By Wolf Richter for WOLF STREET.

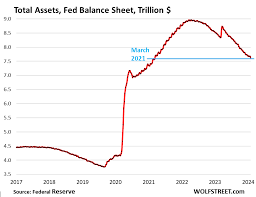

The Fed’s Quantitative Tightening continued on track in January. Total assets on the Fed’s balance sheet dropped by $51 billion in December, to $7.63 trillion, the lowest since March 2021, according to the Fed’s weekly balance sheet today. Since the end of QE in April 2022, the Fed has shed $1.34 trillion. The Fed re-affirmed QT explicitly in yesterday’s FOMC statement and in Powell’s press conference.

And the Fed finally shut down the arbitrage opportunity at the bank-bailout facility, the BTFP, that had opened up in early November when longer-term yields plunged. We’ll get to this mess in a moment. But in the first three weeks of January before the loophole was closed, banks ran up $27 billion in BTFP loans, which is why total assets dropped by only $50 billion in January, and not by close to $90 billion.

During QT #1 between November 2017 and August 2019, the Fed’s total assets dropped by $688 billion, while inflation was below or at the Fed’s target (1.8% core PCE in August 2019), and the Fed was just trying to “normalize” its balance sheet.

Now inflation has come down a lot, driven by price drops in durable goods, and a plunge in energy prices, but it’s still rocking and rolling in services, with “core services” CPI at an annualized rate of over 5%.

QT on autopilot.

Treasury securities: -$61 billion in January, -$1.08 trillion from peak in June 2022, to $4.69 trillion, the lowest since December 2020.

The Fed has now shed 33% of the $3.27 trillion in Treasury securities that it had added during its pandemic QE.

Treasury notes (2- to 10-year securities) and Treasury bonds (20- & 30-year securities) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off is capped at $60 billion per month, and about that much has been rolling off, minus the inflation protection the Fed earns on Treasury Inflation Protected Securities (TIPS) which is added to the principal of the TIPS.

The function of Treasury bills to steady the pace of QT. These short-term securities (1 month to 1 year) are included in the $4.69 trillion of Treasury securities on the Fed’s balance sheet.

The Fed lets them roll off (doesn’t replace them when they mature) if not enough longer-term Treasury securities mature and roll off to get to the $60-billion monthly cap. As long as the Fed has T-bills, the roll-off of Treasury securities can reach the cap of $60 billion every month.

When the Fed runs out of T-bills to fill in the gaps, the Treasury roll-off will start to fall below the $60 billion cap.

From March 2020 through the ramp-up of QT, the Fed held $326 billion in T-bills that it constantly replaced as they matured (flat line in the chart). In September 2022, T-bills first started rolling off to fill in the gap to get the Treasury roll offs to $60 billion a month.

In December, $6 billion in T-bills rolled off, reducing them to $210 billion.

Mortgage-Backed Securities (MBS): -$15 billion in January, -$323 billion from the peak, to $2.42 trillion, the lowest since August 2021. The Fed has now shed 24% of the MBS it had added during pandemic QE.

The Fed only holds government-backed MBS, and taxpayers carry the credit risk. MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made.

Amid the higher mortgage rates, sales of existing homes have plunged 33% in 2023, so fewer mortgages were paid off, and mortgage refinancings have collapsed, which dramatically slowed the mortgage payoffs. As result, the pass-through principal payments to MBS holders have also collapsed, and those MBS are not coming off the balance sheet very quickly, with the MBS run-off between $15 billion and $21 billion a month, well below the $35-billion cap.

Bank liquidity facilities.

Discount Window: $3.2 billion. Roughly in this range for months, and down from $153 billion in bank-panic March. The Discount Window is the Fed’s traditional liquidity supply to banks. The Fed currently charges banks 5.5%, and demands collateral at market value, and that’s expensive money for banks, unless they need to pile up some liquidity.

Bank Term Funding Program (BTFP): The BTFP was cobbled together in all haste over the bank-panic weekend in March 2023 after SVB had failed. To borrow at the BTFP, banks had to pay the Fed a rate equal to the one-year overnight index swap rate plus 10 basis points, fixed for the term of the loan of up to one year. That rate worked out to be a little lower than the rate at the Discount Window, and collateral requirements were looser. So banks used it.

But starting in November, Treasury yields and related yields began to drop amid general rate-cut mania. The 1-year Treasury yield dropped from 5.4% at the end of October to 4.7% by the end of December.

The one-year overnight index swap rate runs a little lower. By the end of December, banks could borrow below 4.7% at the BTFP, and then keep that cash in their reserve account at the Fed and collect 5.4% interest from the Fed, earning risk-free income off the difference. As rates dropped, they could refinance the loans they had taken out with lower-rate loans.

The BTFP balance had been steady for months at about $108 billion. But in early November, with rates dropping, it exploded with this arbitrage. Wednesday last week it reached $168 billion. The cash stays at the Fed and doesn’t go anywhere, it just makes the banks some risk-free moolah.

We’ve been discussing this BTFP arbitrage for a while. It made everyone angry, including the Fed, apparently.

On Wednesday last week, the Fed shut down the BTFP arbitrage opportunity by changing the term sheet for new loans, to where the interest rate banks have to pay on new loans from the BTFP cannot be lower than the interest rate they earn on their reserve balances. And that stopped it.

The BTFP will expire in March, and no new loans can then be taken out, but existing loans can be maintained until their term ends, which is one year after it was issued.

In the current week, the BTFP balance dropped by $3 billion, after having surged by $27 billion in the prior three weeks.

Repos: $0. The Fed’s repos come in two flavors: Repos with “foreign official” counterparties were paid off in April 2023. The repos with US counterparties faded out in July 2020 and have remained at around zero. The Fed currently charges counterparties 5.5% on repos, as part of its five policy rates.

Loans to FDIC: $0. This facility was also cobbled together over the bank-panic weekend in March. The funding allowed the FDIC to quickly make whole all depositors –not just the insured depositors – of the failed banks, before it could sell the failed banks’ assets. The FDIC paid off the remainder in November.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack