Gold prices slid to more than a one-month low on Wednesday, weighed down by a stronger dollar as better-than-expected US economic data raised worries that the Federal Reserve could hike interest rates further.

Spot gold dropped 1.0% to $1,835.66 per ounce by 11:55 a.m. ET, after opening the session above the $1,850 level. US gold futures also fell 1.0% to $1,846.40 per ounce in New York.

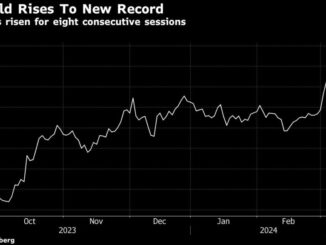

[Click here for an interactive chart of gold prices]

Latest data shows that US retail sales rose 3% in January over the previous month, highlighting economic resilience despite higher borrowing costs.

Higher retail sales were “another indication that if the Fed wants to cool inflation, they’re going to have to raise interest rates to choke off some of this demand,” Jim Wyckoff, senior analyst at Kitco Metals, told Reuters.

This comes after data on Tuesday showing that US consumer price index had increased year-on-year by 6.4%. That was down from 6.5% in December, but above the 6.2% estimated by economists.

Following the data release, the US dollar index rose to a more than one-month high, making gold more expensive for buyers using other currencies.

“In case of a re-acceleration of inflation and a return to more rapid interest rate increases, gold and silver would suffer,” said Carsten Menke, head of Next Generation Research at Julius Baer.

“In contrast, gold and silver would benefit if the Fed started to reduce interest rates due to strengthening signs of recession.”

Also weighing on gold, Fed officials said earlier this week that the US central bank will need to keep raising interest rates gradually.

Markets are now pricing a peak above 5.2%, and traders are becoming less sure that cuts are coming in 2023. Rates currently stand at 4.5% to 4.75%.

(With files from Reuters)