It has been over a month since signs of banking stress first appeared in regional banks, and we quickly identified the beginning of a credit crunch.

Days after the collapse of Silicon Valley Bank, we pointed out that the next “credit event” had arrived. Then cited a note from Jan Hatzius, Goldman Sachs chief economist, who pointed out small and medium-sized banks serve a critical function in the US economy:

“Banks with less than $250bn in assets account for roughly 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.”

And throughout March into April, we outlined the macroeconomic impact of the regional bank blowups that would be a major catalyst in a pullback of lending:

Confirmation of the tightened lending standards and worsening credit crunch that might spark a hard economic landing in the second half was confirmed in the Federal Reserve’s latest Beige Book, which based on information collected before April 10, indicated:

Conditions in the broad finance sector deteriorated sharply coinciding with recent stress in the banking sector. Small to medium-sized banks in the District reported widespread declines in loan demand across all loan segments. Credit standards tightened noticeably for all loan types, and loan spreads continued to narrow. Deposit rates moved higher. Finally, delinquency rates edged up on residential and commercial mortgages.

Lending volumes and loan demand generally declined across consumer and business loan types.

Several Districts noted that banks tightened lending standards amid increased uncertainty and concerns about liquidity.

It is becoming increasingly clear that credit availability in certain sectors of the economy is contracting at a highly alarming pace. And might only worsen through summer.

For more confirmation about the credit crunch is a note from Bloomberg that revealed several findings shedding light on the deteriorating economic outlook.

Small businesses say it hasn’t been this difficult to borrow in a decade; the amount of corporate debt trading at distressed levels has surged about 300% over the past year, effectively locking a growing swath of businesses out of financial markets; bond and loan defaults have ticked up; and the Federal Reserve says banks have tightened lending standards. Corporate bankruptcies are on the rise, too, particularly in the construction and retail industries. –Bloomberg

As a result of the funding crunch, in combination with the Fed’s aggressive interest rate increase, the fastest in decades, Torsten Slok, chief economist at Apollo Global Management, warned:

“If credit conditions continue to tighten because banks need time to be in a position where they can give loans and operate, that increases risk of a harder landing –even more so than what we thought before.”

Slok was already discussing “a hard landing before SVB happened” with clients, but now it appears almost inevitable.

Meanwhile, Treasury Secretary Janet Yellen had her ‘old lady blinders on’ when she recently said there’s no evidence of lending contraction that would alter her economic outlook.

Recall, Yellen, as Fed Chair in 2017, was quoted saying there would be no new financial crisis in ‘our lifetimes.’

However, small businesses are finding it more challenging to borrow money. About 9% of owners who borrow frequently said March was a difficult time to find financing than it was three months earlier, according to a survey by the National Federation of Independent Business.

As lending conditions tighten, Matthew Mish, head of credit strategy at UBS, noted bankruptcies of public and private companies are rising. He said, “We’re already seeing substantial failure rates.”

“The weakness we are seeing in smaller issuers is likely a harbinger of more stress to come,” Barclays Plc strategist Bradley Rogoff warned.

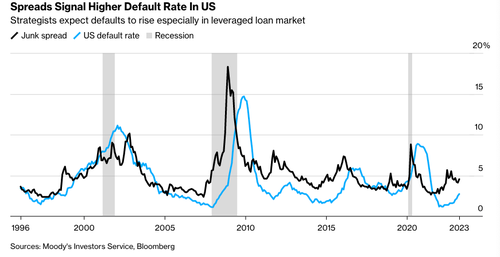

And with the US default rate noticeably rising, junk bond spreads are set to widen.

“The volume of US corporate debt trading at distressed levels — a risk premium of at least 10 percentage points over the benchmark for bonds, or a price of less than 80 cents on the dollar for loans — has surged some 28% since last month’s banking crisis to around $300 billion,” according to Bloomberg.

In a recent interview on Bloomberg Television, Jim Caron, co-chief investment officer at Morgan Stanley Global Balanced Funds, said, “There is going to be a credit crunch, not a credit crisis.” He pointed out the credit crunch would unfold over time.

PitchBook data shows about a quarter of the $1.4 trillion leveraged loan market carries a B- credit rating, just one notch below CCC grade.

Paul Marshall, of Marshall Wace, one of the world’s biggest hedge-fund firms, warned investors earlier this month that the credit crunch will be “fairly severe” and might spark a recession.

Loading…