Germany, once hailed as Europe’s economic powerhouse, is grappling with a profound crisis driven by deindustrialization and aggressive net zero energy policies. High energy costs, regulatory burdens, and the abrupt shift away from reliable energy sources have eroded the nation’s industrial base, leading to job losses, corporate exodus, and stagnant growth. As the country navigates the fallout from lost Russian gas supplies, premature nuclear shutdowns, and EU-mandated sustainability reporting, questions loom about its path to recovery and the broader implications for the European Union. This article examines the key factors contributing to Germany’s woes and assesses the prospects for averting total fiscal failure.

Mounting Job Losses in the Industrial Sector

Over the past four years, Germany’s industrial workforce has been decimated, with hundreds of thousands of jobs vanishing amid rising energy prices and policy-driven inefficiencies. A study revealed that the industrial sector shed nearly 250,000 jobs since 2019, representing a 4.3% contraction in the workforce.

The automotive industry, a cornerstone of German manufacturing, lost 51,500 jobs in just one year, equating to a 7% drop in employment.

Broader manufacturing saw 120,000 positions disappear in 2024 alone, bringing the total to around 6.67 million workers by early 2025.

These losses are closely tied to net zero policies, which have accelerated the transition to renewables while phasing out fossil fuels and nuclear power. Critics argue that the Energiewende—Germany’s ambitious energy transition—has inflated electricity costs, making it uncompetitive for energy-intensive industries like chemicals and steel. For instance, companies such as BASF and Volkswagen have announced mass layoffs, citing the need to adapt to a changing landscape that prioritizes sustainability over economic viability.

Across the EU, nearly a million manufacturing jobs were lost in four years, with Germany accounting for 129,000 of them, underscoring the regional impact of similar green mandates.

Corporate Exodus and Economic Hemorrhage

As deindustrialization accelerates, major companies are fleeing Germany for lower-cost destinations, exacerbating economic losses. Prominent firms are relocating production abroad to escape high energy bills, bureaucratic hurdles, and stringent regulations.

This trend has been fueled by net zero policies that impose additional compliance costs, driving up operational expenses.The economic toll is staggering. Germany’s industrial output has declined for four consecutive years, with a 4.5% drop in 2024 alone.

Automakers have shed 46,000 jobs since 2019, and suppliers lost 11,000 in one year, as sectors struggle with the fallout from energy policy shifts.

The broader impact includes reduced investment and innovation, with Germany’s economy growing by just 0.1% since 2019—far below the U.S.’s 12% expansion over the same period.

If unchecked, this exodus could lead to a permanent hollowing out of Germany’s manufacturing heartland.

GDP Stagnation and Recessionary Pressures

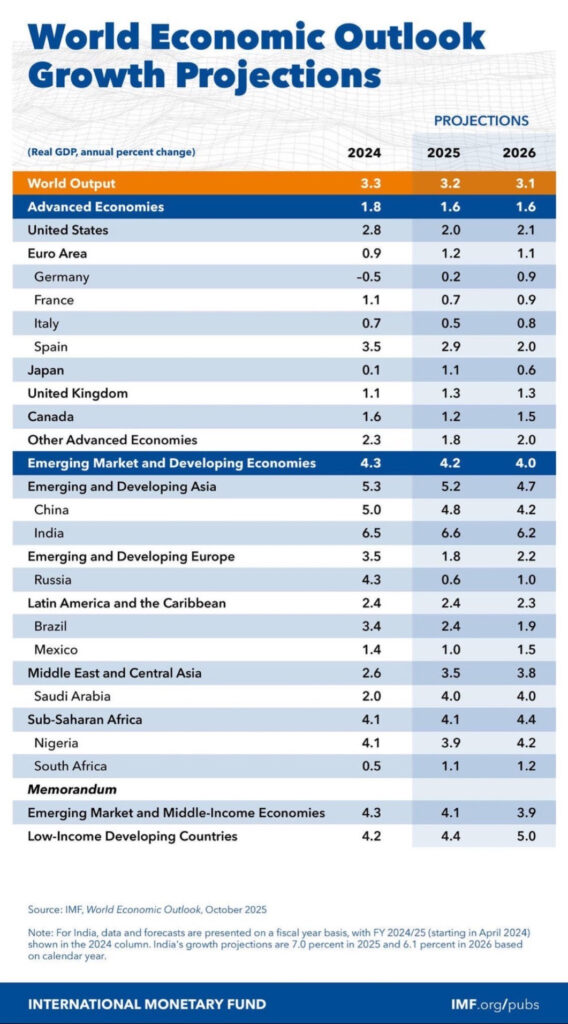

Germany’s GDP has suffered significantly, reflecting the cumulative effects of deindustrialization and energy policy missteps. Real GDP contracted by 0.3% in 2023 and 0.2% in 2024, marking two years of recession.

Over the last four years, annual growth rates have fluctuated wildly: -4.1% in 2020 due to the pandemic, followed by rebounds that failed to sustain momentum.

By 2024, GDP stood at approximately $4.66 trillion, but adjusted for inflation, the economy has barely moved since 2019.

Net zero initiatives have compounded these issues by increasing energy costs and disrupting supply chains. Forecasts for 2025 predict meager growth of 0.2%, with unemployment rising to 6.3%.

This stagnation signals Germany’s longest period of economic inactivity in seven decades, driven by policy-induced vulnerabilities.

EU’s CSRD: Adding Bureaucratic Weight

The European Union’s Corporate Sustainability Reporting Directive (CSRD) is forcing additional burdens on German companies, mandating detailed disclosures on environmental, social, and governance impacts starting in 2024.

This directive, aimed at enhancing transparency for sustainability, applies to large firms and even non-EU entities with significant operations in the bloc, including U.S. subsidiaries.

While intended to drive green behavior, the CSRD adds layers of compliance costs, particularly for Germany’s export-oriented industries. Critics view it as another layer of red tape that accelerates deindustrialization, with companies facing penalties for non-compliance amid already strained finances.

This EU-wide push aligns with net zero goals but risks further alienating businesses in energy-dependent sectors.The Energy Shock: Loss of Russian Gas and Nord Stream FalloutGermany’s dependence on Russian natural gas ended abruptly with the 2022 sabotage of the Nord Stream pipelines, which caused massive leaks and severed supplies.

Prior to this, Russia supplied 55% of Germany’s gas, and the cutoff led to a 60% reduction in flows, spiking energy prices and industrial costs.

The economic impact was severe, with estimates suggesting potential GDP losses of up to 2-3% in a full shutoff scenario.

Compounding this, the EU is moving toward a complete ban on Russian LNG by January 2028, with proposals to accelerate it to 2027.

This phaseout aims to end dependency but leaves Germany scrambling for alternatives like U.S. LNG, which is more expensive and less reliable in volume.

The result: higher energy bills that fuel deindustrialization.

Premature Nuclear Shutdowns: A Costly Mistake

Germany’s decision to close its last nuclear plants in 2023 has drawn sharp criticism for increasing emissions and costs.

The phaseout, rooted in post-Fukushima policies, replaced low-carbon nuclear with coal and gas, leading to higher greenhouse gases and an estimated $12 billion annual cost to society, including health impacts from pollution.

Studies link the closures to 170 premature deaths per year from increased air pollution.

This move, part of net zero ambitions, has not yielded the promised benefits. Instead, it heightened reliance on imports and renewables, which struggled during the energy crisis.

Pathways to Recovery: Can Germany Avoid Fiscal Collapse?

Recovery prospects remain dim, with 2025 GDP growth forecasted at 0.2-0.4% and a gradual uptick to 1.2% in 2026.

Boosting infrastructure and defense spending could help, but structural issues like skilled labor shortages and bureaucracy persist.

Reversing some net zero policies, such as reconsidering nuclear or easing regulations, might stem the tide, but political divisions hinder progress.

Without bold reforms, fiscal failure looms, with rising debt and unemployment threatening stability.

Broader EU Implications: Could Italy and Poland Follow Brexit?

Germany’s crisis could ripple across the EU, fueling discontent in other nations. Italy, burdened by migration and economic strains, has seen polls where nearly half favor exit if Brexit succeeds.

Poland, opting out of EU migration schemes, faces tensions but remains unlikely to leave due to economic benefits.

While no imminent exits are evident, net zero costs and energy dependencies could erode unity, potentially leading to more departures if Germany’s collapse worsens.

In summary, Germany’s deindustrialization, driven by net zero policies and energy disruptions, poses an existential threat. Swift policy reversals are essential to prevent total collapse and preserve the EU’s cohesion. The German and EU leadership 100% own the failure of a once-great manufacturing nation.

On a side note, the United States needs to pay attention. California, New York, New Jersey, and other Democrat run states are following the path of the EU and Germany. Energy Dominance cannot be implemented if it remains unchecked. California is a flat-out energy security crisis thanks to Gavin Newsom.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack