On top of whatever unrealized losses (cumulative $1.3 trillion at end of Q3) from its securities holdings. But losses don’t matter to the Fed.

By Wolf Richter for WOLF STREET.

The Federal Reserve released its preliminary financial information for 2023 today (audited annual financial statements will be released in a few months).

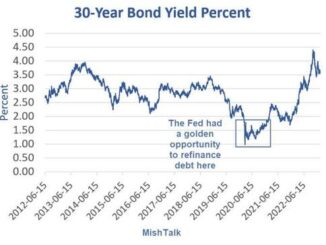

The Fed’s red-ink era began in September 2022, when it started losing money after its rate hikes had increased the interest rate it pays banks for their reserve balances at the Fed (5.4% currently) and the interest rate it pays the counterparties of the overnight Reverse Repos, mostly money market funds (5.3% currently).

And those surging interest expenses have far surpassed the interest income from its now dwindling portfolio of much lower yielding securities that it had bought during QE mostly years ago — since QT began in the summer of 2022, the Fed has shed $1.02 trillion in Treasury securities and $308 billion in MBS.

The total loss from operations (estimated income minus total expenses) nearly doubled to $114.3 billion in 2023 (from a loss of $58.8 billion in 2022).

How its $114.3 billion loss came about:

Interest income at $174.2 billion (compared to $170 billion a year earlier).

Interest income from mostly low-yielding securities the Fed bought years ago fell to $163.8 billion in 2023 (from $170.0 billion in 2022).

Interest income from loans to banks, such as the Bank Term Funding Program (BTFP) amounted to $10.4 billion.

Other income: $0.5 million from payment and settlement services; and $0.1 billion net income from the tail end of the Covid emergency programs

Interest expenses spiked by 175% to $281.1 billion in 2023 (from $102.4 billion in 2022), as the Fed paid much higher interest rates on reserve balances and ON RPPs as a result of its rate hikes. Since the last rate hike in July 2023, the Fed has been paying banks 5.4% on the cash they put on deposit at the Fed (“reserve balances”); and it has been paying ON RRP counterparties, mostly money market funds, 5.3% in interest.

This increase of $178.7 billion in interest expense arose from paying banks $116.3 billion more in interest on their reserve balances in 2023 than a year earlier, and paying money market funds and other ON RRP counterparties $62.4 billion more in interest.

Operating expenses roughly unchanged at $5.5 billion. These are the expense of running the 12 Federal Reserve Banks (FRBs), such as the New York Fed, the San Francisco Fed, the Richmond Fed, etc.

In addition, the 12 FRBs had to pay:

$1.0 billion for the costs related to producing, issuing, and retiring currency (paper dollars).

$1.1 billion in expenses by Federal Reserve Board of Governors, a government agency, funded by the 12 FRBs.

$0.7 billion in expense to operate the Consumer Financial Protection Bureau, a government agency funded by the 12 FRBs.

The incomes, expenses, and losses here are those of the 12 Federal Reserve Banks, which are owned by the largest financial institutions in their districts. The Federal Reserve Board of Governors, of which Powell is Chair, is a government agency, and Powell is a government employee appointed by the President and confirmed by the Senate. But it is an independent Agency, funded by the 12 FRBs (not by Congress).

Statutory dividends rose to $1.5 billion (from $1.2 billion in 2022). The dividends are paid to the shareholders of the 12 FRBs.

The Fed’s 100% income tax bracket.

The Fed is required to remit all its leftover income – after paying its expenses and statutory dividends – to the US Treasury Department, a form of a 100% income tax bracket.

Since 2001, the Fed has remitted $1.36 trillion to the US Treasury. Even over the first eight months in 2022, the Fed still remitted $76 billion to the US Treasury. The remittances stopped in September when it started to lose money.

Over the last months in 2022, the Fed books $16.6 billion in losses against future remittances (red for 2022 in the chart below); and in the year 2023, it booked $116.4 billion in losses against future remittances.

The Fed puts the income it has to remit to the US Treasury into an account on the liability side of its balance sheet, called “Earnings remittances due to the U.S. Treasury.” Since the income remittances were paid regularly, the amounts didn’t accumulate.

But the losses are now accumulating in that account and show up with a negative value. As of December 31, the accumulated losses were $130 billion, per the Fed’s preliminary financial statement today. This negative liability – “deferred asset” – is an amount of future income that the Fed doesn’t have to remit to the Treasury department.

The Fed will continue to lose money for a while. But as QT progresses, those losses will slow.

ON RRP balances are returning to their normal non-QE status of zero or near zero, at which point the interest payments on ON RRPs will be minimal. ON RRPs have already dropped from over $2.2 trillion in 2022 and early 2023 to $603 billion today.

And the reserve balances will decline further, though they will remain “ample,” is what the Fed now calls this, and interest paid on reserves will decline. Reserve balances have dropped from $4.2 trillion in late 2021 to $3.5 trillion now. And they have more room to fall under QT.

In addition, when the Fed cuts its five policy rates, including the interest rates it pays on reserves and ON RPPs, its interest expenses will fall further – paying lower rates on smaller amounts. And at some point, it will start making money again.

At that point, instead of remitting the income to the Treasury Department, it will take this income against the negative balance in “Earnings remittances due to the U.S. Treasury” until the balance turns positive. This will likely take years. And once the balance turns positive, it will start remitting its income to the Treasury.

Unrealized losses: Not part of today’s annual financial report, but part of its most recent quarterly financial statement, the Fed reported $1.3 trillion in cumulative unrealized losses on its portfolio of Treasury securities and MBS. They lost market value as yields rose.

But these unrealized losses are irrelevant for the Fed since it will not sell the securities. It holds Treasury securities to maturity, when it receives face value for them. And from its MBS, it constantly receives pass-through principal payments as the underlying mortgages of the MBS get paid off or get paid down, which amounts to a flow of repayments at face value.

Yields fell in November and December, and so the cumulative unrealized losses as of December 31 will be lower than those reported for September 31. We’ll know the answer in a few months when the Fed releases its audited annual financial statement.

But losses don’t matter to the Fed. The Fed creates its own money, and so it cannot become insolvent. And its capital, which is capped by Congress, is not impacted by the losses because the Fed carries the losses as a “deferred asset” in a liability account on its balance sheet, rather than taking the losses against capital. So its “total capital” on its balance sheet has actually ticked up by $1 billion over the past 12 months to $42.8 billion.

The losses do matter to the Treasury Department though – which is no longer getting the remittances from the Fed. And so the Fed’s losses are swelling the deficit and the debt indirectly via the absence of remittances for years to come.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how: