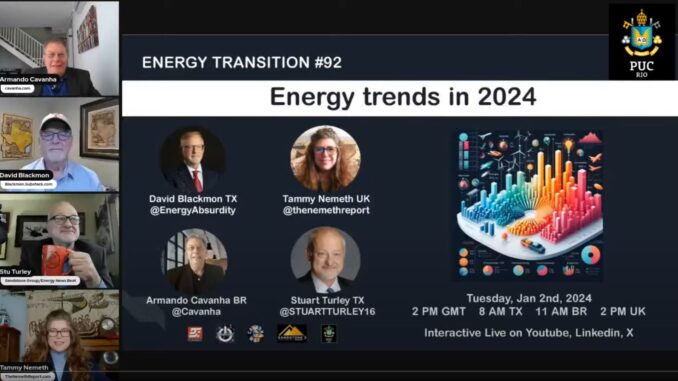

ENERGY TRANSITION EPISODE #92 – Energy Trends in 2024

Highlights of the podcast:

01:17 – Energy restriction by geopolitical influences

04:40 – The governments want something different than what the people want

10:20 – Natural disasters

11:14 – Biden administration tried to keep this quiet

14:22 – The energy transition agenda

17:20 – The UK is going to be importing more energy

21:01 – Election year in the United States

23:26 – The expansion of BRICS

26:26 – The president of BRICS this next year.

33:13 – The European markets

35:02 – The EU used new sustainability and climate

37:50 – The Texas and Louisiana Gulf Coast

39:09 – The pace of mergers and acquisitions

41:20 – The Canadian government and Mexico

The Podcast Hosts for The Energy Transition

Energy Consulting Specialist

Energy Analyst | Economic and Geopolitical Analyst | ExFounder U&I Global | Consultant, Advisor | Commonwealth Scholar

President, and CEO, Sandstone Group, Podcast Host

Blubrry Podcast:

ENERGY TRANSITION EPISODE #92 – Energy Trends in 2024

Armando Cavanha [00:00:01] Energy transition. 92. Energy Trends in 2024. 2024. Happy New Year. Tammy Nemeth, David Blackmon, Stuart Turley

David Blackmon [00:00:14] Happy New Year.

Stuart Turley [00:00:15] Happy New Year,.

Tammy Nemeth [00:00:16] Happy New Year Everyone.

Armando Cavanha [00:00:18] David are you planning to use an ebike to go to the next door to see in Houston.

David Blackmon [00:00:23] Probably not. Probably not. After that subway fire in Toronto that was caused by an exploding e-bike battery that was brought on to the train. You know, I think I’ll forego riding those bikes in the future.

Armando Cavanha [00:00:39] I got the train, the subway or

David Blackmon [00:00:43] The subway train for the subway train. And luckily there were nobody injured. Thank God everyone was able to get out safely. And it took him a while to contain and put out the fire. But it’s fairly out there.

Armando Cavanha [00:00:56] Impressive. A people I was planning and I would like to see if you agree that we could separate in four steps our conversation today and the discourse. Which ones will grow faster? And there’s a security issue. We have some expectations about this issue. Energy restrictions by geopolitical influences may be getting worse. I’m not sure. A merger and acquisition are everything related to big oil. They are pressured or not in this sense. So if you agree. Yeah. Great. Okay, fantastic. So let’s start with the the first point. They really would like to start to be the one to start our company.

David Blackmon [00:01:46] Sure. Yeah. I think that and I’m in the process of writing a forecast column for Forbes that I do every year, and I think it’s kind of obvious, kind of baked into the cake that solar probably is going to be the fastest growing energy source across the globe and in the United States this year. In the Western world, the subsidies are in place or they’re baked into the cake and they’re going to be heavily influential for the next seven, eight years. Wind is probably not going to grow nearly as quickly as solar and probably not as much of an expansion as it even had in 2023, which was a disappointing year for wind, really, because there’s just so many problems with wind now that are popping up as as the older wind farms get older and we find out that they don’t the turbines don’t really last anything close to 25 years and all the maintenance issues. And now there’s a growing a pretty rapidly growing protest movement to new wind farms in the United States that Robert Bryce has done a fabulous job of documenting. So I think wind is going to have a tough year. Oil and gas will expand just like it has the last two years, on a very steady pace to meet global demand. We’ll probably have an increase in global demand somewhere around 2 to 2 and a half million barrels per day. And I expect the United States and Brazil, frankly, Brazil’s offshore province, to fill a lot of that new demand. And so it’s going to create pressures on OPEC’s and Opec+ as a result, coal is, you know, being essentially outlawed by governments in the Western world. But in the developing world, coal is still king, is going to remain king will continue to expand, and we’ll probably use more coal again this year than we ever have in human history. And I don’t expect that trend to subside any time soon. Nuclear. It’s just hard to know. Unfortunately, the developments in the new technology or, you know, kind of slow in coming and government regulators are very plodding and modifying their regulatory structures for nuclear. And you still have all the protests raising alarm that’s really not justified about nuclear. So it’s still got a lot of problems.

Armando Cavanha [00:04:26] Mm hmm. Then you see, the government wants the same that society wants in terms of energy.

Tammy Nemeth [00:04:35] Well, it depends on where you are in the world, right? Because, you know, in the European Union, the governments want something different than what the people want. And, you know, the people want reliable, affordable energy that they know will be there when they need it, that it’s secure. And the government instead is embarking upon a different pathway. And the same in the U.K., where, you know, people in the U.K. want to make sure when they turn the heat on, the heat is on, not, you know, and is affordable, not like the new heat pumps where you can turn it on, it will wear away and not necessarily keep your house warm if you like it at 16 degrees Celsius. Okay, maybe in the winter, but most people would prefer it to be around 20, which doesn’t happen. And I think one of the interesting aspects in the U.K. is that there’s all these all this talk about increasing oil and gas production in the North Sea and whatnot. But the government is talking that way. But the companies aren’t buying it because there’s an election this year. And the government, the party that seems poised to take control, said they would cancel any leases that were were granted. So companies are, of course, holding back on whether or not they pursue this or not. And in respect of Canada, the government announced I think it was a cop 28 figure. They’re going to do a hard emissions cap on oil and gas production in Canada, and a hard emissions cap is basically a production cap. So, you know, they’re telling oil, oil and gas producers in Canada that they’re going to be limited on how much they can produce. So even even though the developing world will will probably increase demand, as David has said and I agree with with pretty much everything David has put forward, you know, Canada won’t be able to contribute to that. The same, you know, there were when Germany came in with Japan, came begging Canada, please support your friends. Can you export some more natural gas? And the government told them you can’t. Don’t talk about that publicly. We’re going to talk about hydrogen. So, you know, it’s it’s very clear that the Canadian government does not want to follow what the people want because the people in Canada also want secure, affordable, reliable energy. And the Canadian government is doing everything in its power to do the opposite.

Armando Cavanha [00:07:03] Yeah. Stuart, If you have hundred dollars and you have the options to bet and this source and their source, how much you can bet in the Trump.

Stuart Turley [00:07:14] How much I can bet on each one. Holy Smokes Batman. Welcome to Monday or Tuesday. I’ll tell you. Here’s the funny. That’s a great question. Armand. Let me answer this way. In COP 28, We had so many head explosions from the climate activists because it wasn’t that fun, David. I mean, when we sit back and go, they all went back and when they snuck in, natural gas is really needed. There was a resurgence to nuclear. And Hugo Kruger basically said, you know, just recently the median countries will excel in nuclear. We’ve seen that in Japan. We’ve seen that in France is now kicking back in Germany is going to coal. The US is not going to increase its fleet because of the legislation through regulatory issues. This is all tied back to the climate thing. So before I started losing my money that I’ll it’s thanks to Biden nomics that’s all I’ve got is $100 for this year and that is the war that is on also on food is out there as well, too. So when we sit back and take a look which ones are going to I think, David, you are it dead on, right? Solar is going to kick in. Huge natural gas is going to really kick in huge. But Armando, I don’t get it. Why the climate? Activists. And I’m not a large fan. I mean, Kerry fan. And when you sit back and take a look, the only reason we lost or reduced our carbon footprint was because of natural gas. Why don’t we support natural gas as the great transition to get us past natural gas should grow, solar should grow. Based off of what I’m seeing in wind farms we’ve talked about. They are unprofitable from day one. I just heard some heads explode.

David Blackmon [00:09:40] It’s true. Even with subsidies, a lot of them are not profitable.

Armando Cavanha [00:09:45] Yeah, yeah, yeah.

Stuart Turley [00:09:46] And they’re never carbon zero.

Armando Cavanha [00:09:49] He’ll never carbon zero. So I dreamt, the second point in terms of energy security its so so Important point. What are your expectations? Starting with Stuart. To. To see the expectation has.

Stuart Turley [00:10:04] Well, Armando, thank you again for letting me be a Debbie Downer. But as men and Tammy, I please take this with you know. We need to be providing for our families. There are natural disasters out there. There are things that could possibly happen. Get ready. Have small electric generators be able to survive for 24 to 72. And if you can survive for a long time without power, that’s great. Solar, wind. Love it for the house. Here’s where energy security becomes a problem. The Chinese will win over the U.S. In the U.S., only Tammy nailed it with the low cost energy. We need low cost, dependable. Our grid is vulnerable. In the United States, there are 30 major interconnects that China now can shut down. I’m not kidding. I’m working on some of that issue. David, I believe it was also the balloon is now documented that it tied to a national Internet provider and that the Biden administration tried to keep this quiet. So now that it is connected in pass through the major interconnects that we bought from China, I’m interviewing Michael Yon tonight. Michael Yon is in Panama and he has been tracking the Chinese army in folks coming in and what all that is about. So not only do we have the energy security, we have the FDR. See, that is said be prepared for blackouts. This morning, there was a major fire going on in New York City and it has had some serious problems this morning. Explosions were happening. Can you survive as a family? The government may not be there to bail you out. So energy security around the world is about natural gas pipelines. That is the number one energy security. We also just had the great interconnect, the most expensive interconnect coming to the UK, I believe, Tammy, this past week it was a huge interconnect coming in from, I believe, France, but I mean, that’s huge for them to be now energy dependent on another country.

David Blackmon [00:12:36] How that funny answer.

Armando Cavanha [00:12:39] And, David, to just see that wind energy is the worst one in terms of our.

David Blackmon [00:12:46] And yeah, so grid security is is a horrible issue in the United States for sure and in many other countries. And it’s the proximate cause of that is because we’re overloading our grids with intermittent energy, with no backup, no reliable backup, no sustainable backup. And and so we’re running out of reliable 24 seven generation capacity. Everybody’s short on it here in Texas. ERCOT says we got about a 16% chance of having blackout conditions at some point this winter if we have any kind of a significant winter weather event in Texas. And, you know, that’s a situation that should never exist in the state of Texas, we produce a third of all the natural gas produced in the United States, in Texas, Texas, if it were a country, would be the third largest producer of natural gas on the face of the earth. We should never have a situation in Texas where our grid has any threat of blackout conditions at all. So it’s scandalous, it’s borderline criminal that this situation exists. And policymakers in Texas had better get their arms around it pretty quick or you’re going to end up with a Democrat state again, because this is all happening on the Republican Party’s watch. And that’s my rant for today.

Armando Cavanha [00:14:12] But is there a special agenda for this voter that see it to put risks in the grid without necessary?

David Blackmon [00:14:21] Well, it’s just all part of the energy transition agenda. It’s this it’s this. We’ve chosen these three rent seeking industries, wind, solar and electric vehicles to subsidize into reality somehow with with debt funded subsidies put in place by the federal government. And the same things happening in Canada and the UK and throughout Europe and probably in Brazil too, all over the Western world. This is what we’re doing. In the meantime, China continues to build all the coal plants it wants to build and needs to build. Yeah, it’s become the second-biggest importer of oil on the face of the earth. India is moving in the same direction, China is moving and the net result is going to inevitably be tremendous energy instability and insecurity in the Western world. And we’re all going to be dependent on China for our energy security. And if anyone, anyone who thinks that’s a healthy and sustainable condition for any Western nation to be in is most likely a traitor, quite frankly, and has a lot of financial interests tied up in China. Kind of like a lot of people in this current presidential administration.

Stuart Turley [00:15:37] David, can I can I also validate what you just said, though, with China? China is building the mega gas production area with over 40 billion cubic meters. They went just very shortly from 30 billion to 40 billion, and that’s now it says, quote unquote, it took this 13 years to increase the annual gas output from 10 billion to 20. And it took just three years to expand from 20 to 30. And they are bringing a whole nother big section on a plan. China. Here’s the problem. They’ve increased their 220% because of the coal. They’re bringing on everything. They have all that. David, well said and well validated. I mean, sorry.

Armando Cavanha [00:16:25] Tammy the UK sorry, the UK and Canada prime ministers, do they know exactly what’s the meaning of and energy security because.

Tammy Nemeth [00:16:35] I don’t think they know what energy security is, to be honest. If I could add to what you’re saying about the interconnections, actually, the UK has had interconnections with France since 1986 and the the new one, I think that came online at the end of 2023, just a few weeks ago. That was an interconnection with Denmark. So there is if you go to the Ofgem website, Ofgem to GOV.UK, it talks about the current six gigawatts of electricity interconnections between the UK and Ireland, Netherlands, Belgium, France and now Denmark. And then it has a list of projects. So we’re going to it. The UK is going to be importing more energy from France and possibly either importing or exporting to Germany. So the German I know it’s going to come online in 2028. So you know, the UK has been part of this integrated European project, right? And that Brexit threw a monkey wrench into all of that. And if Labor gets back. I can. I’m sure Brexit will be over and they are once again double down on on the whole needing to be interconnected with Europe. The problem is that with these interconnections, as with the grids and everything, if you’re constantly expanding it, every time you do something that becomes a choke point, it becomes a place where you can potentially make a country vulnerable with a terrorist attack or or something else. And there’s no redundancies built into these systems. So, David, I really enjoyed your conversation with Robert Bryce the other day where he was talking about, yes, natural gas is great, but we still need the coal because natural gas is just in time. And coal at least you can stockpile. You can slowly ramp it up, you can ramp it down, whatever. But it’s a very, very stable source of electricity, which is why China is investing tremendously in their energy security. They have something of everything, right? More nuclear, more gas, more coal, more solar and wind or whatever where that happens to make sense. Although I question them using that to the extent that they say they are, in any event. India, I think, is is very interesting because the environmentalists made a big show and story when India said they were going to have a moratorium on new coal fired power. And that was back in February or March. But in October, they said, oh, emergency, we need to build so many thousands of megawatts or gigawatts or whatever it is, but to increase significantly their coal power because they want secure, reliable energy. They care about their energy security. And all I can say with Europe and Canada and the UK, oh, my gosh, get your heads out of the sand. Start thinking about the security, because with what’s going on in the Middle East and I’m sure we’ll get into geopolitics in a few minutes here, but there’s all kinds of things going on that that disrupt the flow and increase prices. And I know the environmentalists are making the argument, well, we should just invest more in wind and solar because then we’re not beholden to these international powers for for the price of oil or natural gas or whatever. And it’s just the most ludicrous argument, because who’s controlling, as David said, the components and the production of the wind and solar? Well, that’s China. So China suddenly holds back its its rare earths and now your cost of exponentially increased or they put a tariff on your solar panel. So so it’s not like we make them in Canada and we certainly don’t make them in the UK. So, yeah, okay, it’s going to increase production in China and then they can hold whatever they want over our heads with respect to price.

