As winter approaches in Europe, the continent is grappling with delayed refilling of natural gas inventories amid surging liquefied natural gas (LNG) shipping rates. This situation is compounded by rising demand for natural gas in electricity generation and ongoing challenges in renewable energy sectors, such as Germany’s wind power issues. These factors could lead to higher energy costs for consumers and potential supply vulnerabilities if cold weather intensifies. In this article, we delve into the current state of Europe’s gas storage, demand trends, renewable hurdles, and the ripple effects of escalating LNG transport costs.

Natural Gas Storage Levels: A Concerning Lag Compared to Recent Years

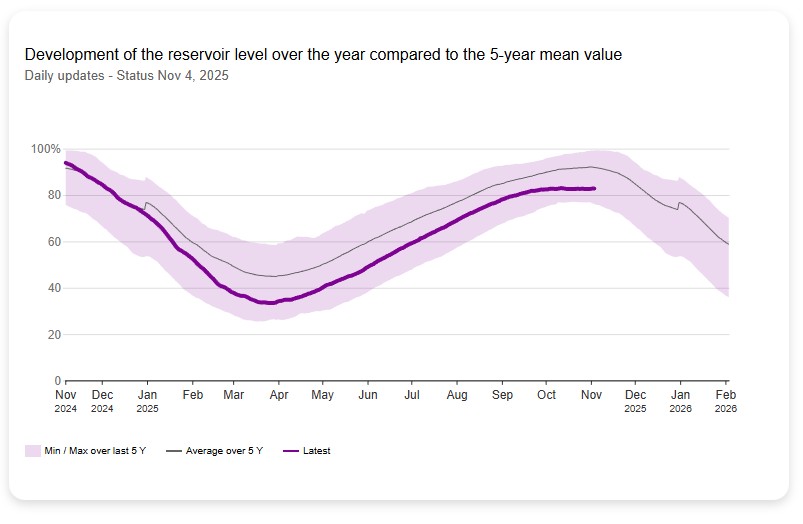

Europe’s natural gas storage levels are running behind schedule for refilling ahead of the peak winter demand period. As of mid-October 2025, EU gas storage stood at 83% capacity, which is notably below the levels recorded in 2022, 2023, and 2024.

This marks a departure from the robust stockpiling seen in recent years, where storage often exceeded historical averages early in the season.

Compared to the last five years (2020-2024), current inventories are lower than the peaks achieved post-2022 energy crisis. For instance, at the end of the 2024-2025 heating season on April 1, 2025, EU storage levels were at 34%, down from higher figures in the prior two winters.

While still above the 2021 averages, the slower refill pace in 2025 is attributed to milder early weather and delayed imports. By October 1, 2025, storage reached 83%, providing some resilience but highlighting the need for accelerated injections to meet potential disruptions.

Historical data shows that five-year averages for this time of year typically hover around higher maximums, with 2023 and 2024 seeing faster builds due to proactive policies.

If refilling doesn’t pick up, Europe risks drawing down reserves more aggressively, potentially spiking prices.

Surging Demand for Natural Gas in Electricity Generation

Demand for natural gas in Europe’s electricity sector is on the rise, driven by economic recovery, electrification trends, and gaps in renewable output. In the first half of 2025, Europe’s overall natural gas demand increased by 6.1%, with a significant portion allocated to power generation.

This uptick follows a period of subdued consumption, as gas-fired plants are increasingly called upon to balance intermittent renewables like wind and solar.

Projections for 2025 indicate a 3% increase in European natural gas demand overall, with electricity generation accounting for a growing share amid rising electrification rates—from 23% to an expected 30% of final energy demand by 2030.

EU electricity consumption itself grew by about 1.5% in 2024, setting the stage for continued reliance on gas in 2025.

During the November 2024-March 2025 period, net storage withdrawals surged by over 50% year-on-year, covering more than 30% of natural gas demand, much of which supported power needs during low-renewable output periods.

This demand pressure is exacerbating the inventory refill delays, as utilities prioritize immediate generation over long-term storage builds.

Germany’s Wind Power Challenges: A Case Study in Renewable Reliability

Germany, a leader in Europe’s energy transition, is facing persistent issues with its wind power sector, which are indirectly boosting natural gas demand. Recent analyses highlight periods of low wind speeds, known as “Dunkelflaute,” where calm, dark weather reduces output from wind and solar, forcing greater reliance on gas-fired backups. While a direct scan of Energy News Beat’s website (energynewsbeat.co) did not yield specific recent articles on this topic, broader industry reports underscore these problems. For example, Germany’s ambitious wind expansion targets are hampered by grid constraints, permitting delays, and variable generation, leading to higher gas usage for stability. In 2025, these challenges will have contributed to increased gas imports, as wind power’s share in the energy mix has underperformed during key demand periods. This vulnerability amplifies Europe’s overall gas needs, making inventory management even more critical.

LNG Shipping Rate Surge and Its Impact on Consumers

LNG shipping rates have surged dramatically in recent weeks, with global freight costs rising by 50% due to tight tanker supply, winter demand spikes, and logistical bottlenecks such as delays in Egyptian cargo deliveries.

Rates have hit multi-month highs, driven by Europe’s urgent efforts to secure supplies amid lagging inventories.

This surge is particularly acute for Atlantic Basin routes, where vessel availability is strained.

For European consumers, these elevated rates translate directly into higher energy bills. As LNG imports jumped 24% year-on-year in the first half of 2025,

the added transport costs—passed through to utilities and suppliers—could increase household and industrial gas prices by 10-20% this winter, depending on contract structures. Vulnerable populations may face amplified heating costs, while industries like manufacturing could see reduced competitiveness. Long-term, if rates remain high into 2026, it might accelerate Europe’s push for domestic renewables and efficiency measures, but short-term pain for consumers is inevitable.

Projections suggest a potential 25% rise in Europe’s LNG imports for 2025 overall, further pressuring budgets.

Conclusion: Navigating a Precarious Winter

Europe’s delayed natural gas inventory refills, coupled with rising demand for power generation and LNG shipping rate surges, paint a picture of heightened energy risks this winter. Germany’s wind challenges exemplify the broader need for reliable backups, underscoring gas’s role in the transition. Consumers should brace for potential price hikes, while policymakers must focus on diversifying supplies and enhancing efficiency to mitigate impacts. Staying informed through channels like Energy News Beat will be key as the situation evolves.