Watch the 3m30y and the 5y30y segments of the yield curve for early signs that a recession is coming into view. Extra caution will be required at this point as equities and equity earnings have yet to adequately price in a downturn.

The yield-curve’s utility as a recession indicator has been a hot topic in recent years. It has an almost unblemished record of forecasting recessions, with the 2s10s curve only giving one false positive in the postwar years. However, it is limited in its usefulness due to the variability between when the curve inverts and when the recession hits, which ranges between six months and two years.

Overall, the yield curve is a bit of red herring when it comes to recession prediction. A much broader suite of indicators is more effective in giving a more timely sign of an economic contraction, with one next year looking highly likely.

Nonetheless, it’s not the yield-curve inversion that’s the more imminent sign of a recession, but the subsequent re-steepening. Even then, not all parts of the yield curve are equal.

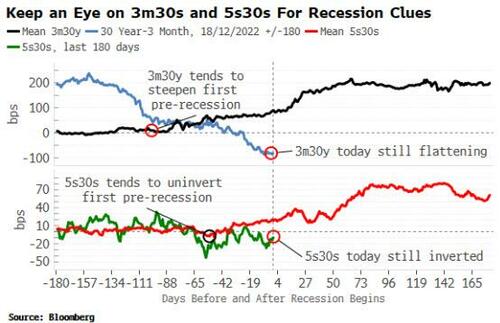

If history is a guide, when 3m30y curve meaningfully steepens and then the 5s30s un-inverts, that will be a sign an NBER recession is as little as two months away.

The chart below shows the set of the most liquid parts of the yield curve before and after recessions going back to 1969 (where certain yields maturities do not have enough history, I only include more recent recessions). The chart shows clearly that the 3m30y curve steepens first, about three months ahead of the recession. It also steepens by the most before and after the recession.

The 5s30s curve also tends to be one of the first to un-invert before a recession, about six-to-eight weeks prior.

At the moment, the 3m30y curve is still flattening and 5s30s is still inverted, suggesting a recession is at least a few months away.

But investors will need to remain vigilant. These trends can change quickly, and recessions always surprise by the rapidity of their onset.

Loading…Authored by Simon White, Bloomberg macro strategist,