is abandoning a self-imposed target to build 400,000 electric vehicles by mid-2024, the latest sign that automakers are concerned about the viability of the market for battery-powered cars.

The Detroit automaker walked back the goal while reporting a healthy third-quarter profit, despite the hit from the continuing United Auto Workers strike. The walkout, which began in mid-September, is now costing

about $200 million a week in profit.

On Tuesday, the UAW further expanded the walkouts at GM, targeting a 5,000-worker factory in Texas that makes sport-utility vehicles and is among its most profitable assembly plants.

The move on EVs is a surprise one for a company that has bet its future on the technology, anticipating that it will eventually phase out sales of gasoline-powered vehicles next decade. It comes as rivals, including Tesla and Ford Motor , have also raised red flags about consumer demand for EVs and buyers’ willingness to pay a premium for them over traditional models.

In July, Ford Motor pushed back its EV-output target by one year. In recent months, amid higher interest rates that are making the already-pricey cars more expensive for many buyers, EV sales growth has slowed and unsold models are piling up on dealership lots.

GM planned to have produced 400,000 EVs over a roughly two-year stretch by the middle of next year but has abandoned that goal. Chief Financial Officer Paul Jacobson on Tuesday cited a slowdown in the market for battery-powered cars.

Last week, GM said it would delay the opening of an EV truck factory in suburban Detroit by a year. Company executives said the automaker stands by its goal of producing one million EVs in North America by the end of 2025 and is trying to build in more flexibility in its manufacturing operations to adjust for fluctuations in demand.

Compared with its competitors, GM has been among the most bullish in pursuing a transition to EVs. Investors cheered its declaration in early 2021 that it would phase out nearly all gasoline- and diesel-powered vehicles by 2035, among the first automakers to vow a full switch to electric.

The question now is whether these pullbacks signal that the car companies wagered too heavily on EVs or are simply confronting hiccups in their transformation toward an electric-dominated future that Tesla pioneered. GM Chief Executive Mary Barra on Tuesday said she believed it was the latter.

“As we get further into the transformation to EV, it’s a bit bumpy, which is not unexpected,” Barra told analysts during GM’s earnings call. “What we’re moving to is something that we can react in a much more agile way to make sure that we have the right vehicles.”

So far, this shift isn’t hitting results, though the strike is. The company’s net income for the July-to-September period fell 7% to about $3.1 billion. The strike impact and higher expenses on warranty repairs contributed to the drop, offsetting strong pricing as car shoppers continued turning out despite higher interest rates and a slowing economy.

The results beat analyst estimates. Operating profit amounted to $2.28 a share, compared with analysts’ average estimate of $1.87, according to FactSet. GM also withdrew its full-year profit guidance because of the strike.

GM shares were up less than 1% in morning trading Tuesday.

EV sales in the U.S. still are growing at a faster clip than the broader auto market, but the pace has slowed, and the prices that automakers are commanding have weakened.

Several factors are contributing to the slowdown. As EV sales took off over the past three years, early adopters were willing to pay top dollar for new, buzzed-about models, and average EV prices soared above $60,000.

Now, carmakers are having to reduce prices and offer discounts on EVs to stimulate interest, moves that cut into profitability.

“We expect the EV market to remain volatile until the winners and losers shake out,” Ford Chief Executive Jim Farley said this summer.

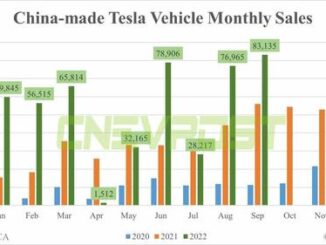

EV leader Tesla has led the industry in price cuts, significantly slashing the cost of its most popular vehicles, the Model Y SUV and Model 3 sedan this year. Traditional carmakers—many of which are just now rolling out several new electric models—have followed with reductions of their own, complicating the business case for EVs that already were unprofitable in many cases.

Last week, Tesla Chief Executive Elon Musk was gloomy about the outlook for EVs, pointing to sharply higher interest rates as a factor in consumers’ willingness to pay up for the technology. Generally, EVs are priced higher than comparably sized gasoline-powered vehicles.

When asked about a planned factory in Mexico, Musk said he was hesitant to “go full tilt” on the project. “I don’t want to be going at top speed into uncertainty,” he said during the company’s earnings call.

On Monday, EV startup

said it would cut prices of its most expensive version of its Ocean SUV, a model that it only recently launched in the U.S. Rival startup

is also rolling out a referral program that offers discounts on its high-end Air sedan, a tactic aimed at juicing sales of its debut model.

On Tuesday, Barra said the company still is committed to “an all-electric future.” GM will calibrate its EV production based on market demand, company executives said, adding that several factories produce both electric and gasoline-powered cars.

The UAW strike, now in its sixth week, hurt GM’s bottom line by $800 million, about a quarter of which came in the third quarter, Jacobson said.

Outside of that, he said, it was an otherwise strong quarter. GM’s average vehicle sold for about $50,750 during the period, down only slightly from last year, despite analysts’ expectations for a significant falloff in consumers’ ability to spend up on new cars.

“The consumer has held up remarkably well,” Jacobson said, allowing pricing to hold up better than had been expected heading into 2023.

GM’s income from China—long a steady profit stream for the automaker—fell 42% to $192 million. GM and other global automakers continue to grapple with price pressures and the rise of Chinese brands, especially in EVs.