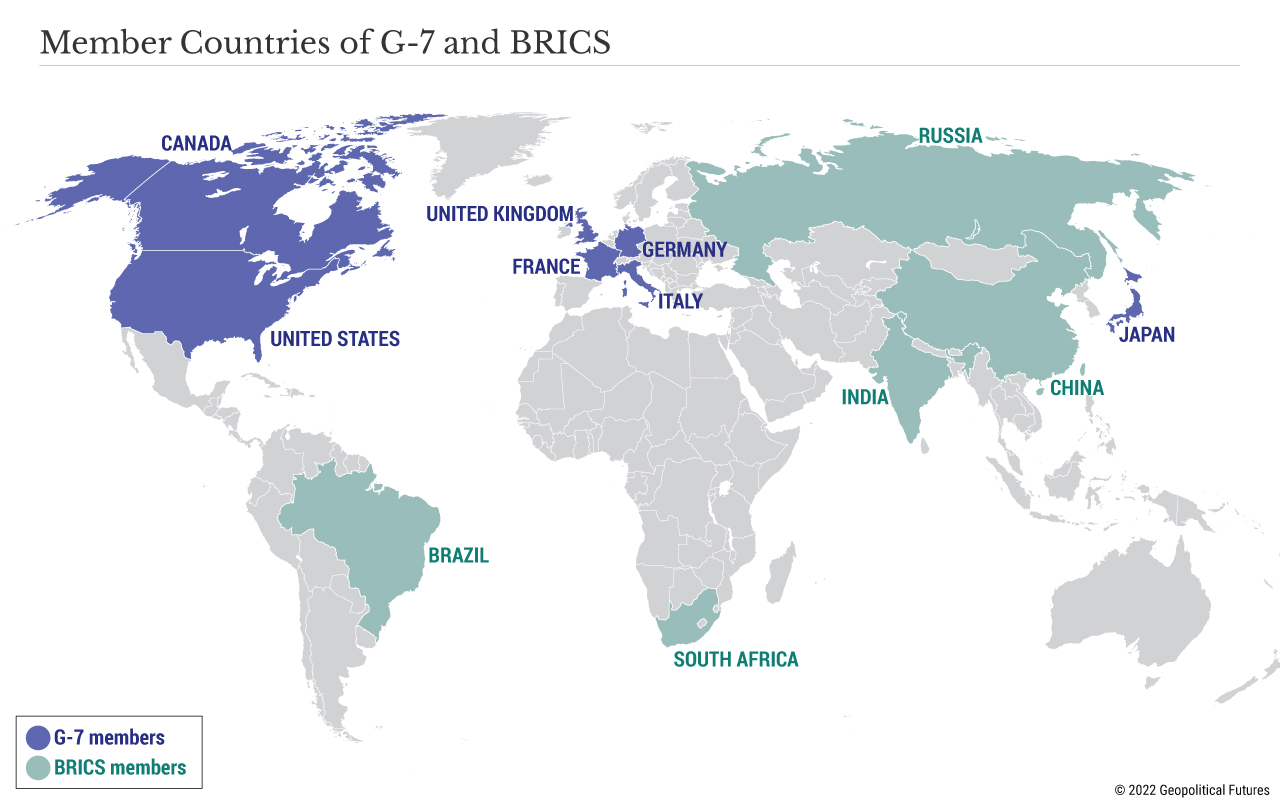

The first half of 2022 is ending with a string of major summits. Meetings of national leaders aren’t usually fateful, but the G-7 summit in southern Germany and the BRICS summit in Beijing are different this year. Amid the Russian-Ukrainian war, surging inflation globally and a looming food crisis, leaders started in earnest the process of redrawing economic alliances and reshaping the world order for years to come.

The G-7

The Group of Seven consists of the world’s wealthiest democracies – Canada, France, Germany, Italy, Japan, the United Kingdom and the United States – plus the European Union. Since Russia’s Feb. 24 invasion of Ukraine, these countries have coordinated to support Kyiv in various ways while launching an economic war against the Kremlin. However, sanctions and Russian countermeasures have helped to drive up energy prices, exacerbating already high inflation and creating serious social and economic risks in much of Europe, which depends heavily on Russian energy. The war has also severely hampered Ukrainian grain production and exports, while high energy and fertilizer prices affect production elsewhere. The scale of these crises calls for high-level, coordinated solutions. The G-7 hopes to mitigate the economic pain on everyone except Russia while turning up the pressure on Moscow to end the war.

One element of that pressure campaign is a gold embargo, which was agreed to on Tuesday. Russia has used its enormous stockpile of gold to blunt the effect of sanctions and support its currency. With the West searching for new ways to pressure the ruble and the Russian economy without European energy sanctions, banning Russian gold imports is a logical step. The U.S. has prohibited gold-related transactions involving Russia since March.

Another measure, far from finalized, concerns a cap on the price of Russian oil. Revenues from energy exports have helped fund the war, and sanctions to date have only forced the price higher. The U.S. and others have already banned imports of Russian oil, but much of Europe is too reliant on Russian supplies and thus resistant to adopting similar bans. A price cap would in theory ensure that flows continue – Russia willing – while eating into Russia’s revenues. However, many questions remain about implementation, and Moscow has meaningful leverage. For instance, it could refuse to sell its oil at the mandated price, or it could shut more natural gas pipelines to Europe under dubious pretenses, as it is threatening to do with Nord Stream 1 to Germany. These countermeasures would come with their own costs for Russia, and it’s simply impossible to know which side could tolerate the pain for longer. What is clear is that the West has struggled to secure alternative energy supplies and is thus in a tough spot.

Zooming out, something more important is happening. The G-7, and the so-called West more generally, needs allies to help it defend existing international rules and norms and to help it reduce its reliance on Russian energy. It also needs allies against the potential food crisis, which is orchestrated by Russia – itself a massive food producer – via its destruction of Ukrainian grain storage facilities and a Black Sea blockade. To that end, the German hosts of the G-7 summit invited Argentina, India, Indonesia, Senegal and South Africa to join. In a statement, the G-7 countries announced their intention to pursue so-called Just Energy Transition Partnerships with the guest countries, indicating that all or some of them may help the West decouple from Russian energy. In the meantime, Germany and Senegal are discussing ways to jointly explore and develop Senegalese natural gas reserves. Argentina formally offered to become “a stable and reliable substitute supplier of Russian gas to Europe and of food to the world.” And India announced the relaunching of free trade talks with the European Union after a nearly decadelong freeze.

At the same time, there’s plenty of reason for caution. For example, most of Argentina’s gas reserves are undeveloped, and it needs significant investment to live up to its promises. For its part, India has yet to condemn Russia over its invasion of Ukraine. Tough discussions lie ahead. Not all players have chosen a side, and convincing the convincible will require compensation.

Russia’s Summits

While the West is recruiting allies, Russia seems to be having problems keeping its partners together. Earlier this month, Russia held its St. Petersburg International Economic Forum, gathering government and business leaders interested in working with Russia. The number of participants has declined significantly since Russian operations first began in Ukraine in 2014, but the forum still included leading figures from the Eurasian Economic Union as well as China, India, Venezuela, Cuba and Serbia.

For the rest of the story:

Source: GPF Geopolitical Futures – Highly Recommend paying and subscribing to their top services.