In a significant shift for global energy markets, the International Energy Agency (IEA) has revised its long-standing predictions on oil and gas demand, prompting major financial institutions like Goldman Sachs to adjust their forecasts accordingly. This “U-Turn” by the IEA, as it’s being dubbed in industry circles, moves away from earlier projections of an imminent peak in fossil fuel demand, instead anticipating continued growth well into the coming decades. The change reflects evolving realities around net-zero transitions, economic growth in developing regions, and persistent global energy needs.

Understanding the IEA’s Reversal

The IEA’s adjustment came to light through a leaked draft of its upcoming report, which indicates that oil and natural gas demand will keep rising for decades rather than plateauing or declining as previously forecasted.

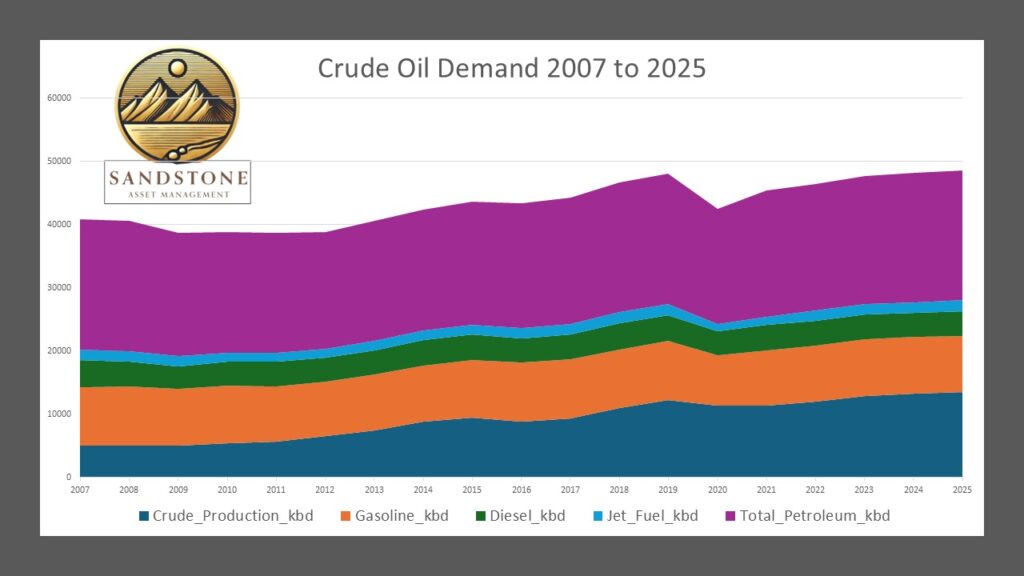

Earlier IEA outlooks had emphasized a rapid shift toward renewables and electrification, predicting a peak in oil demand by the late 2020s. However, the agency’s 2025 World Energy Outlook appears to acknowledge slower progress on net-zero goals, higher-than-expected consumption in emerging markets, and the enduring role of hydrocarbons in transportation, industry, and power generation.

This revision isn’t entirely unexpected. Over recent years, the IEA has repeatedly upwardly adjusted its short-term oil demand estimates while maintaining a more pessimistic long-term view.

The leaked draft, dated from September 2025, suggests a more balanced perspective, challenging the narrative of an accelerated energy transition and highlighting the risks of underinvestment in fossil fuels.

Goldman’s Response: Higher Oil Demand Expectations

In direct response to the IEA’s updated stance, Goldman Sachs has revised its own oil demand forecast upward. The investment bank now projects global oil demand to reach 113 million barrels per day (bpd) by 2040, up from previous estimates, citing the slower pace of net-zero advancements and sustained economic expansion worldwide.

This marks a notable alignment with the IEA’s revised outlook, as Goldman incorporates the agency’s data into its models for long-term commodity trends. On the price front, Goldman’s earlier 2025 oil forecasts had Brent crude averaging around $55 per barrel, with potential dips below $40 in 2026 under bearish scenarios.

More recent projections, influenced by factors like abundant U.S. production and market dynamics, see Brent hovering near $67 per barrel in 2025 before declining to below $60 in late 2025 and around $50 in 2026.

