In a bold move amid Venezuela’s rapidly evolving political landscape, former Chevron executive Ali Moshiri is spearheading an initiative to raise $2 billion for investments in the country’s beleaguered oil sector. This comes just days after U.S. forces captured ousted President Nicolás Maduro, sparking renewed interest in revitalizing what were once the world’s largest proven oil reserves. Moshiri’s plans, detailed in a recent Financial Times interview, highlight both the immense opportunities and persistent challenges in Venezuela’s oil revival.

Moshiri’s Background and Ambitious Investment Strategy

Ali Moshiri, an Iranian-American who previously led Chevron’s operations in Latin America and Africa, has a deep history with Venezuela’s oil industry. During his tenure at Chevron, he navigated complex partnerships with the state-owned Petróleos de Venezuela (PDVSA), even as other majors like ExxonMobil exited amid nationalizations under Hugo Chávez. Moshiri retired from Chevron in 2017 but has remained active in energy investments through his Houston-based firm, Amos Global Energy Management.

In the FT interview, Moshiri revealed that his fund has prepared a private placement memorandum dated December 2025, aimed at securing $2 billion from investors. The goal is to acquire between 20,000 and 50,000 barrels per day (bpd) of oil production capacity, along with approximately 500,000 barrels of reserves directly from PDVSA. He envisions an exit strategy within five to seven years, targeting a 2.5 times return on investment. “We have been anticipating this breakthrough for a while,” Moshiri told the FT, referring to the recent U.S. intervention. He noted a surge in investor interest, with inquiries jumping from “zero to 99 percent” in the 24 hours following Maduro’s capture.

Moshiri’s past attempts to invest in Venezuela underscore his persistence. In 2022, he partnered with Gramercy Funds Management for offshore projects in the Gulf of Paria and struck a deal to acquire assets from China’s Sinopec, but both efforts stalled due to U.S. sanctions under the Biden administration. Now, with the Trump administration’s more business-oriented approach, Moshiri is optimistic about obtaining necessary approvals.

The Political Shockwave: Maduro’s Capture and Its Immediate Aftermath

The catalyst for this investment push was the U.S. military operation on January 3, 2026, which resulted in Maduro’s capture and rendition to the United States. Maduro, along with his wife Cilia Flores, is set to appear in a U.S. court facing charges of drug trafficking and other crimes.

This swift action, justified under an emboldened Monroe Doctrine by the Trump administration, has sent ripples through global geopolitics, drawing reactions from leaders in Russia, China, and across Latin America. In Venezuela, the Supreme Court swiftly directed Vice President Delcy Rodriguez to assume the presidency, ensuring continuity within the socialist United Socialist Party of Venezuela (PSUV).

Rodriguez, a staunch ally of Maduro and sister to former Vice President Jorge Rodriguez, has vowed to maintain the government’s policies. President Trump has warned that the U.S. will “run the country” if the new leadership does not comply, emphasizing “total access” for U.S. oil companies to Venezuela’s reserves.

According to analysis from the Energy News Beat Substack, this regime continuity could temper celebrations. While Venezuelans are portrayed as relieved by Maduro’s removal, the article notes that socialist policies have “eviscerated” the oil fields, making large-scale investment risky without fundamental changes. It positions U.S. firms like Chevron as early winners, already producing oil under special licenses, but warns that full restoration could take years and won’t immediately impact global markets.

Path Forward or Persistent Roadblocks?

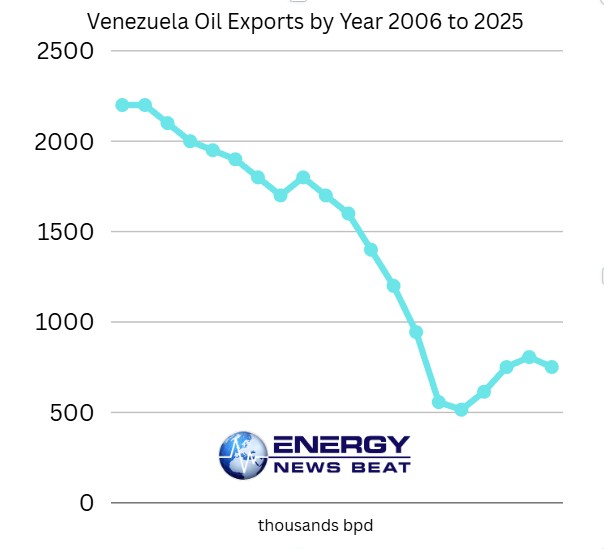

Venezuela’s oil industry, once producing over 3 million bpd, has plummeted to around 800,000 bpd due to decades of mismanagement, corruption, and U.S. sanctions. Reviving it requires tens of billions in investment to repair infrastructure, particularly in the heavy oil-rich Orinoco Belt. Moshiri’s $2 billion fund could serve as a starting point for smaller-scale acquisitions, but experts question whether the Rodriguez regime will facilitate or hinder such efforts.

Opportunities for Revival

U.S. Backing: Trump’s explicit call for “billions of dollars” in U.S. investments, coupled with threats of further strikes, could pressure the new government into favorable terms. Moshiri views this as a “silver bullet,” especially with adversaries like China, Russia, and Iran sidelined.

Chevron’s Head Start: As the only major U.S. oil company still operating in Venezuela, Chevron is prioritizing asset integrity and could expand rapidly if sanctions are fully lifted. Private investors like Moshiri and Continental Resources’ Harold Hamm are signaling readiness to move if stability improves.

Global Interest: European firms such as Repsol and Eni may re-enter if terms are attractive, potentially accelerating recovery. OPEC+ is monitoring closely, committed to market stability, and likely to negotiate Venezuela’s reintegration to avoid price disruptions.

Potential Roadblocks from the Regime

Socialist Continuity: With Rodriguez in power, the PSUV’s influence persists. Historical expropriations under Chávez and Maduro raise fears of asset seizures, deterring majors like ExxonMobil and ConocoPhillips, who are pursuing billions in arbitration awards from past nationalizations.

Investment Scale and Timeline: The Substack analysis emphasizes that fields are “devastated,” with restoration years away. No investor would commit under a regime unwilling to reform fiscal terms or guarantee property rights.

Geopolitical Tensions: Reactions from Putin and Xi suggest potential backlash, including support for Venezuelan holdouts. Ongoing U.S. sanctions on the “Dark Fleet” of tankers could complicate exports, and internal instability might erupt if Rodriguez resists U.S. demands.

Given the timing of the information in the FT interview, it is clear that the White House gave Moshiri a heads-up to get a fund moving.

In summary, Moshiri’s $2 billion push represents a test case for Venezuela’s oil renaissance. While U.S. intervention has cracked open the door, the Rodriguez regime’s socialist leanings could erect significant roadblocks unless Trump’s threats force concessions. For energy investors, the path forward hinges on rapid political stabilization and transparent deals—otherwise, Venezuela’s vast reserves may remain untapped for years to come. As Moshiri put it, the opportunity is here, but execution will define success.

Sources: ft.com, atlanticcouncil.org, theenergynewsbeat.substack.com.