We are at a crossroads in the world’s energy crisis. We know that the worldwide energy crisis did not happen overnight, but rather over a 25-year bad energy policy practice. That being said, Putin has played a beautiful game of chess gaining the most political leverage of the energy price controls in modern history. We … Continue reading “Geopolitical Tensions and Energy, Oil and Gas Prices will have two outcomes – go up or dramatically go up higher, and here is why.”

The post Geopolitical Tensions and Energy, Oil and Gas Prices will have two outcomes – go up or dramatically go up higher, and here is why. appeared first on King Operating Corporaton.

January 25, 2022

We are at a crossroads in the world’s energy crisis. We know that the worldwide energy crisis did not happen overnight, but rather over a 25-year bad energy policy practice. That being said, Putin has played a beautiful game of chess gaining the most political leverage of the energy price controls in modern history. We also have followed the progressive run of the German rush to renewable energy while shutting down nuclear and coal. They increased their dependence on Russian exported natural gas and fought for the Nord Stream 2 pipeline to fuel their failing energy systems. The key elements of their policies were printing money, placing taxes to pay for renewable energy, not planning on the weather not playing along, and the compounded effect that inflation and the high price of electricity would have on their GDP and financial health as a country.

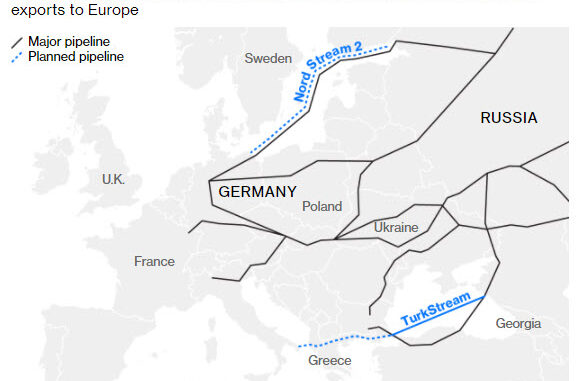

Figure 1 below helps visualize the new pipelines and the real-life valve the EU is expecting in natural gas imports from Russia. The existing pipelines are also represented, and please note that several runs right through Ukraine. There is a real reason that Russia wants to gain control of some of the buffering real estate lost with the former Soviet Union, and now is the last few moves in a chess match Putin has been in the process of setting up for years.

Let’s step back to other countries in Europe or a moment that has also followed down the renewable road. One example is Norway and its abundance of hydroelectricity. Why are their prices to the consumers so high? It’s because they are selling the hydroelectricity to their neighbors. That pesky supply and demand and their citizens get to pay for the surrounding country’s lack of planning. The entire EU is reliant on the export of energy to countries that have resources to those that do not.

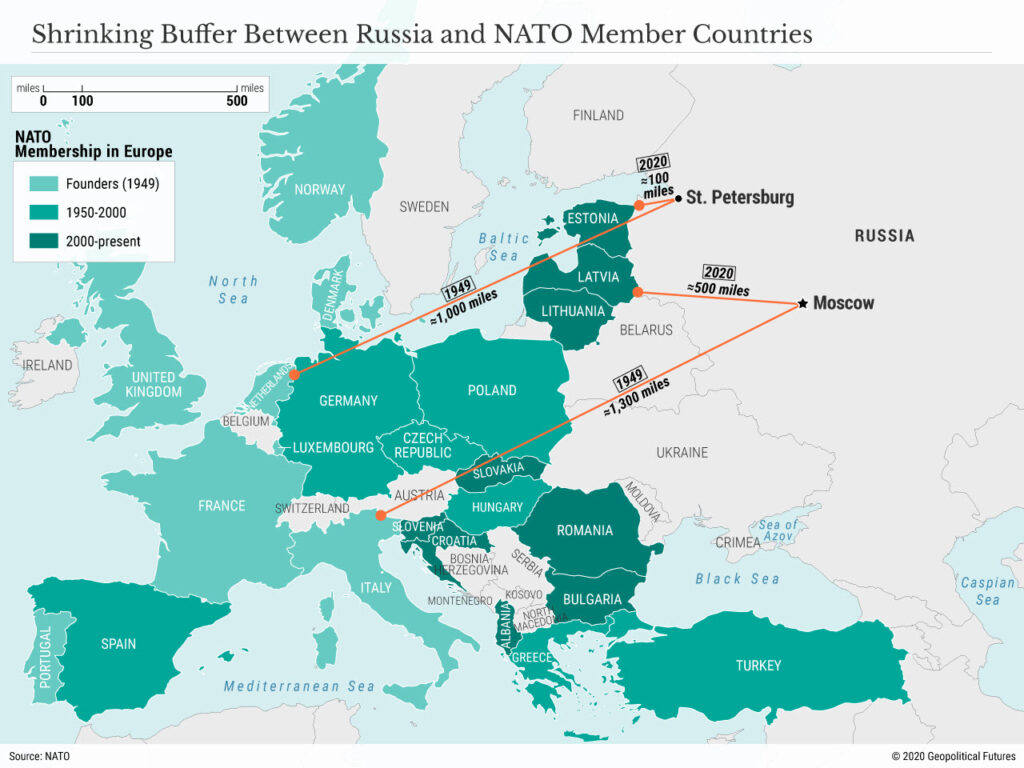

As Europe has traveled down the renewable road, the interdependence of other countries for electricity and imports from oil and gas-rich countries is one of the key steps allowing Russia to claim its leadership spot in the world as a policymaker and influencer because of their energy natural resources. Geopolitical Futures is a company founded by George Friedman, and they have some incredible insights as to the current moves in the energy chess game Putin is about to pull. As mentioned above, gaining the buffer zone of the former Soviet Union starts with Ukraine, and the world is at the weakest point to stop the grab for power. The next graphic will help visualize that Belarus, Ukraine, Crimea, and Moldova are the first level of countries in the reclamation process with Crimea already reclaimed.

So the current crisis is not going to be able to be solved as the United States is no longer a relevant world power, NATO does not have the legal right nor the ability to defend Ukrain as they are not a member state of NATO. This is a critical part of the reason that Russia’s move will happen in the next 30 to 45 days. Russia has treaties that allow for his ability to attack if provoked by NATO’s expansion or threatening behavior. While they have not done any openly aggressive moves, talks around Ukraine’s entry into NATO could be taken as a threat and is a great excuse for invasion.

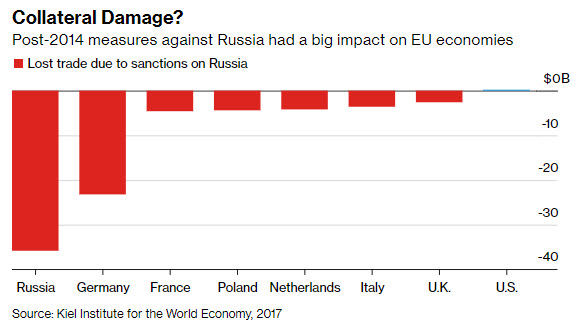

We hear the current administration’s current negotiation tactic is to level sanctions that are devastating to Russia. Well, that is not even a threat that is even a speed bump in Putin’s plans. The graphic below is a great representation of countries that were impacted by the sanctions. All of these countries are at the top of the list that needs Russian natural gas to survive the winter, and in the long term actually move to Net-Zero.

Another interesting key piece to the energy crisis in support of Putin’s reclamation plan is actually the ESG investing movement. The “Greener” movement that has made it a mission to put the oil and gas companies out of business has removed the availability of capital for E&P drilling activities just to replenish the normal depletion of existing wells. The world needs over half of a trillion dollars of new drilling to get the supply moving to match demand over the next several years.

The drilling in the last several years has been shut down so much that it cannot just be turned back on. Bloomberg TV this morning had Amrita Sen, Energy Aspects Founder & Dir. of Research on their show and some of her key points were surrounding the current ability of the Middle Eastern countries to even guarantee supply. She also stated that the normal supply for oil has not been able to be replenished for seasonal expectations and a drawdown is expected from the world’s storage levels. The UAE’s attacks in the news from Yemen are a potential problem in one of the few countries with access capacity to bring production online in the next few months.

So what does all of this mean?

The current level of support coming from all of the countries is minimal from 2 fighter jets, or 8,500 troops and none of the support is going to be in the Ukraine country. This low impacting support is like a political stunt that is telling Putin that he has a green light to move, and move quickly. If the invasion happens anything more than 30 to 45 days from now, the powerful club of shutting off the natural gas in the middle of winter negotiation will be lost.

Countries in the EU have already made their decision to rely on Russia’s natural resources and become dependent on a political regime that is determined to gain world dominance. And energy is the Russian passport to being Energy Czar of the world, with their assistant being Saudi Arabia. The rest of the world has taken a seat in the peanut gallery.

As for the United States Shale E&P companies, our time to shine is just on the horizon. Investing in the U.S. oil companies is not only a safer bet, it is not going away. Not only will it only become more important to national security even no matter who is in charge of the White House.

As always check with your CPA if alternative investments are good for your portfolio Take the assessment and see if it is right for you HERE.

Please reach out to our team at any time for answers to your questions.

Jay R. Young, CEO, King Operating

And visit the King Operating Website for more market information and insights.