While the direct link to the IEA U-Turn is more pronounced in demand forecasts, these price adjustments reflect a broader recalibration amid evolving supply and demand signals. Interestingly, despite lower prices, major oil companies continue to post strong profits, defying expectations of production cuts.

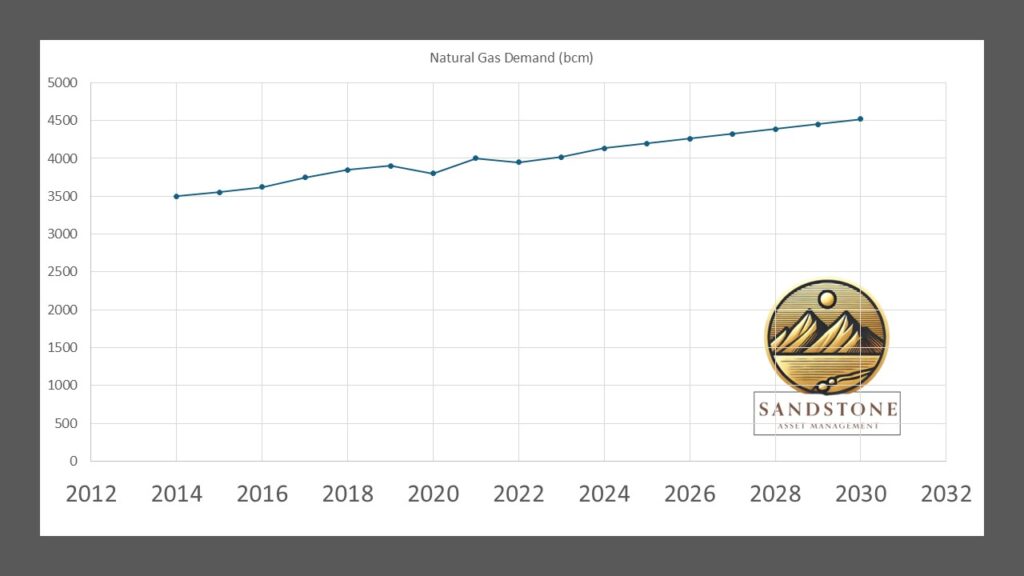

Natural Gas Mentions in Goldman’s Updates

Goldman Sachs has indeed addressed natural gas in its recent forecast updates, though these appear separate from the IEA-driven oil revisions. The bank has maintained or slightly adjusted its Henry Hub natural gas price forecasts downward for 2025, reflecting increased U.S. output and a looser near-term market balance. Specifically, Goldman now expects November-December 2025 prices at $4.00 per million British thermal units (MMBtu), down from an earlier $4.50, with September-October at $3.35/MMBtu.

For 2026, the outlook remains more bullish at $4.60/MMBtu, anticipating medium-term tightness due to growing demand.

These natural gas revisions account for factors like rising U.S. production—forecasted to hit 118 billion cubic feet per day by 2026—and shifting drilling plans amid molecule demand changes.

However, in the context of the IEA U-Turn, Goldman’s oil-focused updates do not explicitly tie natural gas revisions to the agency’s shift, though the IEA’s broader walk-back on peak demand includes gas alongside oil.

Overall commodity prices, including natural gas, are expected to face headwinds, with the S&P Goldman Sachs Commodity Index projected to decline by 1.7% in 2025 and 0.9% in 2026.

Implications for the Energy Sector

This IEA U-Turn and subsequent analyst revisions underscore the uncertainty in energy transitions. For investors and policymakers, it signals the need for balanced strategies that avoid over-reliance on aggressive decarbonization timelines. While oil demand looks set for prolonged growth, price volatility remains a risk, influenced by geopolitical tensions, OPEC decisions, and non-OPEC supply surges.

As markets digest these changes, the focus shifts to whether other forecasters will follow suit. For now, Goldman’s updates provide a data-driven perspective, emphasizing resilience in fossil fuels amid a complex global energy landscape. Stay tuned to Energy News Beat for more insights on how these developments unfold.

Got Questions on investing in oil and gas?

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack