By Wolf Richter for WOLF STREET.

It was Minneapolis Fed President Neel Kashkari’s job today to say out loud what we’ve said here at WOLF STREET in the comments for a while, and what others have said, and what other Fed officials have gotten close to saying with their wait-and-see and in-no-rush lingo, but haven’t yet said:

“If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all,” he said in an interview with Pensions and Investments Magazine. “There’s a lot of momentum in the economy right now.”

If the economy continues to grow as it has, powered by consumer spending, it also raises the question “of why cut rates,” he said.

And more rate hikes are “not off the table, but they are also not a likely scenario given what we know right now,” he said.

“The question is, is inflation going to continue to fall, and/or is it going to be monetary policy’s job to bring inflation all the way back to the 2% target right now,” he said.

Kashkari is not in a voting slot this year on the policy setting FOMC, so he’s sort of a soft voice to put the bug into your ear, the voice to gently get the thought process going.

He said he still “jotted down two rate cuts” for 2024 – a reference to the “dot plot” at the March FOMC meeting where the 19 members wrote down their vision for interest rates. Of the 19 members, 9 saw two cuts or fewer in 2024, 9 saw three cuts, and 1 saw four cuts. So the “median,” cited in the headlines, was still three cuts, but if only one member that saw three cuts switches to two cuts, the median drops to two cuts, as we discussed at the time.

So he was one of the nine FOMC members who saw two or fewer rate cuts by the end of 2024.

The Fed’s models of the economy “are not describing the inflationary dynamics that we’re seeing right now,” he said.

He also pointed out that there was a lot of uncertainty in the economy, and that it has been difficult for forecast.

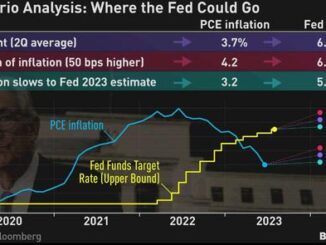

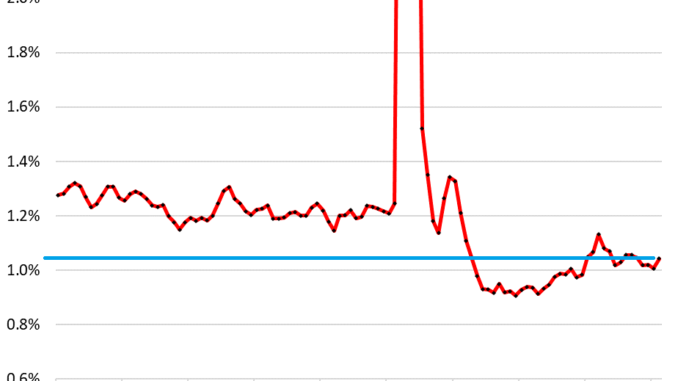

Inflation fell sharply in the first nine months of 2023, driven by the collapse of energy prices and a drop from the pandemic spike of durable goods prices as the supply-chain bottle necks were sorted out, but toward the end of the year, the underlying measures turned around and started accelerating again, particularly services, and then we had two awful inflation readings in a row for January and February — that were “a little bit concerning,” Kashkari said.

He said he needed more confidence that inflation is moving toward the 2% target before cutting rates, and emphasized that the coming inflation would guide interest-rate decisions, something that every Fed official has emphasized: the rate decisions would be data dependent.

So, to use Kashkari’s term of “sideways”: inflation hasn’t really moved “sideways” in recent months, it re-accelerated. And that has spooked lots of people. Obviously, that could have been just a temporary bump in the road, or it could have been more than that, as Powell pointed out during the press conference, and no one knows.

But what the Fed officials have been doing for two months is slowly and systematically dialing back the rate-cut expectations, and Kashkari just turned the dial a little further.

The stock market didn’t like this at all. When this no-rate-cut scenario started spreading in the afternoon, stocks began to head south, and the S&P 500 ended down 1.2% for the day. But I mean, anything – a butterfly batting its wings – could have deflated the sentiment in the market after this crazy rally.