Golden Pass LNG, a joint venture owned by energy giants QatarEnergy and ExxonMobil, has secured approval from the US FERC to place into service its MP 33 compressor station, as it continues to move forward with commissioning activities at its three-train LNG plant in Texas.

According to a FERC order dated September 5, the regulator granted Golden Pass Pipeline to place into service the MP 33 compressor station and related appurtenances in Orange County, Texas.

Are you Paying High Taxes in New Jersey, New York, or California?

FERC noted the requested facilities would provide natural gas for delivery to the Golden Pass LNG terminal export facilities.

Site clearing activities for the project began in 2022.

The MP33 compressor station project includes a new compressor station and three new GPPL interconnects to enable receipt and delivery of natural gas to and from the Golden Pass terminal.

Last year, Golden Pass sought approval from FERC to increase the peak workforce to speed up the construction of the pipeline project as part of its project.

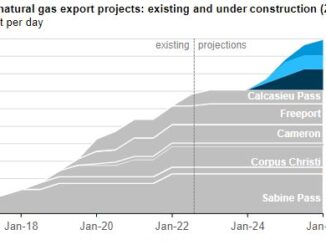

The pipeline project includes modifications to the existing Golden Pass pipeline system to provide transportation of up to 2.5 billion cubic feet per day (Bcf/d) of domestically sourced natural gas for delivery to the Golden Pass LNG export facilities.

It involves three key components and these are the Milepost 1 compressor station in Sabine Pass on the terminal site in Texas which serves as the last stop before natural gas enters the liquefaction facility, and the Milepost 33 compressor station project.

Also, the project includes the Milepost 69 compressor station project in Starks, Louisiana, which will connect the Golden Pass pipeline to the Gulf Run pipeline, and connect the LNG terminal to more sources of natural gas supply.

Golden Pass continues to progress with commissioning activities as it looks to start producing LNG at the first train by the end of this year.

Other FERC filings show that Golden Pass recently received approval to introduce hazardous fluids into ground flare No. 3.

In addition, the JV won approval to introduce hazardous fluids into the essential diesel generator system.

State-owned QatarEnergy owns a 70 percent stake in the Golden Pass LNG project with a capacity of more than 18 mtpa and will offtake 70 percent of the capacity, while US energy firm ExxonMobil has a 30 percent share.

In July, Golden Pass sought approval from the US DOE to export previously imported LNG from October.

The JV requested that DOE’s Office of Fossil Energy and Carbon Management issue an order granting GPLNG to engage in short-term exports of up to 50 Bcf of LNG, on a cumulative basis, that will have been previously imported into the US from foreign sources.

Moreover, the LNG supplies that are proposed to be exported would be derived from GPLNG’s LNG importing activities and will be residing in LNG storage tanks at the terminal.

The LNG supplies will either be re-exported or regasified to be used as fuel gas at the facility.

GPLNG further plans to use the imported LNG as part of the start-up of its export facility.

The JV sought approval for a two-year period starting on October 1, 2025.

Japan’s Chiyoda and US-based McDermott signed a binding term sheet with GPLNG in June to complete the construction of the second and third liquefaction units at the giant LNG export plant in Texas.

Chiyoda said that the JV partners and GPLNG will “continue engagements to finalize amendment to the contract and will disclose promptly when we conclude such agreement.”

A joint venture of Chiyoda, McDermott’s CB&I, and Zachry won the EPC contract to build the three Golden Pass trains worth about $10 billion next to the existing LNG import terminal in the vicinity of Sabine Pass, Texas.

However, Zachry Holdings said in May last year that it had filed for bankruptcy, initiating a structured exit from the Golden Pass LNG export project due to “financial challenges” related to the facility’s construction.

In November 2024, Chiyoda and US-based CB&I reached a deal with Golden Pass LNG to complete the construction of the first liquefaction at the LNG export plant.

After that, Houston-based McDermott completed the sale of its CB&I storage business to a consortium of financial investors led by New York-based Mason Capital Management.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack