Sellers coming out of the closet with their vacant homes. Active listings exploded the most in San Diego (+77%).

By Wolf Richter for WOLF STREET.

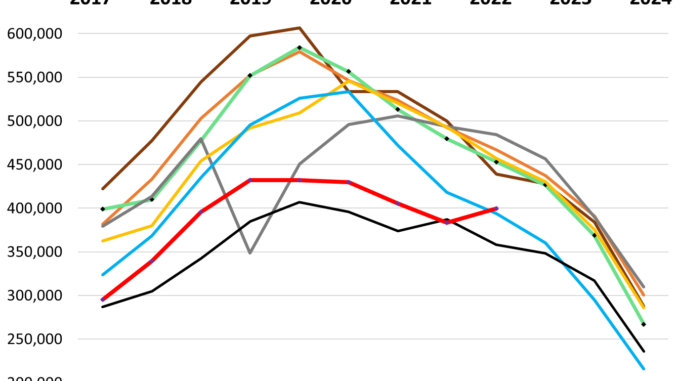

New listings jumped in September, when they normally fall in September and for the rest of the year. This was the first time in the data going back to 2016 that new listings didn’t fall in September, according to data released today by Realtor.com (red line = 2024; green line with black dots = 2019):

The Seattle metropolitan statistical area (MSA) had the biggest year-over-year surge in new listings (+42%), followed by the southern part of Silicon Valley (San Jose-Sunnyvale-Santa Clara). Of the biggest 50 MSAs, new listings rose by double-digit percentages in 26 of them. This is occurring even as demand for these homes has wilted:

| Metro September 2024 | New Listings % YoY |

| Seattle-Tacoma-Bellevue | 42% |

| San Jose-Sunnyvale-Santa Clara | 27% |

| Washington-Arlington-Alexandria | 26% |

| Denver-Aurora-Lakewood | 26% |

| Boston-Cambridge-Newton | 24% |

| Raleigh-Cary | 24% |

| Los Angeles-Long Beach-Anaheim | 23% |

| San Diego-Chula Vista-Carlsbad | 22% |

| Providence-Warwick | 22% |

| Richmond | 20% |

| San Francisco-Oakland-Berkeley | 20% |

| Las Vegas-Henderson-Paradise | 16% |

| Oklahoma City | 16% |

| Portland-Vancouver-Hillsboro | 15% |

| New York-Newark-Jersey City | 15% |

| Riverside-San Bernardino-Ontario | 15% |

| Baltimore-Columbia-Towson | 14% |

| Nashville-Davidson-Murfreesboro-Franklin | 14% |

| Phoenix-Mesa-Chandler | 12% |

| Detroit-Warren-Dearborn, Mich. | 12% |

| Atlanta-Sandy Springs-Alpharetta | 12% |

| Miami-Fort Lauderdale-Pompano Beach | 10% |

| Charlotte-Concord-Gastonia | 10% |

| Hartford-East Hartford-Middletown, Conn. | 10% |

| Kansas City, Mo.-Kan. | 10% |

| Minneapolis-St. Paul-Bloomington | 10% |

Active listings (total inventory minus listings with a pending sale) surged 34% year-over-year, to 940,980 listings, the highest since April 2020, and the highest for any September since 2019, as sales have wilted and as inventory gets stale because prices are way too high (data via Realtor.com).

Of the biggest 50 metros, active listings exploded in the San Diego MSA (+77% year-over-year), followed by Tampa (+74%), Orlando (+69%), Seattle (+68%), and Miami (+68%).

The red line = 2024, purple line with black dots = 2019. The four lines below the 2024 line are the years 2020, 2021, 2022, and 2023 (data via Realtor.com).

The combination of wilting demand and surging active listings means that sellers put vacant homes on the market after having already moved out perhaps years ago, but kept the vacant home off the market to ride up the price spike all the way. We can see that because a seller that puts their home on the market that they still live in will buy another home to move into, and so demand rises by 1 home and active listings rise by 1 home, and both rise.

Now demand is falling and active listings are rising. So these are the vacant homes coming on the market that sellers had already moved out of and have kept off the market for years – which was responsible for the inventory shortages in 2020-2022, and we discussed that a lot at the time.

The San Diego MSA is #1. These are the 30 metros of the 50 biggest metros where active listings have surged the most:

| Metro September 2024 | Active Listings % YoY |

| San Diego-Chula Vista-Carlsbad | 77% |

| Tampa-St. Petersburg-Clearwater | 74% |

| Orlando-Kissimmee-Sanford | 69% |

| Seattle-Tacoma-Bellevue | 68% |

| Miami-Fort Lauderdale-Pompano Beach | 68% |

| Jacksonville | 62% |

| Denver-Aurora-Lakewood | 62% |

| Charlotte-Concord-Gastonia | 61% |

| Atlanta-Sandy Springs-Alpharetta | 53% |

| Dallas-Fort Worth-Arlington | 49% |

| Sacramento-Roseville-Folsom | 49% |

| Phoenix-Mesa-Chandler | 49% |

| Raleigh-Cary | 48% |

| Las Vegas-Henderson-Paradise | 47% |

| Los Angeles-Long Beach-Anaheim | 47% |

| Riverside-San Bernardino-Ontario | 40% |

| San Jose-Sunnyvale-Santa Clara | 39% |

| Columbus | 39% |

| Oklahoma City | 38% |

| Memphis | 37% |

| Cincinnati | 35% |

| Providence-Warwick | 33% |

| Louisville/Jefferson County | 31% |

| Nashville-Davidson-Murfreesboro-Franklin | 31% |

| Houston-The Woodlands-Sugar Land | 30% |

| Boston-Cambridge-Newton | 30% |

| Birmingham-Hoover | 30% |

| Portland-Vancouver-Hillsboro | 28% |

| Richmond | 28% |

| San Francisco-Oakland-Berkeley | 28% |

But buyers are still on strike because prices are too high.