Armando Cavanha [00:20:35] Right. Please do not stop Tammy. Go ahead with the geopolitical influences and they can get worse. No opinion.

Tammy Nemeth [00:20:45] Well, sure, because so just at the end of the year, we had all of these new geopolitical issues starting, right? So we had the Venezuela, Guyana situation, which is unresolved. They’re still building up. They’re still kind of quasi negotiating how this is going to play out. It’s an election year in the United States, as David and Stu have mentioned, which throws all kinds of different variables into the equation. Then you have what’s going on with the Suez Canal and the Red Sea and the Houthi rebels going around attacking ships and so on. You have Iran coming into the fray there on the side of the Houthis. And it’s like, okay, so now Iran has a warship there or they’re doing something in the Red Sea that that affects that particular choke point, which is really a significant one. But I was looking on this map. You can find the all the the ships that are currently en route or whatever through the Red Sea, through the Suez Canal and the ones that are going around. Well, look at what companies own, the ones that are continuing to use Suez. Well, sure, the European companies may be going around Africa now because their targets are Chinese container ships. Are Chinese tankers being targeted by the Houthis? I don’t think so. So they get to the shortcut and the Western countries have to go the long way around. When you have China cutting, you know, sitting there being the mediator between Iran and Saudi Arabia to figure out what to do about Gaza and Israel. So China is now taking this kind of diplomatic position that they’re the calm, sober mediator for these different things. And so maybe in 2024, they also become elevated in trying to resolve what’s going on with Russia and Ukraine. What happens if that’s resolved? Does the oil and gas trade get to continue as it was before? If Russia somehow makes some kind of settlement, do they continue with the sanctions? Can they permit? Can the E.U. permit the sanctions to be lifted when they’re so close to achieving their their aim of putting their people into energy insecurity? So I don’t know. It’s an interesting year. I think there’s a lot of moving parts right now that that can make things very interesting.

Armando Cavanha [00:23:00] But, David, you mentioned Brazil, and Brazil is now being a friend of Russia and China. So be less west and more east of friendship. How do you see and being part of OPEC and BRICS? So please insert this variable. Your comment. Please go ahead.

David Blackmon [00:23:19] Well, I think that that’s a very big deal. And, you know, I’ve talked about that for the last year now. I think the the expansion of BRICS, you know, Brazil has always been a part of BRICS, but the expansion of BRICS to include the United Arab Emirates, Saudi Arabia, Egypt now makes in a couple of other countries. It now makes BRICS not just a the really the largest, the most economically powerful global trade organization. It also the members of OPEC’s now control more daily oil production than OPEC does. Okay. With Russia and Saudi Arabia both in there. And and so that means BRICS being a part of BRICS now just I think is going to be heavily influential in Brazil’s foreign policy outlook and its international outlook outlook. And the same is going to be true. And we’re seeing it as as Tammy noted, we’re seeing it playing out in real time now. The same is going to be true with Saudi Arabia and the UAE. It’s that China is going to become the mediator of these disputes and not the United States. It’s going to be a gradual displacement of US influence really around the world. And a lot of that’s going to be driven by BRICS as an organization. So, you know, you have to give China credit. They’re very smart. They are unrelenting. They they have a long term outlook on all of this, where the United States just I mean, and this administration in particular just kind of doesn’t seem to have any long term outlook at all on anything. And, yeah, we send our carrier groups in and what did we do? We shot three little Houthi boats out of the water over the weekend and killed ten of them. And that’s been our big military objective in the Middle East now. So it’s just it’s it’s a real. Well, I can’t even say the word where U.S. foreign policy is concerned. And I just think China just is going to continue to gain influence in that room.

Tammy Nemeth [00:25:41] Yeah.

Armando Cavanha [00:25:42] And Stuart if you’ve been flying with the president of Brazil in the same airplane, sit by seat, what what could be your conversation with him?

Stuart Turley [00:25:54] Holy smoke, Batman. Well, I would I’d look over because Putin would be in the same airplane. And I thought that was a good one when in and Putin would look at him and say, you know, it’s the way I think of the U.S. is it’s mind over matter. And I’m paraphrasing Putin. So it would be it’s mind over matter because the U.S. doesn’t matter. Because I don’t mind. And what they’ve done is a beautiful job. Putin is now the president of BRICS this next year. So that’s why he’s in the plane with the president of Brazil that would be in there and I’d be firing up a podcast and David would be right there and then Tammy would be there and we’d have a big old podcast going on with you leading the question. So I’m not sure I would put this in my my weird mind here. Now.

David Blackmon [00:26:51] I don’t know what any of that means Stu, but I like it.

Stuart Turley [00:26:55] All right. We’re going to have to. Here’s what the big thing is. And that is the Monroe. I believe it’s the Monroe Doctrine you brought up before, David, on this. And that is, we are idiots in the United States and Canada. Total idiots. We could negate OPEC by being a traitor within our own hemisphere and and wipe out their ability to do this over here. So here I am. I got Putin, and Putin has said, Hey, I don’t want to cut off the West, but the West doesn’t matter anymore. So we have this paradigm, and I would like to be the guy out there. And I know David would not be able to do this because of his sense of humor. My sense of humor. I think and Tammy would be very, very sensible and then the smart one in the room. So I would go out and I would say, Guys, let’s all work together. Let’s work for energy security. Let’s work for energy. And I think next week, when Irene Oswald comes on, we need to talk about OPEC and her great article that just came out today that was wonderful about OPEC’s not dead yet. Yeah, I got a few points on it that it is losing some some traction on the pricing matrixes because I think the oil matrices is messed up. Pricing matrices for oil has got some the DART fleet 600 tanker in all of this. My head’s exploding with what’s going on, but I can’t wait for that plane ticket. Armand, we’re going to have a blast.

Tammy Nemeth [00:28:40] Can I add in there a little bit? Because I feel like Brazil is something like a double agent. Because Lula, who I think and I’m sure I’m wrong, but I think it’s an interesting idea that Lula owes his position to the United States. I mean, the reason he won, I think it was due to support or interference with from the United States. But on the and but he kind of likes to be against the United States because of the whole South American sort of post-colonial idea. And so I feel like he’s a spy in OPEC and the BRICS, giving some information back to the United States about what’s actually happening within these groups and so on. But is a double spy because he also wants to be assert the independence of Brazil, but he’s still beholden somewhat to the United States. And so I have this idea that he’s like this double agent.

Armando Cavanha [00:29:38] Yeah

Tammy Nemeth [00:29:42] But if I could add to what they were saying about the new BRICS members. So originally Argentina had been invited, but with the election of L.A., he it’s kind of on hold right now. So Egypt is a new member, Iran, the United Arab Emirates, Saudi Arabia and Ethiopia. So we’ve got the five countries instead of the original six that were proposed, because Argentina is in a state of flux at the moment. But even so, Egypt, Iran, Emirates, Saudi Arabia and Ethiopia, those are. But aside from Ethiopia, I think those are four very strong countries in vis a vis the OPEC and the oil and gas trade. And I think it’s very signify. Against that. These Middle Eastern members are now part of the Brazil, South Africa, India, Russia, China connection.

David Blackmon [00:30:41] But look at where Ethiopia’s geographically is strategically located at the mouth of the Red Sea. And it’s just such a smart thing to bring Ethiopia into that organization for strategic geopolitical reasons. I mean, it’s just, you know, you have to admire them. Very smart.

