In the depths of a harsh Nordic winter, Finland’s ambitious push toward renewable energy has hit a literal freeze. Ice accumulation on wind turbine blades has forced widespread shutdowns, slashing green power generation and exposing the vulnerabilities of weather-dependent sources in extreme conditions. This incident, as reported in recent market analyses, underscores a critical debate in energy markets: the need to evaluate reliability on par with profitability. While renewables like wind promise cost savings and environmental benefits, their intermittency can lead to supply shortfalls and price volatility, prompting questions about how energy systems should balance green goals with dependable output.

The Freeze-Out: What Happened in FinlandWestern Finland, battered by sub-zero temperatures and low-lying fog, saw ice buildup on turbine blades that halted operations to prevent damage.

Bloomberg data show that Finnish wind output is expected to remain very low for the next two weeks. Meteorologists at MetDesk forecast that Nordic wind generation will remain as much as 20% below normal through at least the midpoint of the month.

Most of the country’s wind fleet lacks advanced blade-heating systems designed for such extremes, resulting in a dramatic plunge in output. Wind power dropped from a peak of 9,433 MW to just 430 MW—merely 5% of nominal capacity—amid “Russian frosts” that gripped the region.

Grid operator Fingrid Oyj was compelled to curtail production further, with forecasts indicating low wind generation persisting for at least two weeks, potentially 20% below normal across the Nordics.

This curtailment coincided with surging demand from the cold snap, driving electricity prices to their winter highs. Spot prices averaged over 38 cents per kilowatt-hour (kWh) on peak days, with spikes reaching 60 cents/kWh during morning hours.

Social media anecdotes highlighted the human cost: one household reported a €45 daily bill, while others turned to firewood for heat amid market disruptions.

The event strained Finland’s grid, which relies heavily on renewables—the country ranks second in the EU for renewable share in final energy consumption—revealing how winter conditions can undermine even high-penetration green systems.

Finland’s Electricity Costs in Context: A Comparative Edge, But Weather Adds Bite

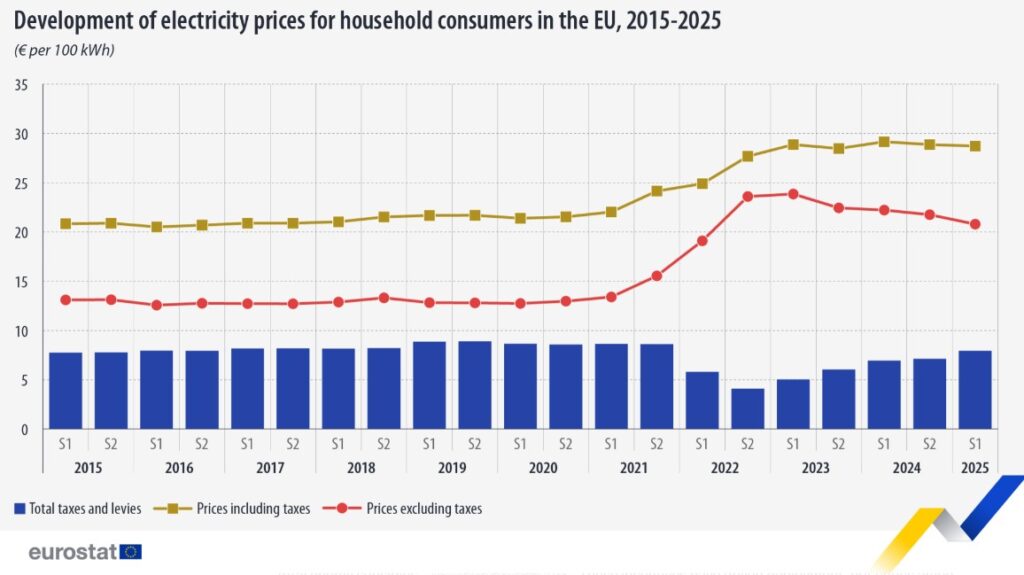

Despite the volatility, Finland maintains some of the EU’s most competitive electricity prices overall. In the first half of 2025, non-household prices were the lowest in the bloc at €0.0804/kWh, while household rates averaged around €0.189/kWh—ranking third-cheapest in Europe behind Sweden and Norway.

This affordability stems from abundant hydropower, nuclear capacity, and efficient markets, with prices dropping 9% year-over-year in 2025, bucking trends in much of Europe where costs rose.

However, cold weather exacerbates costs for consumers. During prolonged freezes, consumption spikes—potentially nearing 15,000 MW—while wind output falters, forcing reliance on pricier imports or fossil backups.

In early 2026, prices surged to 210 €/MWh for hours, inflating bills significantly.

Estimates suggest such events could add hundreds of euros to annual household expenses, with industrial users facing even steeper hikes.

Fingrid warns of minor adequacy risks in extreme scenarios, though new interconnections like the Aurora Line to Sweden help mitigate shortages.

For a clearer comparison, here’s a table of average household electricity prices (in €/kWh) across select EU countries in the first half of 2025:

|

Country

|

Price (€/kWh)

|

|---|---|

|

Finland

|

0.189

|

|

Sweden

|

0.0964

|

|

Hungary

|

0.104

|

|

Germany

|

0.3835

|

|

Ireland

|

0.2726

|

|

Italy

|

0.2336

|

|

EU Average

|

0.1902

|

Data sourced from Eurostat and related analyses.

🇫🇮 News from the “green garden”. In Finland, the blades of wind turbines froze

The electricity production of wind power stations in Finland fell from 9433 MW to about 430 MW. Thus, they produced no less than 5% of the nominal power.

The culprit turned out to be Russian frosts,… pic.twitter.com/DNXNUM5Rs7

— dana (@dana916) January 30, 2026

Lessons for the US: Rethinking Pricing and Prioritizing Reliability

Finland’s experience raises pertinent questions for the United States, where electricity pricing often favors renewables through substantial subsidies, potentially at the expense of grid stability. In the US, wind and solar receive production and investment tax credits estimated at $289.63 billion and $131.44 billion respectively from 2025-2034—far outpacing deductions for oil and gas, which constitute about 6% of total energy subsidies.

These incentives have driven deployment, but critics argue they distort markets, making intermittents artificially competitive while undermining investment in reliable baseload like natural gas and nuclear.

Unsubsidized levelized costs show onshore wind ($37-86/MWh) and solar ($38-78/MWh) edging out new gas plants ($48-109/MWh), but existing fossil and nuclear resources remain cheaper due to amortized capital.

Yet, subsidies offset over 50% of renewable project costs, leading to overbuilds that require costly backups and contribute to rising bills—up 25% for US residential users under recent policies.

With AI-driven demand surging, phasing out perpetual renewable subsidies—as attempted in the One Big Beautiful Bill Act—could refocus on dispatchable sources, enhancing reliability without inflating costs.

Ultimately, energy markets must treat reliability as a core metric alongside profitability. Finland’s freeze serves as a cautionary tale: prioritizing weather-vulnerable sources risks consumer burdens and system fragility. The US could benefit from recalibrating incentives to reward consistent, 24/7 power from gas, nuclear, and emerging tech, ensuring a resilient grid for future demands.

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Sources: zerohedge.com, gridio.io, scientificamerican.com, instituteforenergyresearch.org