London, 13 April (Argus) — The impending closure of Germany’s remaining nuclear plants this weekend might raise the call on gas-fired generation to fill the gap as falling gas prices have pushed gas ahead of coal in the merit order, although a rise in renewable generation may counter the upside.

The three remaining nuclear power stations which were meant to go off line by the end of 2022 are on track to close on 15 April, while output from the plants has already been reduced gradually since the beginning of this year. Nuclear power generation made up roughly 4.5pc of the German generation mix so far this year at 2.68GW, down from 6.5pc at 3.74GW in 2022.

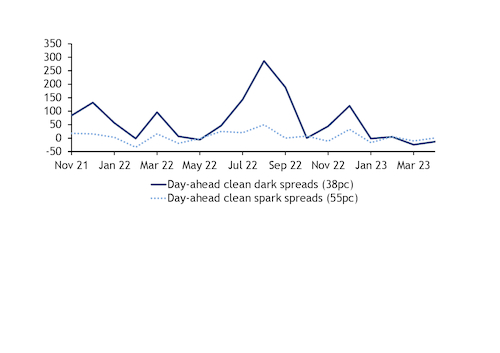

Day-ahead spark spreads for gas-fired units with 55pc efficiency have hovered just inside positive territory so far this month, having averaged minus €10.50/MWh in March, while they have remained well ahead of 38pc-efficient coal-fired units in the merit order (see graph). And forward prices suggest that gas will remain more profitable than coal to burn for power generation over the rest of the summer. This suggests that gas-fired stations could take a larger share of the power mix once the nuclear stations are shut down — although the extent of this depends on output from renewable energies.

The last nuclear stations that were closed, according to schedule at the end of 2021 — the Grohnde, Gundremmingen and Brokdorf units — left roughly 4GW of baseload capacity to be replaced. Fuel-switching levels were largely in favour of coal ahead of gas in January 2022, but most of the lost capacity was at the time replaced by a surge in wind generation.

Fuel-switching levels now paint a markedly different picture, as high gas stocks across Europe as well as brisk European LNG sendout may free up ample spare gas supply for the power sector. And a ramp-up in Germany’s LNG sendout may further bolster supply — the country’s regasification reached fresh highs in recent days.

In addition, forecasts point to slightly lower wind power generation on 16-17 April, which could add support to gas burn, while potentially prolonged curtailments to French nuclear generation as a result of strike action could also add upside.

German energy and water association BDEW managing director Kerstin Andreae this week highlighted that flexible gas-fired power plants were needed to “provide guaranteed output as a partner of the renewables” as nuclear energy has constituted a significant share of the mix so far this year.

“The strategy of the federal government to rely on hydrogen-capable gas-fired power plants and to increase gas imports to Germany” is the right one, according to Andreae.

The country’s energy supply security will “remain guaranteed” despite the closure of the nuclear fleet, German economy and climate protection minister Robert Habeck said today.