Armando Cavanha [00:31:02] Yeah, they are growing very fast. And this is something that we need to take care to see what can happen.

Tammy Nemeth [00:31:09] But part of the Belt and Road Initiative, right where they have the train lines that go through and securing the shipping lines and and making sure that the oil and gas trade and the other really important resources from Africa, North Africa will have now access to that to the China India sort of market.

Armando Cavanha [00:31:32] For example, Nigeria, Angola, they are producing more oil and gas. And that being part of I don’t know what Europe they are.

Stuart Turley [00:31:43] great points.

Tammy Nemeth [00:31:46] such a Central African group. I can’t remember.

Stuart Turley [00:31:49] You cut out Tammy, you said. Oh.

Tammy Nemeth [00:31:53] And look.

Armando Cavanha [00:31:56] What this.

David Blackmon [00:31:56] Yeah, this is good. Yeah, we should. Should have explained that. You know, we kind of assume people know what Brexit is, but it is an acronym for Brazil, Russia, India, China and South Africa. It’s a global trade organization created by those five countries, and it expanded in August to have the countries that Tammy listed. And and and as we mentioned, it now controls the members of that organization, control more daily crude oil production now than Opec+.

Armando Cavanha [00:32:32] Yeah, yeah. OPEC’s 13 million barrels a day, I suppose.

David Blackmon [00:32:36] And BRICS is around more.

Armando Cavanha [00:32:39] Yeah, this must be great. Let’s go to the last point. That’s up for me. It’s a very tricky point because modes and acquisitions last year were very strong, were peak, but peak oil was, let’s see, pressured to to be green or not so Stuart. Please tell a little bit about your vision for big oil in terms of green energy or transition and things like that.

Stuart Turley [00:33:09] Yeah, we we talked to a little bit about the difference between the big oil in the European markets versus the big oil in the U.S. markets. I see a lot more mergers going on, but I also see mergers going along with the green big oil. If the markets would allow it, either the European Middle Eastern or they will become more, quote unquote, ESG or environmentally friendly based off of demand. And if demand is demanding that people do it like in Texas, we’ve talked about that before, I applaud the big oil for doing it again. You’ve got total energy, as I say here in Texas, that is bought nuclear, natural gas power plants. They’ve divested it. I’m looking to see their financial statements to see how they bury that. But yet you’re still seeing people buy renewable companies. There’s there’s all of that coming forward. So the big oil is going to be moving more green and the big oil is also going to become better. In ESG They’re also going to be doing better at giving money back to their thing. So I applaud the leadership of the big oil right now where they’re going . I hope that makes sense.

Tammy Nemeth [00:34:44] I think they have no choice. But, you know, if they want to stay relevant, you know, if they want to get financing, if they want to have a bank account. I think one of the interesting thing developments this year is that starting yesterday, January 1st, the EU used new sustainability and climate accounting has come into force for fairly large corporations, which will affect all of the oil and gas companies. And so since they have to account for scope three emissions, which is, you know how people use their products, they have to be responsible for the CO2 emissions of how people use oil and gas. That increases what their their emissions profile is, which will then affect how much money they have to spend on offsets or any of these other things. And so I think 2024 will be a very interesting year for the the balance books of oil and gas companies, European ones, at least at our headquarters in the EU, because they’re they’re going to have to account for all of these things. Now, BP, for example, has a joint project, I believe it’s with Shell where they’ve got three different carbon capture and hydrogen production sites that are moving forward in the UK in what’s called the side project, and they’re getting some government subsidies to do this. They want some assurances that there will be some kind of carbon trading regime that they can somehow make money, you know, instead of just sinking it all into the ground. So it’ll be interesting to see how this moves forward. But the governments, as I said at the outset, are really making it so the companies have no choice but to walk down these pathways. Otherwise, they they they can’t really exist or they can’t get financing, they can’t get insurance even though they’re producing something that is absolutely essential for how we live our lives and make our lives affordable and enjoyable.

Armando Cavanha [00:36:48] Yup. David Do you see more mergers and acquisitions this year and especially for the green side of the oil companies?

David Blackmon [00:36:58] Well, you know, there will definitely be more mergers and acquisitions, particularly in the US shale space, because economies of scale are just so important to profitability in that area of the business. You know, and there’s always mergers and acquisitions to some extent. But yes, I think becoming greener and more ESG friendly is is becoming a more and more important factor in evaluating mergers and acquisitions. For example, we saw Exxon Mobil acquired them very last summer. And Denver, of course, had this vast network 7000 miles, I think, of carbon dioxide pipelines in place already that are pretty handy for the big carbon capture and storage projects that Exxon Mobil has big plans for along the Texas and Louisiana Gulf Coast. So that that was just the synergy between those two companies that made all kinds of sense. And I think you’ll see more and more of that as time goes on when companies like Exxon and BP and Shell are developing hydrogen hubs. And, you know, there’s there’s going to be companies out there, third party vendor companies that have assets that are really convenient for making those projects work. And so you’ll see those companies start gobbling up those those third party companies. And it makes it the other aspect of all that is doing that. By doing that, it makes it easier for these big companies to track those. I’m sorry. Category three emissions. It’s like Category three. What’s it called?

Tammy Nemeth [00:38:44] Scope three.

David Blackmon [00:38:45] Scope three emissions. I’m sorry. I apologize.

Tammy Nemeth [00:38:47] It’s like a hurricane.

David Blackmon [00:38:50] But if you own all the infrastructure and you you own everything cradle to grave until the product gets on a ship or goes to an end user. It just makes it easier to account for for the scope three emissions. And so I, I just think we’re going to probably the pace of mergers and acquisitions will continue to increase this year, certainly in the United States.

Stuart Turley [00:39:16] Armand and then great points, David. The other big one was Occidental and Crown Rock and Michael PENNER and I did an evaluation of that deal and everybody was saying that Oxy overpaid for Crown Rock. But then when I looked at the whole infrastructure about it, I found that there were other that Oxy already had CO2 wells in the wells that were offsetting wells in everything that we looked at was one of the main reasons that right after that happened, you had Warren Buffett buying millions and millions more and during that transition. So you’re going to see that and you’re also going to see the more greener investments out of those guys, if that makes sense.

Armando Cavanha [00:40:12] Yup. So from our conversation today, I have three points that been my attention. The first one is natural gas. Should not be. Let’s see, forget them. It’s so important that you are not doing the the right approach for natural gas. The second point is short pipelines is a fantastic solution that we are not, let’s say, attributing the right approach for that. And the third, David, are really the U.S. lost the opportunity to make of South America, North America with relationship then and they lost the United States lost to Russia and China.

David Blackmon [00:40:58] Yeah, I think that’s right. I agree with all those.

Tammy Nemeth [00:41:04] Well, that would.

Stuart Turley [00:41:04] A year.

Tammy Nemeth [00:41:06] Yeah. The last point about hemispheric energy being an energy superpower. I mean, that was talked about in the early 2000 and it was one of the the sort of talking points between George W Bush and the Canadian government and Mexico. And they wanted to create this kind of powerhouse fortress North America and eventually bring South America into it so that there could be this very strong hemispheric power. And that was all undermined by the climate movement. And so you have to ask yourself, whose interest is it to undermine Western hemispheric energy security?

David Blackmon [00:41:45] Who might that be?

Tammy Nemeth [00:41:46] Who might That be? Right, Because, I mean, you look at the billions that have been funneled into the climate movement and there was an inquiry in the in Canada regarding some of the finances or at least what they could uncover, you know, looking at the accounting and so on. And there’s a lot of murky things going on there. So and I think there was a congressional investigation as well regarding some of the dark money that the dark green money that gets cycled through things.

Armando Cavanha [00:42:17] Yeah, That’s right

Tammy Nemeth [00:42:18] That was wonderful.

Armando Cavanha [00:42:20] Fantastic conversation with Professor Stuart Turley, my good friend David Blackmon and Dr. Tammy Nemeth, waiting for this next week.

David Blackmon [00:42:29] All right

Tammy Nemeth [00:42:30] Thank you. Looking forward to it. Thank you so much, Armando.

David Blackmon [00:42:33] Thank you.

Armando Cavanha [00:42:33] Thank you.

David Blackmon [00:42:34] Have a great week. Happy New Year.

Tammy Nemeth [00:42:35] Bye

Stuart Turley [00:42:35] I can’t find the button here.

Armando Cavanha [00:00:01] Energy transition. 92. Energy Trends in 2024. 2024. Happy New Year. Tammy Nemeth, David Blackmon, Stuart Turley

David Blackmon [00:00:14] Happy New Year.

Stuart Turley [00:00:15] Happy New Year,.

Tammy Nemeth [00:00:16] Happy New Year Everyone.

Armando Cavanha [00:00:18] David are you planning to use an ebike to go to the next door to see in Houston.

David Blackmon [00:00:23] Probably not. Probably not. After that subway fire in Toronto that was caused by an exploding e-bike battery that was brought on to the train. You know, I think I’ll forego riding those bikes in the future.

Armando Cavanha [00:00:39] I got the train, the subway or

David Blackmon [00:00:43] The subway train for the subway train. And luckily there were nobody injured. Thank God everyone was able to get out safely. And it took him a while to contain and put out the fire. But it’s fairly out there.

Armando Cavanha [00:00:56] Impressive. A people I was planning and I would like to see if you agree that we could separate in four steps our conversation today and the discourse. Which ones will grow faster. And there’s a security issue. We have some expectation about this issue. Energy restriction by geopolitical influences may be getting worse. I’m not sure. A merger and acquisition are everything related to big oil. They are pressure or not in this sense. So if you’re agree. Yeah. Great. Okay, fantastic. So let’s start with the the first point. They really would like to start to be the one to start our company.

David Blackmon [00:01:46] Sure. Yeah. I think that and I’m in the process of writing a forecast column for Forbes that I do every year, and I think it’s kind of obvious, kind of baked into the cake that solar probably is going to be the fastest growing energy source across the globe and in the United States this year. In the Western world, the subsidies are in place or they’re baked into the cake and they’re going to be heavily influential for the next seven, eight years. Wind is probably not going to grow nearly as quickly as solar and probably not as much of an expansion as it even had in 2023, which was a disappointing year for wind, really, because there’s just so many problems with wind now that are popping up as as the older wind farms get older and we find out that they don’t the turbines don’t really last anything close to 25 years and all the maintenance issues. And now there’s a growing a pretty rapidly growing protest movement to new wind farms in the United States that Robert Bryce has done a fabulous job of documenting. So I think wind is going to have a tough year. Oil and gas will expand just like it has the last two years, on a very steady pace to meet global demand. We’ll probably have an increase in global demand somewhere around 2 to 2 and a half million barrels per day. And I expect the United States and Brazil, frankly, Brazil’s offshore province, to fill a lot of that new demand. And so it’s going to create pressures on OPEC’s and Opec+ as a result, coal is, you know, being essentially outlawed by governments in the Western world. But in the developing world, coal is still king, is going to remain king will continue to expand, and we’ll probably use more coal again this year than we ever have in human history. And I don’t expect that trend to subside any time soon. Nuclear. It’s just hard to know. Unfortunately, the developments in the new technology or, you know, kind of slow in coming and government regulators are very plodding and modifying their regulatory structures for nuclear. And you still have all the protests raising alarm that’s really not justified about nuclear. So it’s still got a lot of problems.

Armando Cavanha [00:04:26] Mm hmm. Then you see, the government wants the same that society wants in terms of energy.

Tammy Nemeth [00:04:35] Well, it depends on where you are in the world, right? Because, you know, in the European Union, the governments want something different than what the people want. And, you know, the people want reliable, affordable energy that they know will be there when they need it, that it’s secure. And the government instead is embarking upon a different pathway. And the same in the U.K., where, you know, people in the U.K. want to make sure when they turn the heat on, the heat is on, not, you know, and is affordable, not like the new heat pumps where you can turn it on, it will wear away and not necessarily keep your house warm if you like it at 16 degrees Celsius. Okay, maybe in the winter, but most people would prefer it to be around 20, which doesn’t happen. And I think one of the interesting aspects in the U.K. is that there’s all these all this talk about increasing oil and gas production in the North Sea and whatnot. But the government is talking that way. But the companies aren’t buying it because there’s an election this year. And the government, the party that seems poised to take control, said they would cancel any leases that were were granted. So companies are, of course, holding back on whether or not they pursue this or not. And in respect of Canada, the government announced I think it was a cop 28 figure. They’re going to do a hard emissions cap on oil and gas production in Canada, and a hard emissions cap is basically a production cap. So, you know, they’re telling oil, oil and gas producers in Canada that they’re going to be limited on how much they can produce. So even even though the developing world will will probably increase demand, as David has said and I agree with with pretty much everything David has put forward, you know, Canada won’t be able to contribute to that. The same, you know, there were when Germany came in with Japan, came begging Canada, please support your friends. Can you export some more natural gas? And the government told them you can’t. Don’t talk about that publicly. We’re going to talk about hydrogen. So, you know, it’s it’s very clear that the Canadian government does not want to follow what the people want because the people in Canada also want secure, affordable, reliable energy. And the Canadian government is doing everything in its power to do the opposite.

Armando Cavanha [00:07:03] Yeah. Stuart, If you have hundred dollars and you have the options to bet and this source and their source, how much you can bet in the Trump.

Stuart Turley [00:07:14] How much I can bet on each one. Holy Smokes Batman. Welcome to Monday or Tuesday. I’ll tell you. Here’s the funny. That’s a great question. Armand. Let me answer this way. In COP 28, We had so many head explosions from the climate activists because it wasn’t that fun, David. I mean, when we sit back and go, they all went back and when they snuck in, natural gas is really needed. There was a resurgence to nuclear. And Hugo Kruger basically said, you know, just recently the median countries will excel in nuclear. We’ve seen that in Japan. We’ve seen that in France is now kicking back in Germany is going to coal. The US is not going to increase its fleet because of the legislation through regulatory issues. This is all tied back to the climate thing. So before I started losing my money that I’ll it’s thanks to Biden nomics that’s all I’ve got is $100 for this year and that is the war that is on also on food is out there as well, too. So when we sit back and take a look which ones are going to I think, David, you are it dead on, right? Solar is going to kick in. Huge natural gas is going to really kick in huge. But Armando, I don’t get it. Why the climate? Activists. And I’m not a large fan. I mean, Kerry fan. And when you sit back and take a look, the only reason we lost or reduced our carbon footprint was because of natural gas. Why don’t we support natural gas as the great transition to get us past natural gas should grow, solar should grow. Based off of what I’m seeing in wind farms we’ve talked about. They are unprofitable from day one. I just heard some heads explode.

David Blackmon [00:09:40] It’s true. Even with subsidies, a lot of them are not profitable.

Armando Cavanha [00:09:45] Yeah, yeah, yeah.

Stuart Turley [00:09:46] And they’re never carbon zero.

Armando Cavanha [00:09:49] He’ll never carbon zero. So I dreamt, the second point in terms of energy security its so so Important point. What are your expectations? Starting with Stuart. To. To see the expectation has.

