Five Below

Five Below

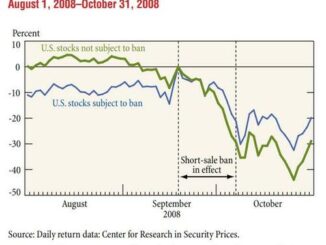

FIVE

216.72

$9.68

4.68%

76%

Clears 212.66 buy point in above-average volume

Relative strength line hits new high

EPS growth has returned, sales growth picks up in last two quarters

Industry Group Ranking

Emerging Pattern

Flat Base

One of three positive chart patterns to look for when doing technical analysis. It usually occurs after a stock has advanced off of a “cup with handle” or “double bottom” pattern. The “flat base” moves straight sideways in a fairly tight price range for at least five weeks and does not correct more than 15%.

11:39AM EDT on

04/10/2023.

Five Below (FIVE) is Monday’s IBD Stock Of The Day, as the retail discount chain broke out past a buy point amid higher-than-average volume Monday. FIVE shot up Monday.

On March, 15, Philadelphia-based Five Below, which operates 1,292 teen- and tween-focused discount stores in 42 states, closed out 2022 with an earnings and revenue beat. For the fourth quarter, Five Below earnings popped 23% to $3.07 per share, ending a three-quarter string of year-over-year declines. Revenue rose 12.7% to $1.12 billion, with top-line growth picking up for a second straight quarter. The results edged out analyst expectations of $3.06 earnings per share on $1.1 billion in sales.

Comparable sales rose 1.9%, topping forecasts of 0.9% growth.

Five Below projects first-quarter earnings of 59- to 65-cents per share on $723 million to $735 million in net sales. The outlook is about in line with analyst forecasts.

The company plans to open a record 200 stores in 2023, up from 150 new stores in 2022. Five Below expects fiscal 2023 earnings to range from $5.25 to $5.76 per share on $3.49 billion to $3.59 billion in sales. It recorded $4.69 earnings per share and $3.07 billion in sales in 2022.

Five Below also sees comparable sales increasing 1%-4%. Wall Street sees full year earnings at $5.62 per share and $3.57 billion in revenue, with 3% comparable sales growth.

Analysts see Five Below earnings growing on average 22% over the next three years, to $8.57 per share in 2026, according to FactSet.

Five Below Stock

FIVE jumped 4.7% to 216.72 in heavy volumeduring Monday’s market trade, breaking above a 212.66 buy point and hitting a 52-week high. FIVE formed a short flat base and is up 21% since the beginning of 2023.

Five Below stock is up more than 4% so far in April after rising for nine straight months.

FIVE stock’s relative strength line hit a new high.

On March 24, Loop Capital raised its price target on Five Below stock to 200, up from 190. Analyst Anthony Chukumba maintained a “Hold” rating on FIVE shares. Chukumba said Five Below remains one of the firm’s “favorite fundamental organic square footage growth stories” and it “eagerly awaits” a more favorable entry point to become more constructive.

Five Below stock has a 94 Composite Rating out of 99. FIVE stock also has an 95 Relative Strength Rating. The EPS Rating is 84 out of 99.

Please follow Kit Norton on Twitter @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Get An Edge In The Stock Market With IBD Digital

Best Growth Stocks To Buy And Watch

Tesla Stock In 2023: The EV Giant Faces Different Challenges In Its Two Megamarkets

SVB Financial Crashed 15 Years After Bear Stearns. How Has The Federal Response Changed?

5 S&P 500 Stocks Near Buy Points As Recession Fears Rise

The post Five Below, IBD Stock Of The Day, Breaks Out As Growth Picks Up appeared first on Investor’s Business Daily.