Demand for existing homes has wilted as buyers have gone on strike because prices are too high, and what’s on the market is taking much longer to sell.

Many buyers have switched to buying new houses because homebuilders understand this market and have offered homes at lower prices and have thrown incentives into deals, and have spent massively to buy down mortgage rates, and so new house sales have remained strong, amid surging supply of spec homes.

The most current measure of demand – the weekly applications for mortgages to purchase a home, released by the Mortgage Bankers Association – shows that demand for homes remains wilted. Purchase mortgage applications have been running along historic lows for a year and remained there over the weeks since the Fed’s rate cut:

Mortgage rates have risen since the rate cut. After briefly touching 7.8% in October 2023, mortgage rates zigzagged lower to briefly touch 6.09% last month, according the weekly Freddie Mac data, as a bunch of rate cuts were being priced in.

But when the Fed finally did cut its policy rates by 50 basis points on September 18, mortgage rates – following longer-term Treasury yields – started inching higher, confounding hopes that the actual rate cuts would reduce mortgage rates even more than the bunch of priced-in rate cuts already had. So the Fed cut its policy rates, and mortgage rates rose.

The daily measure by Mortgage News Daily has already risen to 6.26% as of today, from the low of 6.11% before the rate cut:

The median listing price in September dropped for the third month in a row from the seasonal peak in June, which had been lower than the all-time peak in June 2022, and flat with June 2023. Year-over-year, the median listing price was down 1.1% (data via Realtor.com):

For the past four months, the median listing price has been below where it had been in the same period 2 years earlier. This percentage change from 2 years ago shows how insane sellers’ pricing expectations had gotten in 2021 and 2022.

That price spike was why many homeowners who’d bought a another home to move into didn’t sell the old home they’d moved out of because they wanted to ride up the price spike all the way, and now those vacant homes are starting to come on the market.

So supply is piling up. And sellers are becoming a little more motivated. Median listing prices show where sellers stand. To make a deal, they need buyers, and actual buyers determine the selling price, and the prices of closed sales, which we’ll get later this month, show where actual buyers stood.

Here are the 23 metros of the biggest 50 metros with the largest year-over-year drops in median listing prices, according to Realtor.com:

| Metro September 2024 | Median Listing Price | % Change YoY |

| Miami-Fort Lauderdale-Pompano Beach | $525,000 | -12% |

| Cincinnati | $337,000 | -10% |

| San Francisco-Oakland-Berkeley | $997,500 | -9% |

| Kansas City, Mo.-Kan. | $389,500 | -8% |

| Austin-Round Rock-Georgetown | $520,000 | -7% |

| Jacksonville | $399,000 | -6% |

| Denver-Aurora-Lakewood | $610,250 | -6% |

| Orlando-Kissimmee-Sanford | $429,950 | -6% |

| Tampa-St. Petersburg-Clearwater | $414,948 | -6% |

| Nashville-Davidson-Murfreesboro-Franklin | $547,865 | -5% |

| San Diego-Chula Vista-Carlsbad | $997,000 | -5% |

| Oklahoma City | $314,950 | -5% |

| Seattle-Tacoma-Bellevue | $772,425 | -3% |

| Portland-Vancouver-Hillsboro | $604,890 | -3% |

| New Orleans-Metairie | $325,000 | -3% |

| Minneapolis-St. Paul-Bloomington | $432,500 | -3% |

| San Antonio-New Braunfels | $339,948 | -3% |

| Atlanta-Sandy Springs-Alpharetta | $414,560 | -3% |

| Washington-Arlington-Alexandria | $599,948 | -2% |

| Dallas-Fort Worth-Arlington | $439,450 | -2% |

| Phoenix-Mesa-Chandler | $519,850 | -2% |

| Sacramento-Roseville-Folsom | $635,000 | -2% |

| Los Angeles-Long Beach-Anaheim | $1,154,440 | -2% |

Median Days on the Market: The median number of days a property sat on the market for sale before it sold or before it was pulled off the market rose to 55 days in September, the highest for any September since 2019 (red line = 2024, purple line with black dots = 2019).

This number shows a mix of:

How aggressively sellers pulled listings off the market if it didn’t sell;

And how fast properties sold that did sell.

The number is kept down by sellers pulling their home off the market when it doesn’t sell, to then relist it later at a lower price, or as rental or vacation rental, or not list it at all for a while.

When sellers get more desperate to sell the property, they leave it on the market and reduce prices until it sells, and the days on the market lengthens.

Price reductions: The share of active listings with price reductions in September, at 34.5%, was the highest share in the data going back to 2016 except for 2018, 2021, and 2022. The years with the highest asking prices after a huge spike – 2022 and 2023 – were also the years with the biggest share of price reductions (black and green lines).

All other years were lower, including 2019 (purple line with black dots). But those price reductions clearly aren’t enough to bring buyers into the market (data via Realtor.com):

We give you energy news and help invest in energy projects too, click here to learn more