. assets less attractive to foreign investors, and the firing of Cook—a vocal proponent of maintaining higher rates—has fueled bets on accelerated rate reductions.

Trump’s going after Fed governor Cook for mortgage fraud.

If he succeeds, he gets his easy money boom ahead of schedule. If he fails, it’s Jerome Powell’s economy through 2028. pic.twitter.com/EdMQzfENA7

— Peter St Onge, Ph.D. (@profstonge) August 26, 2025

The energy sector, particularly sensitive to currency fluctuations, could feel the impact. A weaker dollar often boosts commodity prices like oil, as they become cheaper for international buyers. For energy markets, this could mean upward pressure on crude prices, benefiting producers but potentially straining consumers amid ongoing economic uncertainties.

Powell’s Friday Remarks: A Clear Signal for Rate Cuts

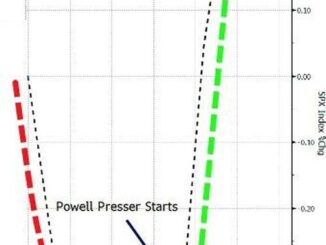

Fed Chair Jerome Powell’s speech at the annual Jackson Hole symposium last Friday provided the clearest indication yet that the central bank is poised to ease monetary policy.

“The time has come for policy to adjust,” Powell stated, emphasizing that the direction toward rate cuts is evident, though the timing and pace will depend on incoming economic data, evolving outlooks, and the balance of risks.

He highlighted cooling inflation and emerging risks in the labor market as key factors warranting a shift from the Fed’s current stance of holding rates steady.

Powell’s comments come at a pivotal moment, with inflation having moderated from its post-pandemic peaks, but job market indicators showing signs of softening. This dovish pivot has been welcomed by markets, but the sudden vacancy on the Fed’s Board adds a layer of complexity, potentially accelerating the timeline for cuts if a more accommodative governor is appointed.

The Federal Reserve’s Structure: Independence Under Scrutiny

The Federal Reserve’s Board of Governors consists of seven members, each nominated by the President and confirmed by the Senate for staggered 14-year terms to ensure continuity and insulation from short-term political pressures.

The President also designates the Chair and Vice Chair for four-year terms. This structure is designed to promote independence, with governors removable only “for cause” by the President—a provision rarely invoked to avoid undermining the Fed’s autonomy.

Governor Cook, appointed in 2022, has been a key voice in recent decisions to keep interest rates elevated, citing concerns over persistent inflation risks, including those potentially amplified by policies like tariffs.

Her removal creates an immediate vacancy, allowing President Trump to nominate a replacement. If confirmed by the Senate, a new appointee aligned with Trump’s preference for lower rates could tilt the Board’s voting dynamics toward more aggressive easing.

Historically, Trump has criticized the Fed for high rates during his previous term, arguing they hinder economic growth. Appointing a governor sympathetic to this view might strengthen the case for rate cuts, especially if the nominee prioritizes employment over inflation control. However, this move raises questions about the Fed’s independence, potentially eroding investor confidence and contributing to market volatility.

Implications for Energy and the Broader Economy

For the energy industry, lower rates could stimulate demand by reducing borrowing costs for infrastructure projects and consumer spending on fuel. Yet, a weaker dollar might inflate import costs for equipment, creating a mixed bag for operators. As the Fed navigates this transition, all eyes will be on the Senate confirmation process for Cook’s successor and upcoming economic data that could dictate the depth of any cuts.

This development underscores the intricate interplay between politics, monetary policy, and market forces. While the dollar’s slide may offer short-term relief for exporters, including energy firms, the long-term stability of the Fed’s decision-making hangs in the balance. Stay tuned to Energy News Beat for updates on how these shifts unfold.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack