With ERCOT’s frequent congestion in West Texas, getting the precise area (or line) when trading, managing or assessing congestion is crucial. Ending up on the wrong side of these constraints can be costly.

The recent day-ahead and real-time trends have included strong LPLMK_LPLNE_1 congestion. But what is driving this congestion? Will it continue? Enverus’ new P&R Forecast, which is built into the Mosaic platform and incorporates the MUSE data, can help us answer these types of questions.

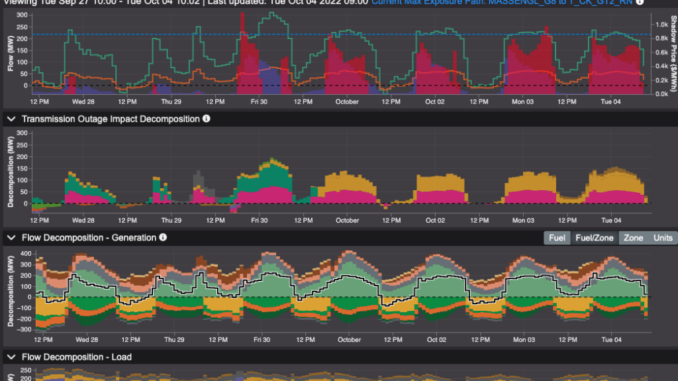

The screenshot below shows our breakdown of the noted constraint in Mosaic. The top chart shows the real-time constraint flows coming from MUSE, including the hourly shadow price (red shading). From here, our auto analysis breaks down flows by looking at the impact from transmission outages (second chart), and generation and load (third and fourth charts).

The second chart assesses the impact of transmission outages on the constraint. You’ll notice a lot of shading, indicating there are some transmission outages impacting the flows. The hover box shows the outages and their impact on flows. We’ll focus on the pink shading, which represents some nearby transmission outages. Outage details, including duration and future outages on that branch, are available with a click. As of now, those outages appear to end Oct. 28, 2022.

Using the Flow Decomposition — Generation chart, we break down the constraint by generation impact. The white box highlights the fuel-level breakdown during one binding event (Oct. 3 HE4), which shows the largest impact is from wind. The green shading seems correlated to the constraint flows and binding events in the top chart. Another interesting note is that solar impact is negative (red box), indicating this is really an off-peak risk as solar generation reduces constraint flows.

Does this mean wind in general causes this congestion? Our Fuel/Zone breakdown provides more details. In the image below, it shows how the strong North WZ wind is driving the increase in flows.

Our MUSE platform provides actionable intelligence on the effect of the congestion on Resource Nodes and Hub prices. Providing market participants more insight into hedging opportunities around these areas of volatility. This constraint does have a primary driver in the intermittent renewable wind in North and West Texas as well as counter flow (relieving) from nearby solar projects. To predict what conditions will cause this congestion over the next week, we have our P&R Forecast.

Below, you see the next six days of forecast for the LPLMK-LPLNE. To the left of the vertical white dotted line is all the historical data provided by MUSE. To the right is the P&R Forecast, including forecasted post contingency line flows, the forecasted monitored line flows and any forecasted shadow prices. From Oct. 11-12, the purple shading indicates shadow prices and the return of this constraint.

In the second graph, there are still transmission outages, increasing constraint flows for the next six days. In the third graph, you see the return of North weather zone wind (Panhandle wind), which is helping drive the flow higher Oct. 11 and 12, resulting in forecasted shadow prices. However, the lack of wind in prior days aligns with lower flows.

The P&R Forecast allows users to see the forecast, the specific hours with the highest risk and the fundamental drivers that comprise the forecast, including transmission outages, generation and demand.

The max exposure path of this constraint as shown in MUSE is MASSENGL_G8 to T_CK_GT2_RN. From Sept. 19-Oct. 4, a cleared PTP on this path during HE 1-9 and 20-24 would have resulted in approximately $7,500 profit per megawatt for each hour. MUSE and P&R Forecast combined help users determine the drivers of the congestion and the best hours to bid the path.

Interested in learning more about how our solutions remove the guesswork when it comes to hedging risks and identifying opportunities? Contact our team to learn more about MUSE and P&R Forecast below.

The post Identify Investment Opportunities With MUSE and P&R Forecast first appeared on Enverus.