In the escalating geopolitical tussle between the United States and China over rare earth elements (REEs)—critical minerals essential for everything from smartphones and electric vehicles (EVs) to fighter jets and renewable energy technologies—Europe finds itself caught in the crossfire, emerging as the unintended primary victim. As both superpowers vie for dominance in supply chains that underpin modern economies and defense systems, Europe’s aggressive pursuit of Net Zero emissions targets, coupled with ongoing deindustrialization, has amplified its vulnerabilities, potentially accelerating a fiscal collapse. Meanwhile, the US has made significant strides in bolstering its domestic REE production and processing capabilities, highlighting a stark contrast in strategic resilience.

The Geopolitical Battlefield: US-China Rare Earth Tensions

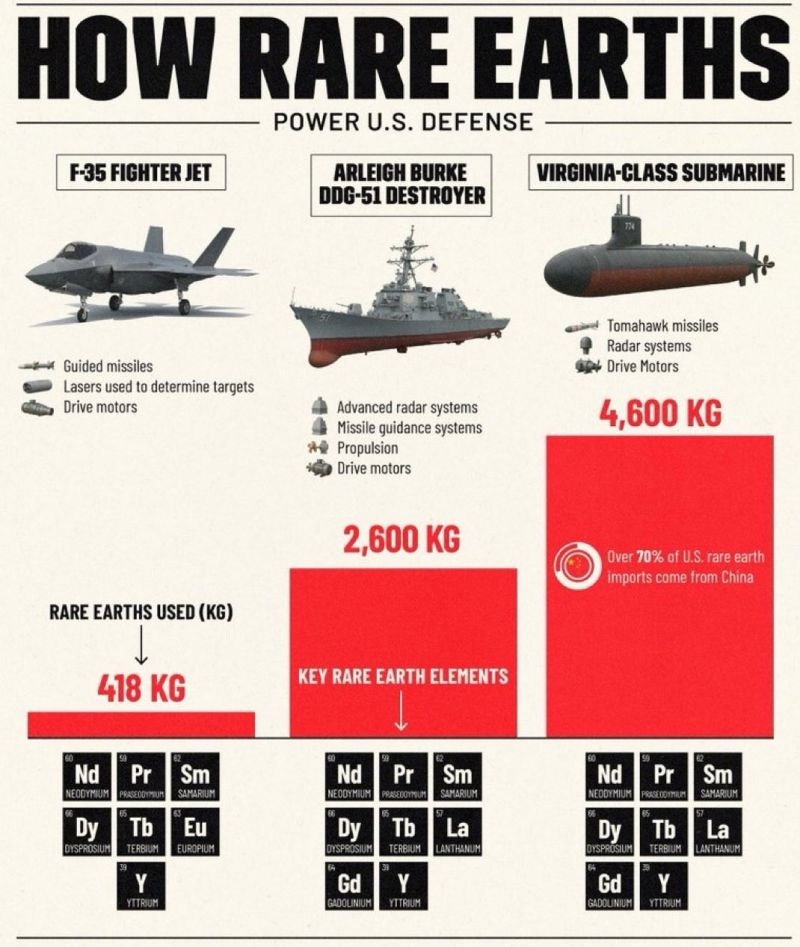

Rare earth elements, a group of 17 metals, are indispensable for high-tech manufacturing, green energy transitions, and military applications. China has long dominated this space, controlling around 70-80% of global REE processing and extraction.

This monopoly allows Beijing to wield significant leverage, as evidenced by its recent expansion of export controls on 12 of the 17 rare earth metals, citing national security concerns.

These restrictions, announced in October 2025, prohibit the export of REEs for foreign military use and tighten scrutiny on dual-use technologies, directly countering US efforts to restrict high-end semiconductor exports to China.

The US, under successive administrations, has responded aggressively. Drawing parallels to Cold War-era export controls that contributed to the Soviet Union’s downfall, Washington has imposed curbs on advanced chips and manufacturing equipment, aiming to hobble China’s technological ascent in areas like AI, quantum computing, and robotics.

However, China’s ability to retaliate—unlike the Soviets—stems from its cost-effective processing (30% cheaper than competitors) of most of the 54 critical minerals identified by the US Geological Survey (USGS).

This asymmetry has global ripple effects, but none more pronounced than in Europe.

Europe’s Vulnerabilities: Net Zero Ambitions Meet Geopolitical Reality

Europe’s commitment to Net Zero by 2050 has positioned it at the forefront of the global energy transition, emphasizing renewables like solar, wind, and EVs—sectors heavily reliant on REEs. Ironically, this forward-looking agenda has exposed the continent to severe supply chain risks. China dominates production in these areas, having outpaced Europe in solar panels, wind turbines, lithium-ion batteries, and EVs, where the EU was once a pioneer.

For instance, demand for REEs in EV motors surged 32% year-over-year in 2024, reaching 37 kilotons, largely driven by neodymium and praseodymium—elements now under tighter Chinese controls.

The EU’s “dual dependence” exacerbates the issue: reliant on US digital services for innovation and Chinese-processed minerals for hardware.

This leaves Europe squeezed between US export restrictions, which limit access to cutting-edge tech, and Chinese countermeasures that could spike prices or halt supplies. Experts at a recent Vienna conference on critical raw materials concluded that Europe is the “primary victim,” as its economy and identity are tied to green technologies now controlled by Beijing.

In conflicts like the Iran-Israel skirmish in June 2025, where 800 missiles consumed 1.6-16 metric tons of REEs in just seven days, or Ukraine’s drone warfare against Russia (almost entirely dependent on Chinese electronics), Europe’s defense and support capabilities are indirectly threatened.

Moreover, environmental and political barriers hinder Europe’s self-sufficiency. The EU’s Critical Raw Materials Act aims to boost domestic mining, but stiff resistance from green groups has stalled progress, leaving the bloc “barely at the races” compared to US influence over South American lithium reserves or China’s entrenched dominance.

Deindustrialization and the Path to Fiscal CollapseEurope’s deindustrialization, accelerated by high energy costs, regulatory burdens, and the shift to renewables, compounds these challenges. Once a manufacturing powerhouse, the continent has seen industries relocate to cheaper locales, often in Asia, eroding its competitive edge in high-tech and green sectors.

Net Zero policies, while environmentally laudable, have imposed trillions in transition costs without adequate domestic supply chains, leading to higher import dependencies and vulnerability to price shocks from Chinese restrictions.

This trajectory risks fiscal collapse. EU investments in high-tech pale against the trillions poured in by the US and China, forcing reliance on subsidies to compete—draining public coffers amid already strained budgets from energy crises and post-pandemic recovery.

Geopolitical risks further amplify export disruptions for REE permanent magnets, Europe’s key imports from China, potentially hiking costs and stifling growth.

Without mobilization, Europe could become a “permanent supplicant” to the superpowers, accelerating deindustrialization and fiscal strain as import bills soar and market shares dwindle.

US Advancements: A Model of Resilience

In contrast, the US has ramped up efforts to secure its REE supply chain. From 2023 to 2025, domestic initiatives have flourished, with the Department of Defense aiming for a complete mine-to-magnet chain by 2027.

The Trump administration’s expansion of price supports for mining, processing, recycling, and magnet production in July 2025 underscores this push.

USGS data shows US imports of REE compounds and metals dropped 11% from $186 million in 2023 to $170 million in 2024, signaling growing self-reliance.

Innovative approaches, like mining critical minerals from existing waste without new digs, address import dependencies—e.g., 80% of REEs, 100% of gallium and graphite in 2024.

Reshoring has surged, with jobs in the sector increasing 26-fold from 2010 to 2023, bolstered by policies to counter China’s grip.

Global reserves also rose from 28 million tons in 2024 to 30 million tons in 2025, partly due to US exploration.

These moves not only mitigate risks but position the US to influence allies and competitors alike.

Conclusion: A Wake-Up Call for Europe

As the US-China rare earth wars intensify, Europe’s position as the biggest loser stems from its Net Zero-driven dependencies, deindustrialization trends, and insufficient investments—paving the way for fiscal vulnerabilities. To avert collapse, the EU must overcome internal hurdles, ramp up domestic production, and forge strategic alliances. Otherwise, in this high-stakes game, Europe risks being sidelined while the superpowers advance. I do not see the EU leadership capable of recovering. We can always hope, but in my opinion, the current leadership lacks the talent to reindustrialize the EU. In fact, I see energy as the core reason that the EU risks losing members and collapsing before it has the opportunity to succeed.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack