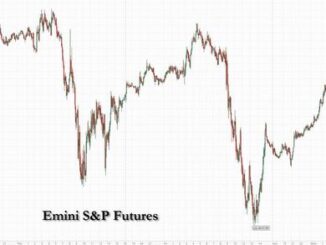

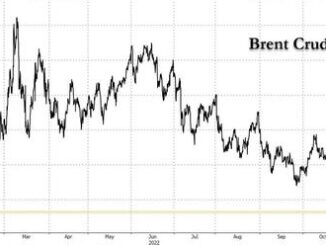

US equity futures traded flat to start today’s massive triple-witching option expiration, as the UAW labor union went on strike, while Arm Holdings shares rallied as much as 10% before turning red. As of 8:15am, S&P futures were flat while Nasdaq 100 futures dropped 0.1%; in Europe and Asia, stocks jumped on the back of better-than-expected economic data in China, which fueled hopes stimulus measures are paying off. Brent crude traded near $94 per barrel, at new YTD high, up 0.4% after rising 1.9% Thursday, putting additional upward pressure on Treasury yields while the dollar edged lower versus most major peers. Gold rose and bitcoin dropped.

In premarket trading, GM and Ford shares dropped about 2% before the official US open. The UAW started an unprecedented a strike, setting the stage for a protracted showdown and shutting down about half of US auto production.

Adobe fell over 2% after the software company gave an outlook that analysts see as conservative even as it reported third-quarter results that beat expectations. Arm Holdings rose as much as 10% after its IPO, before reversing all gains and turning red. Here are some other notable premarket movers:

Canopy Growth shares jump 10%, putting it on track to extend gains for a second session, after the cannabis company ceased funding for BioSteel Sports Nutrition on Thursday.Celsius Holdings rises 0.7% is initiated outperform at Cowen, which says the growing appeal of the energy-drink maker’s differentiated product line-up is helping the firm continue to build US market share.DoorDash 1.9% after MoffettNathanson downgrades shares to market perform from outperform, saying the resumption of student-loan payments introduces bookings risk to food-delivery businesses.Iovance jumps 16% after the FDA extended its target action date for its treatment for advanced melanoma, lifileucel, saying that there are no major review issues.Lindsay drops 12% as it is cut to hold from buy at Stifel, citing a challenging near-term outlook and lack of positive catalysts for the irrigation company.Nikola climbs 11%, putting the electric-vehicle maker on track to extend Thursday’s 32% advance and end the week higher.GM and Ford fell as the United Auto Workers started strikes at the companies’ plants.Unity Software Inc. shares are up 4% after BofA upgraded the graphic tools provider to buy from neutral.

Markets were braced for Friday’s triple witching event, which at $3.4 trillion will be the biggest September options expiration in history…

… and which may trigger violent market swings, volume spikes and volatility as a huge number of pins centered around 4,500 matures and “unclenches” the gamma gravity which has kept the market from making large moves. Attention is also turning to the Federal Reserve’s meeting next week, with traders betting at the US will keep interest rates on hold and avoid a sharp economic slowdown.

Meanwhile, expectations that the ECB is done raising rates hammered the euro: the currency headed toward its ninth straight week of losses, the longest run on record. President Christine. Lagarde reiterated on Friday that the ECB isn’t discussing cuts in interest rates. She told reporters after a meeting of the Eurogroup that the level of borrowing costs and the length of time they stay elevated “will matter significantly,” without elaborating.

Equity funds saw the biggest weekly inflow in 18 months amid growing investor confidence the US economy is headed for a soft landing. Global stocks attracted $25.3 billion in the week to Sept. 13, the most since March 2022, according to EPFR data. “It looks like ‘happy hour’ for the market,” said Guillermo Hernandez Sampere, head of trading at asset manager MPPM. “To confirm the bull case, high cash piles must find their way into markets, and next week the Fed could send signals to initiate such action.”

European equities rallied after better-than-expected economic data in China fueled hopes stimulus measures are paying off. Euro Stoxx 50 climbs 1%. CAC 40 outperforms peers, adding 1.5%, boosted by exposure to luxury companies. Consumer products, autos and travel are the strongest performing sectors.

Earlier in the session, Asia stocks also rallied after Chinese industrial production and retail sales statistics beat estimates. The Chinese data showed the economy picking up steam in August as a summer travel boom and a heftier stimulus push boosted consumer spending and factory output. Here are the most notable European movers:

European luxury shares rise after Chinese industrial production and retail sales data beat estimates, easing fears consumers in the world’s second-largest economy would no longer be able to fuel growth for the sector.Games Workshop shares jump as much as 11% after the table-top games maker said that recent trading was ahead of its expectations, with Jefferies saying that the quarter has been “outstanding” and Peel Hunt noting robust growth. Both brokers highlighted a successful launch for the company’s ‘Warhammer 40,000 Leviathan’ boxed set.MorphoSys shares gain as much as 9.5% to the highest since January 2022 after Goldman Sachs upgraded its recommendation on the German biotech firm to neutral from sell ahead of results from a late-stage study.Vitrolife shares rise as much 8.8% after Handelsbanken raised its short-term recommendation to buy from hold, citing the stock’s steep decline.Pharming shares gain as much as 6.2% after Kempen upgraded the stock to buy from neutral, saying the Dutch biopharmaceutical company is “in growth mode” as it expands the sales opportunity for its Joenja drug.H&M shares drop as much as 5.8%, the most since March, after the Swedish clothing retailer reported 3Q sales that missed estimates. The “flattish” net sales in local currencies suggest limited pricing power and a lack of traction with shoppers on product ranges, according to Bernstein.ASML and other European chip-equipment stocks fall on Friday after Reuters reported that TSMC asked its major suppliers to delay shipment of high-end chipmaking equipment.

In FX, the Bloomberg dollar spot index is near flat. Yen and Canadian dollar are the weakest performers among G-10 peers.

In rates, Treasuries grind lower in early US session with futures near lows of the day, following wider losses in core European rates that pare most of Thursday’s post-ECB gains. Parallel yield shift across the curve leaves curve spreads little changed. US session has heavy economic data slate, headed by industrial production. US yields are cheaper by 3bp to 4bp across the curve with 10-year around 4.32%, cheaper by ~3.5bp on the day, outperforming bunds and gilts by 2.5bp and 3bp in the sector; both UK and German curves cheaper by 4bp to 6bp on the day. Dollar IG issuance slate empty so far with muted activity expected; three names priced $2.1b Thursday, taking weekly total above $34bn.

In commodities, crude futures advance. WTI drifts 0.3% higher to trade near $90.44. Spot gold rises roughly $7 to trade near $1,918/oz.

Bitcoin is a touch firmer on the session, holding around the USD 26.5k mark with newsflow light to end a busy week ahead of a particularly busy week for Central Bank activity.

To the day ahead now, and US data releases include industrial production and capacity utilisation for August, the Empire State manufacturing survey for September, and the University of Michigan’s preliminary consumer sentiment index for September. Otherwise, central bank speakers include ECB President Lagarde and the ECB’s Villeroy.

Market Snapshot

S&P 500 futures little changed at 4,509.00STOXX Europe 600 up 0.8% to 464.76MXAP up 0.6% to 164.01MXAPJ up 0.7% to 509.24Nikkei up 1.1% to 33,533.09Topix up 0.9% to 2,428.38Hang Seng Index up 0.7% to 18,182.89Shanghai Composite down 0.3% to 3,117.74Sensex up 0.4% to 67,761.76Australia S&P/ASX 200 up 1.3% to 7,279.03Kospi up 1.1% to 2,601.28German 10Y yield little changed at 2.65%Euro up 0.2% to $1.0665Brent Futures up 0.5% to $94.17/bblGold spot up 0.4% to $1,917.57U.S. Dollar Index down 0.18% to 105.21

Top Overnight News

China economic data came in strong for Aug, with retail sales +4.6% Y/Y (up from +2.5% in Jul and ahead of the Street’s +3% forecast) and industrial production +4.5% (up from +3.7% in Jul and ahead of the Street’s +3.9% forecast). BBGChina injects more liquidity via its medium-term lending facility (the net injection was CNY191B), the second easing measure in as many days (after the RRR cut yesterday morning). BBGRepublican lawmakers are pressing the Biden administration to completely cut off Huawei Technologies Co. and Semiconductor Manufacturing International Corp. from their American suppliers after Huawei launched a new phone using highly advanced technology the US has been trying to keep out of China’s hands. BBGThe US government believes Chinese defense minister Li Shangfu has been placed under investigation in the latest sign of turmoil among elite members of Beijing’s military and foreign policy establishment. FTBOJ officials see a discrepancy between what Governor Kazuo Ueda said in a recent interview and how traders interpreted the remarks, according to people familiar with the matter. Most of what Ueda said in the Yomiuri newspaper interview published Saturday was consistent with his routine remarks of late. Taken in total, his comments indicate little change in the view among officials that they’ll need to weigh both upside and downside risks in deciding whether to adjust policies. BBGItalian and Portuguese politicians lashed out at the ECB’s latest rate hike, with the Italian Deputy PM Matteo Salvini accusing Christine Lagarde of “living on Mars.” Elsewhere, ECB officials Madis Muller and Luis de Guindos said current levels are probably sufficient to return inflation to the 2% target, reducing chances of further rate increases. BBGHouse Republicans begin working on a 30-day continuing resolution to avoid a shutdown at the end of the month (the proposal will receive pushback from the Dem-controlled Senate, but it could form the basis for negotiations). The HillAAPL is relying on aggressive carrier subsidies to drive iPhone sales following a relatively underwhelming iPhone 15 debut. WSJFord and GM shares fell premarket as 12,700 auto workers went on strike at targeted plants; Stellantis was little changed in Paris. Sites affected include a Ford factory in Michigan that makes the Bronco SUV, a GM facility in Missouri and a plant in Ohio that builds the Jeep Wrangler. It’s the first time the UAW has taken action against the Big Three legacy Detroit carmakers simultaneously. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks gained after global risk was fuelled by the upside in Europe and the US, while sentiment was also bolstered by better-than-expected Chinese activity data. ASX 200 was boosted with miners leading the advances seen across all sectors following the reserve ratio cut in China which is expected to release over CNY 500bln of liquidity for Australia’s largest trading partner and with recent comments from RBA watcher McCrann that there will likely be no more rate hikes. Nikkei 225 extended its gains amid notable outperformance in power companies and with SoftBank boosted after shares in its Arm unit climbed 25% in its US debut. Hang Seng and Shanghai Comp were both initially underpinned by the encouraging Chinese activity data in which Industrial Production and Retail Sales both topped forecasts, while attention was also on the PBoC which recently cut the RRR by 25bps but maintained its 1-year MLF rate at 2.50%, although Shanghai Comp later faded into the red.

Top Asian News

PBoC announced CNY 591bln (CNY 400bln maturing) through 1-year MLF with the rate maintained at 2.50%.China reportedly told brokers to cut FX trading to shore up a weak yuan, according to Bloomberg.PBoC injected CNY 105bln via 7-day reverse repos with the rate kept at 1.80% and CNY 34bln via 14-day reverse repos with the rate at 1.95% (prev. 2.15%).China’s NBS said the economy saw accelerated demand but domestic demand remains insufficient and the foundation of the economic recovery needs to be consolidated. Furthermore, the stats bureau stated the domestic economy is recovering but still faces difficulties and that China should focus on expanding domestic demand.US senior House Republicans urged the US Commerce Department to toughen export controls against Huawei and SMIC citing the new advanced smartphone from Huawei.Sino-Ocean Group (3377 HK) announced the suspension of trading of offshore USD securities and said the group has been in talks with creditors, while it noted that the optimal path forward is holistic restructuring and payments under all of its offshore debts will be suspended until holistic restructuring and/or extension are implemented.JP Morgan upgrades China’s 2023 GDP growth forecast to 5.0% (prev. 4.8%); Goldman Sachs maintains China’s Q3 GDP growth forecast 4.9% YY while acknowledging elevated uncertainties surrounding the property sector.BoJ is said to see continued upside risks to the price outlook and discrepancy between recent comments by Governor Ueda and how traders interpreted the comments, according to Bloomberg citing sources.

European bourses are in the green, Euro Stoxx 50 +0.9%, as sentiment picks up following constructive Chinese data and after yesterday’s ECB announcement, despite subsequent sources. Sectors are mostly in the green with Consumer Products & Services the major outperformer, given Luxury names; with sectors exposed to China also underpinned. At the other end of the spectrum, Chip names are pressured following a Reuters source piece that TSMC told vendors to delay chip equipment delivery, citing nervousness about consumer demand. Stateside, futures are flat/mixed after the modest rally on Thursday, ES +0.1%; Arm gave the NQ +0.1% a helping hand and continues to climb in the pre-market. US auto names are pressured in pre-market trade as strike action commences; Ford (F) -1.7%.

Top European News

Several of the ECB’s more hawkish rate-setters believe that rates could rise again in December, in the scenario of hot wages and inflation, via FT citing sources. Three individuals involved in the September meeting said if EZ inflation were above forecast the door remains open to a hike in December, when the next set of projections are provided. One respondent said a “very negative surprise” on inflation would be needed for an October move.ECB’s de Guindos says both headline and core CPI will continue to ease, any future cuts will depend on multiple factors, via Cope radio.ECB’s Muller says no additional hikes expected in the coming months, though higher inflation could merit a further hike.ECB’s President Lagarde says ECB will return to 2% inflation target, will set rates at restrictive level as long as needed for it.ECB’s Kazaks says this week’s rate decision was not a ‘dovish hike’; does not preclude future decisionsECB TLTRO.III September early repayment figure (EUR): 34.2bln (prev. 29.5bln).Bank of England/Ipsos Inflation Attitudes Survey – August 2023: Median expectations of the rate of inflation over the coming year were 3.6%, up from 3.5% in May 2023.

FX

DXY idles above 105.000 after Thursday’s near 100 tick bounce on a combination of Euro losses and strong US data releases.Yen retreats amidst a rebound in UST yields towards YTD lows vs. USD circa 147.87 after hitting resistance ahead of 147.00.Yuan rebounds as Chinese activity data beats consensus and PBoC cuts 14-day reverse repo to provide more stimulus.USD/CNY and USD/CNH probe 7.2500 and 7.2600 respectively.Aussie extends gains vs Buck to 0.6470+ as iron ore soars.Sterling and Euro recover as Gilts and EGBs retreat further than TreasuriesCable back above 200 DMA after bounce from 1.2400, EUR/USD off multiple lows within 1.0635-69 range.PBoC set USD/CNY mid-point at 7.1786 vs exp. 7.2849 (prev. 7.1874)

Fixed Income

Bonds in freefall following deeper reversal from post-ECB highs through levels prevalent prior to the ‘dovish’ hike.Bunds towards base of 131.27-130.43 range, Gilts nearer 95.39 than 96.08 and T-note hovering close to 109-15+ having peaked at 109-28+.Multiple factors weighing on debt including better-than-forecast Chinese data, ongoing strength in crude prices and hawkish ECB/BoJ sources.

Commodities

WTI and Brent futures are firmer intraday but off best levels, with overnight gains fuelled by the broader constructive tone and better-than-expected Chinese activity data.Spot gold held onto the USD 1,900/oz handle yesterday despite the gains in the DXY, with the yellow metal climbing north of USD 1,915/oz in APAC trade, and briefly topped its 21 DMA (1,918.55/oz) as it eyes its 200 DMA at USD 1,921.93/oz.Metals are relatively mixed and off best levels after seeing some upside on the aforementioned Chinese data, with 3M LME copper briefly rising above USD 8,500/t before waning alongside the mainland Chinese stock market.Qatar set November-loading Al-Shaheen crude term price at about USD 2.73/bbl above Dubai quotes.Turkish Energy Minister says a survey of the Iraq-Turkey oil pipeline is complete with a report expected soon; the pipeline will soon be technically operational.

Geopolitics

Russia seeks to expand its naval presence in the Mediterranean in which it wants access for its warships to a Mediterranean port in Libya, according to WSJ.

US Event Calendar

08:30: Sept. Empire Manufacturing +1.9, est. -10.0, prior -19.008:30: Aug. Import Price Index YoY, est. -2.8%, prior -4.4%

Aug. Import Price Index MoM, est. 0.3%, prior 0.4%Aug. Export Price Index YoY, est. -6.8%, prior -7.9%Aug. Export Price Index MoM, est. 0.4%, prior 0.7%09:15: Aug. Industrial Production MoM, est. 0.1%, prior 1.0%

Aug. Manufacturing (SIC) Production, est. 0.1%, prior 0.5%Aug. Capacity Utilization, est. 79.3%, prior 79.3%10:00: Sept. U. of Mich. Sentiment, est. 69.0, prior 69.5

Sept. U. of Mich. Current Conditions, est. 74.8, prior 75.7Sept. U. of Mich. Expectations, est. 65.0, prior 65.5Sept. U. of Mich. 1 Yr Inflation, est. 3.5%, prior 3.5%Sept. U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

DB’s Jim Reid concludes the overnight wrap

If you thought patrolling a laser quest party for my twins was hard work two weeks ago, tomorrow we have a private party for Maisie’s 8th birthday at the local swimming pool. So I’ll be doing my best David Hasselhoff impression and operating as a lifeguard. Problem is Maisie is already 10x the swimmer I am so I’m hoping my skills won’t be required.

Markets haven’t required much saving over the last 24 hours, with risk assets posting a strong advance overcoming several potential pitfalls. Among others, we had a 25bp rate hike from the ECB, which was mostly expected by markets but went against the consensus of economists who were forecasting a pause. Then we had another relatively strong round of US data, which kept the idea of a further Fed hike firmly on the table. And if that wasn’t enough, oil prices hit another YTD high as Brent Crude surpassed $93/bbl (+1.98%), which raised the prospect of even more inflationary pressures still in the pipeline. We’re up above $94 in Asia. Countering this, China cut its RRR rate yesterday and their monthly data dump this morning was better than expected. Just when you thought it was safe to go back into the water watch out for triple witching today which brings huge volumes of derivative contracts simultaneously expiring across the board.

We’ll start with the ECB, who after much speculation announced a 25bp rate hike yesterday, which took their deposit rate up to 4%. That’s the highest level for the deposit rate since the ECB’s creation, exceeding the previous peak back in 2000. And having now delivered 450bps of rate hikes over the last 15 months, it also marks the fastest pace of tightening they’ve ever done as well. Indeed, even if you go back before the ECB’s formation and look at previous tightening episodes from the German Bundesbank, they’ve now delivered as much tightening in the space of 15 months as the Bundesbank did from the start of our data in 1948.

President Lagarde said that a “solid majority” were in favour of the decision to hike rates (which sounds less convincing than the “large” or “overwhelming” majorities seen in the recent past). The Governing Council’s statement said they thought rates were now at levels that if “maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.” The statement also said that “future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary.”

In its forecasts, the ECB raised the inflation projections for this year to +5.6% (vs. 5.4% in June), and for 2024 to +3.2% (vs. +3.0% in June), although this was largely due to energy prices with the core inflation projection a touch lower for 2024 and 2025. So the recent oil price rise may have played a sizeable part in the rationale for yesterday’s hike. The growth forecast was revised down as the ECB pushed out its expected recovery from H2-23 to H1-24, with 2024 growth downgraded half a point to +1.0% as a result.

Obviously the question for markets is whether that’s it for the ECB’s tightening cycle, though President Lagarde said “we can’t say” that. Our European economists see a mild hawkish bias persisting, but with a long pause being the baseline. In their view, it would take a substantial surprise relative to ECB expectations to deliver another hike, with duration of restrictive policy now the more relevant policy dimension. See their full ECB reaction note here.

Looking forward, markets are now pricing a 45% likelihood of another hike from the ECB by year-end. So as with the Fed, investors are clearly still alive to the prospect of further hikes. But in spite of that, we actually saw a big reduction in bond yields over the day, with 10yr bunds (-5.8bps) and OATs (-6.9bps) seeing their strongest rally in two weeks, possibly because the market thinks the ECB is getting ahead of the inflation curve or that they are over hiking and taking the economy to a recession and will have to cut sooner. The strong equity performance (see below) might argue against the latter interpretation! Italy’s BTPs (-10.7bps) outperformed, also helped by President Lagarde’s comments noting the importance of PEPP flexibility, suggesting a high hurdle for early exit from PEPP reinvestments that are part of the ECB’s anti-fragmentation toolkit. The euro itself also weakened noticeably, ending the day -0.86% lower against the US Dollar at $1.065, which is the second lowest close (and the largest daily decline) since March.

The stronger dollar narrative was also buoyed by greater optimism about the state of the US economy, with a fresh round of data that added to hopes of a soft landing. First up, the retail sales numbers for August grew by +0.6% (vs. +0.1% expected), and the measure excluding autos and gas was also up +0.2% (vs. -0.1% expected). Within the details of the print, retail control (which enters goods spending in GDP) was actually a touch below consensus when accounting for revisions. But this is still tracking at a strong 5% annualised in Q3, according to our US economists. Secondly, the weekly initial jobless claims came in at 220k (vs. 225k expected) over the week ending September 9, which takes the 4-week moving average down to its lowest level since late February.

Treasury yields saw choppy price action around the US releases and the ECB meeting but a risk-on mood prevailed, with yields moving higher across the curve. The 10yr yield was up +3.8bps to 4.29%, while the 2yr rose back above 5% (+4.3bp to 5.01%). Those moves were given further momentum by the latest PPI data for August, which also showed that inflation was a bit stronger than thought, with the headline measure at a monthly +0.7% (vs. +0.4% expected). So that was certainly consistent with the prospect that the Fed could yet deliver another hike by the end of the year, and futures are still pricing in a 43% likelihood they’ll do so. This was a slight decline from 47% the day before, but with end-24 Fed funds pricing (+7.7bp) closing at a new high of 4.50%.

For equities, this was all great news, and the economic optimism led to a strong rally on both sides of the Atlantic. In the US, the S&P 500 posted both the strongest (+0.84%) and the broadest advance so far this month, with 429 of its constituents and each of the 24 industry groups positive on the day. Bank stocks (+1.79%) were among the strongest performers in the S&P 500, while small cap stocks also outperformed with the Russell 2000 up +1.40%. Over in Europe, the gains were even stronger, and the STOXX 600 surged +1.52% to a one-month high, whilst the FTSE 100 (+1.95%) had its best daily performance since last November.

The other big story in the background has been the ongoing rise in commodity prices, and oil in particular. Yesterday saw Brent Crude close above $93/bbl for the first time so far in 2023 (+1.98% to $93.70), having traded above $94/bbl late it the day. It has moved higher overnight, trading at $94.50/bbl as I type. The ongoing oil price rally is likely to lead to further pressure on gasoline prices. Separately, another potential risk for commodities (including food prices) is the current El Nino event, and yesterday we got the latest forecasts from the US Climate Prediction Center. They said there was now a 73% likelihood that this current El Nino develops into a strong one over Q4, which would be the first time we’ve had a strong one since the 2014-16 event.

Overnight in Asia risk on continues alongside a batch of China’s economic data for August that came in better than anticipated. The Hang Seng (+1.58%) is leading gains even if mainland Chinese markets are a bit more subdued, with the CSI (+0.07%) and the Shanghai Composite (+0.27%) only edging up. Elsewhere, the Nikkei (+1.34%) and the KOSPI (+1.30%) are sharply higher. S&P 500 (+0.20%) and NASDAQ 100 (+0.23%) futures are moving higher.

Coming back to China, industrial output as well as retail sales picked up in August indicating that the recent flurry of support measures may be slowly starting to have an effect. Industrial production advanced +4.5% y/y in August (v/s +3.9% expected), faster than the +3.7% increase in July while retail sales grew by +4.6% y/y in August beating market expectations for a +3.0% gain as against a rise of +2.5% in July. However, Fixed asset investment grew by 3.2% y/y in August on a year-to-date basis missing market expectations for a +3.3% increase, and slower than last month’s +3.4% uptick.

Additionally, the Chinese central bank further ramped up stimulus by adding a net 191 billion yuan into the financial system via a one-year policy loan, a day after announcing another cut (+25 bps) to lenders’ reserve requirements. According to some estimates, this measure is expected to free up as much as 500 billion yuan. The central bank kept the medium-term lending facility (MLF) borrowing cost unchanged at 2.5%, after a surprise 15bps cut last month. The Chinese yuan has risen by +0.31%, trading at 7.57 against the dollar following the August data releases while yields on the 10yr government bonds moved higher by +2.3bps to 2.65% as we go to print.

To the day ahead now, and US data releases include industrial production and capacity utilisation for August, the Empire State manufacturing survey for September, and the University of Michigan’s preliminary consumer sentiment index for September. Otherwise, central bank speakers include ECB President Lagarde and the ECB’s Villeroy.

Loading…