Stuart Turley [00:10:04] Well, Armando, thank you again for letting me be a Debbie Downer. But as men and Tammy, I please take this with you know. We need to be providing for our families. There are natural disasters out there. There are things that could possibly happen. Get ready. Have small electric generators be able to survive for 24 to 72. And if you can survive for a long time without power, that’s great. Solar, wind. Love it for the house. Here’s where energy security becomes a problem. The Chinese will win over the U.S. In the U.S., only Tammy nailed it with the low cost energy. We need low cost, dependable. Our grid is vulnerable. In the United States, there are 30 major interconnects that China now can shut down. I’m not kidding. I’m working on some of that issue. David, I believe it was also the balloon is now documented that it tied to a national Internet provider and that the Biden administration tried to keep this quiet. So now that it is connected in pass through the major interconnects that we bought from China, I’m interviewing Michael Yon tonight. Michael Yon is in Panama and he has been tracking the Chinese army in folks coming in and what all that is about. So not only do we have the energy security, we have the FDR. See, that is said be prepared for blackouts. This morning, there was a major fire going on in New York City and it has had some serious problems this morning. Explosions were happening. Can you survive as a family? The government may not be there to bail you out. So energy security around the world is about natural gas pipelines. That is the number one energy security. We also just had the great interconnect, the most expensive interconnect coming to the UK, I believe, Tammy, this past week it was a huge interconnect coming in from, I believe, France, but I mean, that’s huge for them to be now energy dependent on another country.

David Blackmon [00:12:36] How that funny answer.

Armando Cavanha [00:12:39] And, David, to just see that wind energy is the worst one in terms of our.

David Blackmon [00:12:46] And yeah, so grid security is is a horrible issue in the United States for sure and in many other countries. And it’s the proximate cause of that is because we’re overloading our grids with intermittent energy, with no backup, no reliable backup, no sustainable backup. And and so we’re running out of reliable 24 seven generation capacity. Everybody’s short on it here in Texas. ERCOT says we got about a 16% chance of having blackout conditions at some point this winter if we have any kind of a significant winter weather event in Texas. And, you know, that’s a situation that should never exist in the state of Texas, we produce a third of all the natural gas produced in the United States, in Texas, Texas, if it were a country, would be the third largest producer of natural gas on the face of the earth. We should never have a situation in Texas where our grid has any threat of blackout conditions at all. So it’s scandalous, it’s borderline criminal that this situation exists. And policymakers in Texas had better get their arms around it pretty quick or you’re going to end up with a Democrat state again, because this is all happening on the Republican Party’s watch. And that’s my rant for today.

Armando Cavanha [00:14:12] But is there a special agenda for this voter that see it to put risks in the grid without necessary?

David Blackmon [00:14:21] Well, it’s just all part of the energy transition agenda. It’s this it’s this. We’ve chosen these three rent seeking industries, wind, solar and electric vehicles to subsidize into reality somehow with with debt funded subsidies put in place by the federal government. And the same things happening in Canada and the UK and throughout Europe and probably in Brazil too, all over the Western world. This is what we’re doing. In the meantime, China continues to build all the coal plants it wants to build and needs to build. Yeah, it’s become the second-biggest importer of oil on the face of the earth. India is moving in the same direction, China is moving and the net result is going to inevitably be tremendous energy instability and insecurity in the Western world. And we’re all going to be dependent on China for our energy security. And if anyone, anyone who thinks that’s a healthy and sustainable condition for any Western nation to be in is most likely a traitor, quite frankly, and has a lot of financial interests tied up in China. Kind of like a lot of people in this current presidential administration.

Stuart Turley [00:15:37] David, can I can I also validate what you just said, though, with China? China is building the mega gas production area with over 40 billion cubic meters. They went just very shortly from 30 billion to 40 billion, and that’s now it says, quote unquote, it took this 13 years to increase the annual gas output from 10 billion to 20. And it took just three years to expand from 20 to 30. And they are bringing a whole nother big section on a plan. China. Here’s the problem. They’ve increased their 220% because of the coal. They’re bringing on everything. They have all that. David, well said and well validated. I mean, sorry.

Armando Cavanha [00:16:25] Tammy the UK sorry, the UK and Canada prime ministers, do they know exactly what’s the meaning of and energy security because.

Tammy Nemeth [00:16:35] I don’t think they know what energy security is, to be honest. If I could add to what you’re saying about the interconnections, actually, the UK has had interconnections with France since 1986 and the the new one, I think that came online at the end of 2023, just a few weeks ago. That was an interconnection with Denmark. So there is if you go to the Ofgem website, Ofgem to GOV.UK, it talks about the current six gigawatts of electricity interconnections between the UK and Ireland, Netherlands, Belgium, France and now Denmark. And then it has a list of projects. So we’re going to it. The UK is going to be importing more energy from France and possibly either importing or exporting to Germany. So the German I know it’s going to come online in 2028. So you know, the UK has been part of this integrated European project, right? And that Brexit threw a monkey wrench into all of that. And if Labor gets back. I can. I’m sure Brexit will be over and they are once again double down on on the whole needing to be interconnected with Europe. The problem is that with these interconnections, as with the grids and everything, if you’re constantly expanding it, every time you do something that becomes a choke point, it becomes a place where you can potentially make a country vulnerable with a terrorist attack or or something else. And there’s no redundancies built into these systems. So, David, I really enjoyed your conversation with Robert Bryce the other day where he was talking about, yes, natural gas is great, but we still need the coal because natural gas is just in time. And coal at least you can stockpile. You can slowly ramp it up, you can ramp it down, whatever. But it’s a very, very stable source of electricity, which is why China is investing tremendously in their energy security. They have something of everything, right? More nuclear, more gas, more coal, more solar and wind or whatever where that happens to make sense. Although I question them using that to the extent that they say they are, in any event. India, I think, is is very interesting because the environmentalists made a big show and story when India said they were going to have a moratorium on new coal fired power. And that was back in February or March. But in October, they said, oh, emergency, we need to build so many thousands of megawatts or gigawatts or whatever it is, but to increase significantly their coal power because they want secure, reliable energy. They care about their energy security. And all I can say with Europe and Canada and the UK, oh, my gosh, get your heads out of the sand. Start thinking about the security, because with what’s going on in the Middle East and I’m sure we’ll get into geopolitics in a few minutes here, but there’s all kinds of things going on that that disrupt the flow and increase prices. And I know the environmentalists are making the argument, well, we should just invest more in wind and solar because then we’re not beholden to these international powers for for the price of oil or natural gas or whatever. And it’s just the most ludicrous argument, because who’s controlling, as David said, the components and the production of the wind and solar? Well, that’s China. So China suddenly holds back its its rare earths and now your cost of exponentially increased or they put a tariff on your solar panel. So so it’s not like we make them in Canada and we certainly don’t make them in the UK. So, yeah, okay, it’s going to increase production in China and then they can hold whatever they want over our heads with respect to price.

Armando Cavanha [00:20:35] Right. Please do not stop Tammy. Go ahead with the geopolitical influences and they can get worse. No opinion.

Tammy Nemeth [00:20:45] Well, sure, because so just at the end of the year, we had all of these new geopolitical issues starting, right? So we had the Venezuela, Guyana situation, which is unresolved. They’re still building up. They’re still kind of quasi negotiating how this is going to play out. It’s an election year in the United States, as David and Stu have mentioned, which throws all kinds of different variables into the equation. Then you have what’s going on with the Suez Canal and the Red Sea and the Houthi rebels going around attacking ships and so on. You have Iran coming into the fray there on the side of the Houthis. And it’s like, okay, so now Iran has a warship there or they’re doing something in the Red Sea that that affects that particular choke point, which is really a significant one. But I was looking on this map. You can find the all the the ships that are currently en route or whatever through the Red Sea, through the Suez Canal and the ones that are going around. Well, look at what companies own, the ones that are continuing to use Suez. Well, sure, the European companies may be going around Africa now because their targets are Chinese container ships. Are Chinese tankers being targeted by the Houthis? I don’t think so. So they get to the shortcut and the Western countries have to go the long way around. When you have China cutting, you know, sitting there being the mediator between Iran and Saudi Arabia to figure out what to do about Gaza and Israel. So China is now taking this kind of diplomatic position that they’re the calm, sober mediator for these different things. And so maybe in 2024, they also become elevated in trying to resolve what’s going on with Russia and Ukraine. What happens if that’s resolved? Does the oil and gas trade get to continue as it was before? If Russia somehow makes some kind of settlement, do they continue with the sanctions? Can they permit? Can the E.U. permit the sanctions to be lifted when they’re so close to achieving their their aim of putting their people into energy insecurity? So I don’t know. It’s an interesting year. I think there’s a lot of moving parts right now that that can make things very interesting.

Armando Cavanha [00:23:00] But, David, you mentioned Brazil, and Brazil is now being a friend of Russia and China. So be less west and more east of friendship. How do you see and being part of OPEC and BRICS? So please insert this variable. Your comment. Please go ahead.

David Blackmon [00:23:19] Well, I think that that’s a very big deal. And, you know, I’ve talked about that for the last year now. I think the the expansion of BRICS, you know, Brazil has always been a part of BRICS, but the expansion of BRICS to include the United Arab Emirates, Saudi Arabia, Egypt now makes in a couple of other countries. It now makes BRICS not just a the really the largest, the most economically powerful global trade organization. It also the members of OPEC’s now control more daily oil production than OPEC does. Okay. With Russia and Saudi Arabia both in there. And and so that means BRICS being a part of BRICS now just I think is going to be heavily influential in Brazil’s foreign policy outlook and its international outlook outlook. And the same is going to be true. And we’re seeing it as as Tammy noted, we’re seeing it playing out in real time now. The same is going to be true with Saudi Arabia and the UAE. It’s that China is going to become the mediator of these disputes and not the United States. It’s going to be a gradual displacement of US influence really around the world. And a lot of that’s going to be driven by BRICS as an organization. So, you know, you have to give China credit. They’re very smart. They are unrelenting. They they have a long term outlook on all of this, where the United States just I mean, and this administration in particular just kind of doesn’t seem to have any long term outlook at all on anything. And, yeah, we send our carrier groups in and what did we do? We shot three little Houthi boats out of the water over the weekend and killed ten of them. And that’s been our big military objective in the Middle East now. So it’s just it’s it’s a real. Well, I can’t even say the word where U.S. foreign policy is concerned. And I just think China just is going to continue to gain influence in that room.

Tammy Nemeth [00:25:41] Yeah.

Armando Cavanha [00:25:42] And Stuart if you’ve been flying with the president of Brazil in the same airplane, sit by seat, what what could be your conversation with him?

Stuart Turley [00:25:54] Holy smoke, Batman. Well, I would I’d look over because Putin would be in the same airplane. And I thought that was a good one when in and Putin would look at him and say, you know, it’s the way I think of the U.S. is it’s mind over matter. And I’m paraphrasing Putin. So it would be it’s mind over matter because the U.S. doesn’t matter. Because I don’t mind. And what they’ve done is a beautiful job. Putin is now the president of BRICS this next year. So that’s why he’s in the plane with the president of Brazil that would be in there and I’d be firing up a podcast and David would be right there and then Tammy would be there and we’d have a big old podcast going on with you leading the question. So I’m not sure I would put this in my my weird mind here. Now.

David Blackmon [00:26:51] I don’t know what any of that means Stu, but I like it.

Stuart Turley [00:26:55] All right. We’re going to have to. Here’s what the big thing is. And that is the Monroe. I believe it’s the Monroe Doctrine you brought up before, David, on this. And that is, we are idiots in the United States and Canada. Total idiots. We could negate OPEC by being a traitor within our own hemisphere and and wipe out their ability to do this over here. So here I am. I got Putin, and Putin has said, Hey, I don’t want to cut off the West, but the West doesn’t matter anymore. So we have this paradigm, and I would like to be the guy out there. And I know David would not be able to do this because of his sense of humor. My sense of humor. I think and Tammy would be very, very sensible and then the smart one in the room. So I would go out and I would say, Guys, let’s all work together. Let’s work for energy security. Let’s work for energy. And I think next week, when Irene Oswald comes on, we need to talk about OPEC and her great article that just came out today that was wonderful about OPEC’s not dead yet. Yeah, I got a few points on it that it is losing some some traction on the pricing matrixes because I think the oil matrices is messed up. Pricing matrices for oil has got some the DART fleet 600 tanker in all of this. My head’s exploding with what’s going on, but I can’t wait for that plane ticket. Armand, we’re going to have a blast.

Tammy Nemeth [00:28:40] Can I add in there a little bit? Because I feel like Brazil is something like a double agent. Because Lula, who I think and I’m sure I’m wrong, but I think it’s an interesting idea that Lula owes his position to the United States. I mean, the reason he won, I think it was due to support or interference with from the United States. But on the and but he kind of likes to be against the United States because of the whole South American sort of post-colonial idea. And so I feel like he’s a spy in OPEC and the BRICS, giving some information back to the United States about what’s actually happening within these groups and so on. But is a double spy because he also wants to be assert the independence of Brazil, but he’s still beholden somewhat to the United States. And so I have this idea that he’s like this double agent.

Armando Cavanha [00:29:38] Yeah

Tammy Nemeth [00:29:42] But if I could add to what they were saying about the new BRICS members. So originally Argentina had been invited, but with the election of L.A., he it’s kind of on hold right now. So Egypt is a new member, Iran, the United Arab Emirates, Saudi Arabia and Ethiopia. So we’ve got the five countries instead of the original six that were proposed, because Argentina is in a state of flux at the moment. But even so, Egypt, Iran, Emirates, Saudi Arabia and Ethiopia, those are. But aside from Ethiopia, I think those are four very strong countries in vis a vis the OPEC and the oil and gas trade. And I think it’s very signify. Against that. These Middle Eastern members are now part of the Brazil, South Africa, India, Russia, China connection.

David Blackmon [00:30:41] But look at where Ethiopia’s geographically is strategically located at the mouth of the Red Sea. And it’s just such a smart thing to bring Ethiopia into that organization for strategic geopolitical reasons. I mean, it’s just, you know, you have to admire them. Very smart.

Armando Cavanha [00:31:02] Yeah, they are growing very fast. And this is something that we need to take care to see what can happen.

Tammy Nemeth [00:31:09] But part of the Belt and Road Initiative, right where they have the train lines that go through and securing the shipping lines and and making sure that the oil and gas trade and the other really important resources from Africa, North Africa will have now access to that to the China India sort of market.

Armando Cavanha [00:31:32] For example, Nigeria, Angola, they are producing more oil and gas. And that being part of I don’t know what Europe they are.

Stuart Turley [00:31:43] great points.

Tammy Nemeth [00:31:46] such a Central African group. I can’t remember.

Stuart Turley [00:31:49] You cut out Tammy, you said. Oh.

Tammy Nemeth [00:31:53] And look.

Armando Cavanha [00:31:56] What this.

David Blackmon [00:31:56] Yeah, this is good. Yeah, we should. Should have explained that. You know, we kind of assume people know what Brexit is, but it is an acronym for Brazil, Russia, India, China and South Africa. It’s a global trade organization created by those five countries, and it expanded in August to have the countries that Tammy listed. And and and as we mentioned, it now controls the members of that organization, control more daily crude oil production now than Opec+.

Armando Cavanha [00:32:32] Yeah, yeah. OPEC’s 13 million barrels a day, I suppose.

David Blackmon [00:32:36] And BRICS is around more.

Armando Cavanha [00:32:39] Yeah, this must be great. Let’s go to the last point. That’s up for me. It’s a very tricky point because modes and acquisitions last year were very strong, were peak, but peak oil was, let’s see, pressured to to be green or not so Stuart. Please tell a little bit about your vision for big oil in terms of green energy or transition and things like that.

Stuart Turley [00:33:09] Yeah, we we talked to a little bit about the difference between the big oil in the European markets versus the big oil in the U.S. markets. I see a lot more mergers going on, but I also see mergers going along with the green big oil. If the markets would allow it, either the European Middle Eastern or they will become more, quote unquote, ESG or environmentally friendly based off of demand. And if demand is demanding that people do it like in Texas, we’ve talked about that before, I applaud the big oil for doing it again. You’ve got total energy, as I say here in Texas, that is bought nuclear, natural gas power plants. They’ve divested it. I’m looking to see their financial statements to see how they bury that. But yet you’re still seeing people buy renewable companies. There’s there’s all of that coming forward. So the big oil is going to be moving more green and the big oil is also going to become better. In ESG They’re also going to be doing better at giving money back to their thing. So I applaud the leadership of the big oil right now where they’re going . I hope that makes sense.

Tammy Nemeth [00:34:44] I think they have no choice. But, you know, if they want to stay relevant, you know, if they want to get financing, if they want to have a bank account. I think one of the interesting thing developments this year is that starting yesterday, January 1st, the EU used new sustainability and climate accounting has come into force for fairly large corporations, which will affect all of the oil and gas companies. And so since they have to account for scope three emissions, which is, you know how people use their products, they have to be responsible for the CO2 emissions of how people use oil and gas. That increases what their their emissions profile is, which will then affect how much money they have to spend on offsets or any of these other things. And so I think 2024 will be a very interesting year for the the balance books of oil and gas companies, European ones, at least at our headquarters in the EU, because they’re they’re going to have to account for all of these things. Now, BP, for example, has a joint project, I believe it’s with Shell where they’ve got three different carbon capture and hydrogen production sites that are moving forward in the UK in what’s called the side project, and they’re getting some government subsidies to do this. They want some assurances that there will be some kind of carbon trading regime that they can somehow make money, you know, instead of just sinking it all into the ground. So it’ll be interesting to see how this moves forward. But the governments, as I said at the outset, are really making it so the companies have no choice but to walk down these pathways. Otherwise, they they they can’t really exist or they can’t get financing, they can’t get insurance even though they’re producing something that is absolutely essential for how we live our lives and make our lives affordable and enjoyable.

Armando Cavanha [00:36:48] Yup. David Do you see more mergers and acquisitions this year and especially for the green side of the oil companies?

David Blackmon [00:36:58] Well, you know, there will definitely be more mergers and acquisitions, particularly in the US shale space, because economies of scale are just so important to profitability in that area of the business. You know, and there’s always mergers and acquisitions to some extent. But yes, I think becoming greener and more ESG friendly is is becoming a more and more important factor in evaluating mergers and acquisitions. For example, we saw Exxon Mobil acquired them very last summer. And Denver, of course, had this vast network 7000 miles, I think, of carbon dioxide pipelines in place already that are pretty handy for the big carbon capture and storage projects that Exxon Mobil has big plans for along the Texas and Louisiana Gulf Coast. So that that was just the synergy between those two companies that made all kinds of sense. And I think you’ll see more and more of that as time goes on when companies like Exxon and BP and Shell are developing hydrogen hubs. And, you know, there’s there’s going to be companies out there, third party vendor companies that have assets that are really convenient for making those projects work. And so you’ll see those companies start gobbling up those those third party companies. And it makes it the other aspect of all that is doing that. By doing that, it makes it easier for these big companies to track those. I’m sorry. Category three emissions. It’s like Category three. What’s it called?

Tammy Nemeth [00:38:44] Scope three.

David Blackmon [00:38:45] Scope three emissions. I’m sorry. I apologize.

Tammy Nemeth [00:38:47] It’s like a hurricane.

David Blackmon [00:38:50] But if you own all the infrastructure and you you own everything cradle to grave until the product gets on a ship or goes to an end user. It just makes it easier to account for for the scope three emissions. And so I, I just think we’re going to probably the pace of mergers and acquisitions will continue to increase this year, certainly in the United States.

Stuart Turley [00:39:16] Armand and then great points, David. The other big one was Occidental and Crown Rock and Michael PENNER and I did an evaluation of that deal and everybody was saying that Oxy overpaid for Crown Rock. But then when I looked at the whole infrastructure about it, I found that there were other that Oxy already had CO2 wells in the wells that were offsetting wells in everything that we looked at was one of the main reasons that right after that happened, you had Warren Buffett buying millions and millions more and during that transition. So you’re going to see that and you’re also going to see the more greener investments out of those guys, if that makes sense.

Armando Cavanha [00:40:12] Yup. So from our conversation today, I have three points that been my attention. The first one is natural gas. Should not be. Let’s see, forget them. It’s so important that you are not doing the the right approach for natural gas. The second point is short pipelines is a fantastic solution that we are not, let’s say, attributing the right approach for that. And the third, David, are really the U.S. lost the opportunity to make of South America, North America with relationship then and they lost the United States lost to Russia and China.

David Blackmon [00:40:58] Yeah, I think that’s right. I agree with all those.

Tammy Nemeth [00:41:04] Well, that would.

Stuart Turley [00:41:04] A year.

Tammy Nemeth [00:41:06] Yeah. The last point about hemispheric energy being an energy superpower. I mean, that was talked about in the early 2000 and it was one of the the sort of talking points between George W Bush and the Canadian government and Mexico. And they wanted to create this kind of powerhouse fortress North America and eventually bring South America into it so that there could be this very strong hemispheric power. And that was all undermined by the climate movement. And so you have to ask yourself, whose interest is it to undermine Western hemispheric energy security?

David Blackmon [00:41:45] Who might that be?

Tammy Nemeth [00:41:46] Who might That be? Right, Because, I mean, you look at the billions that have been funneled into the climate movement and there was an inquiry in the in Canada regarding some of the finances or at least what they could uncover, you know, looking at the accounting and so on. And there’s a lot of murky things going on there. So and I think there was a congressional investigation as well regarding some of the dark money that the dark green money that gets cycled through things.

Armando Cavanha [00:42:17] Yeah, That’s right

Tammy Nemeth [00:42:18] That was wonderful.

Armando Cavanha [00:42:20] Fantastic conversation with Professor Stuart Turley, my good friend David Blackmon and Dr. Tammy Nemeth, waiting for this next week.

David Blackmon [00:42:29] All right

Tammy Nemeth [00:42:30] Thank you. Looking forward to it. Thank you so much, Armando.

David Blackmon [00:42:33] Thank you.

Armando Cavanha [00:42:33] Thank you.

David Blackmon [00:42:34] Have a great week. Happy New Year.

Tammy Nemeth [00:42:35] Bye

Stuart Turley [00:42:35] I can’t find the button here.

Sponsorships are available or get your own corporate brand produced by Sandstone Media.

David Blackmon LinkedIn

The Crude Truth with Rey Trevino

Rey Trevino LinkedIn

Energy Transition Weekly Conversation

David Blackmon LinkedIn

Irina Slav LinkedIn

Armando Cavanha LinkedIn