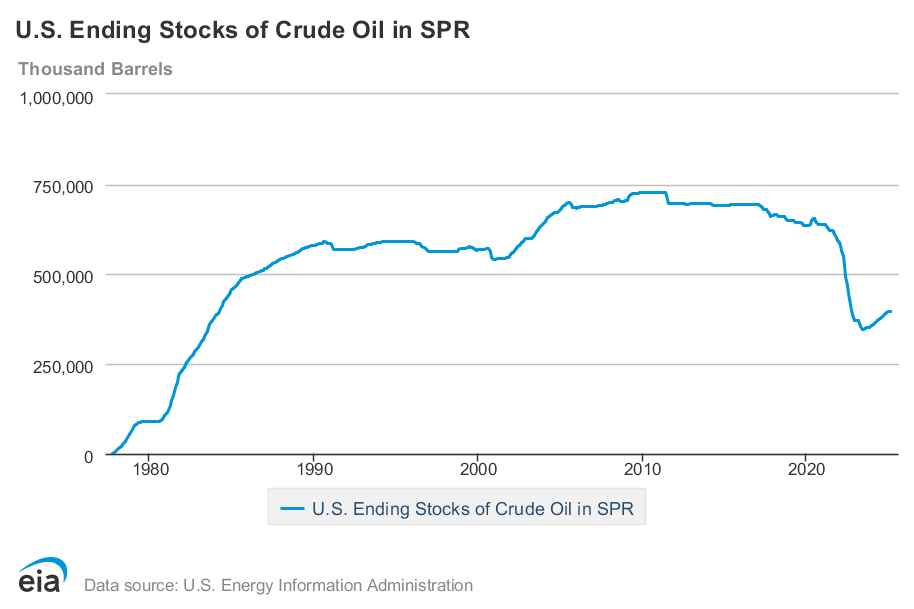

The U.S. Department of Energy (DOE) has delayed plans to replenish the Strategic Petroleum Reserve (SPR) by seven months, pushing back significant repurchasing efforts to mid-2025. This setback, driven by rising oil prices and budgetary constraints, raises concerns about the nation’s energy security at a time of global market volatility. Below, we explore the reasons for the delay, provide a historical overview of the SPR, and offer annualized storage data for context.

We highly recommend that Congress fulfill its responsibilities and enact legislation to better control the political weaponization of the Strategic Oil Reserve for partisan gain during election cycles.

Why the Delay?

The DOE’s decision to postpone SPR replenishment stems from a combination of market dynamics and fiscal challenges:

-

Rising Oil Prices: The DOE had planned to repurchase oil at prices below $79 per barrel, but recent market trends, including Middle East tensions and supply uncertainties, have pushed West Texas Intermediate (WTI) prices above $80 per barrel. The DOE canceled solicitations for 3 million barrels slated for delivery to the Bayou Choctaw site in August and September 2024, citing unfavorable market conditions.

-

Budgetary Constraints: Congress has not fully recapitalized the DOE’s SPR purchasing account, limiting the agency’s ability to buy oil at scale. While the Biden administration has utilized $16.95 billion in emergency revenue from 2022 sales, further funding is needed to restore the SPR to pre-2022 levels.

-

Infrastructure Limitations: Repeated drawdowns have strained the SPR’s salt cavern storage facilities, reducing replacement capacity. The DOE requires additional investments to maintain and expand storage infrastructure, further complicating refill timelines.

-

Political Considerations: With the 2024 presidential election approaching, the Biden administration has been cautious about actions that could drive up oil prices, impacting consumers at the pump. Analysts suggest this delay aligns with efforts to avoid market disruptions ahead of the election.

The DOE remains committed to refilling the SPR “as market conditions allow,” but the seven-month delay signals a slower path to restoring the reserve’s capacity, which currently stands at 402.3 million barrels as of June 13, 2025—a 40-year low.

History of the U.S. Strategic Petroleum Reserve

The SPR was established under the Energy Policy and Conservation Act (EPCA) of 1975, signed by President Gerald Ford in response to the 1973–1974 OPEC oil embargo. The embargo, which saw oil prices quadruple, exposed U.S. vulnerabilities to supply disruptions, prompting the creation of an emergency stockpile to protect the economy and national security.

Key Milestones:

-

1977: Construction of storage facilities began in salt caverns along the Gulf Coast in Texas and Louisiana. The first oil delivery—412,000 barrels of Saudi Arabian light crude—arrived on July 21, 1977.

-

1980s: The SPR grew rapidly, reaching 500 million barrels by 1986, fueled by purchases during high oil price periods (often exceeding $30 per barrel).

-

1995: Filling was suspended to fund infrastructure upgrades, extending the life of the aging facilities.

-

1999–2009: The SPR adopted a royalty-in-kind program, acquiring oil as royalties from federal Gulf of Mexico leases. This program filled the SPR to its peak capacity of 726.6 million barrels on December 27, 2009.

-

2001: President George W. Bush directed the SPR to reach 700 million barrels post-9/11, emphasizing energy security.

-

2015–2021: Congress mandated sales of 150 million barrels to fund federal spending, reducing the SPR by 15% from its 2017 peak.

-

2022: The Biden administration authorized a historic release of 180 million barrels over six months to counter oil price spikes following Russia’s invasion of Ukraine. This drawdown, the largest in SPR history, lowered the reserve to 371.6 million barrels by January 2023—the lowest since 1983.

-

2023–2025: The DOE repurchased 59 million barrels at an average price of $76 per barrel and secured 140 million barrels by canceling mandated sales through 2026. However, the SPR remains 45% below its January 2021 level.

The SPR’s current authorized capacity is 714 million barrels, stored across four sites: Bryan Mound and Big Hill in Texas, and West Hackberry and Bayou Choctaw in Louisiana. It serves as a critical tool for mitigating supply disruptions, with a maximum drawdown rate of 4.4 million barrels per day for up to 90 days.

Annualized SPR Storage Data

The following Chart summarizes annualized SPR crude oil stocks from 1982 to 2025, based on data from the U.S. Energy Information Administration (EIA).

Implications and Outlook

The seven-month delay in refilling the SPR underscores the delicate balance between energy security, market stability, and fiscal policy. While the DOE has made progress in repurchasing oil at favorable prices, the reserve’s depleted state—equivalent to 19 days of U.S. consumption or 47 days of imports—leaves the nation vulnerable to supply shocks.

Critics argue that the SPR has been politicized, with drawdowns used to manage gas prices rather than address true emergencies. Others, including analysts at the Federal Reserve Bank of Dallas, suggest the SPR’s size may not need to return to its historical peak due to increased U.S. oil production and lower net imports.

As global oil markets remain volatile, the DOE’s ability to navigate price fluctuations, secure funding, and maintain infrastructure will determine the SPR’s future effectiveness. For now, the seven-month delay serves as a reminder of the complex challenges facing America’s energy security strategy. And the damage done by the Biden Administration’s political weaponization of the SPR.