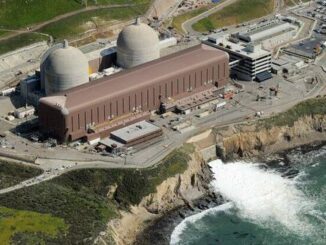

In a surprising turn of events, California officials are scrambling to secure a buyer for Valero Energy’s Benicia refinery, slated for closure in April 2026, according to three anonymous sources familiar with the matter.

This intervention by the state government marks a rare departure from its aggressive push toward green energy policies, highlighting growing anxieties over fuel shortages and skyrocketing gasoline prices in the nation’s most populous state. With nearly 28 million drivers already burdened by some of the highest fuel costs in the U.S., the potential shutdown of this 145,000-barrel-per-day facility near San Francisco could exacerbate supply issues, forcing greater reliance on expensive imports. Valero, the second-largest U.S. refiner by capacity, announced earlier this year its intention to cease operations at the Benicia plant, citing declining fuel supplies and persistently high gasoline prices in California.

The company is also reviewing the future of its 91,300-bpd Wilmington refinery, located near Los Angeles, which adds to the uncertainty. The California Energy Commission (CEC) has confirmed it is “engaging with market players to explore pathways for the continued operation of in-state refineries,” though it stopped short of admitting direct involvement in buyer negotiations.

This move comes amid a wave of refinery closures, including Phillips 66’s decision in October 2024 to shutter its 139,000-bpd Los Angeles-area refinery, with operations winding down by October 2025.

Together, these facilities represent approximately 17% of California’s gasoline production, and their loss—coupled with conversions like Phillips 66’s Rodeo plant to renewable fuels—threatens to further drive up costs.A History of Refinery Closures in California: Decades of DeclineCalifornia’s refinery landscape has been shrinking for decades, a trend accelerated by stringent environmental regulations, high operational costs, and shifting market dynamics. From nearly 50 refineries in the 1980s, the state now operates just 14, with more closures on the horizon.

Historical data from the California Energy Commission shows a pattern of shutdowns: for instance, the Kern Oil Refinery closed in March 1992 but continued as a terminal until 1997, while others like the Marathon refinery in Martinez were idled in August 2020 amid COVID-19 demand drops and never reopened.

Recent years have seen an exodus. In 2024-2025 alone, announcements from Valero and Phillips 66 signal a loss of 17% of the state’s refining capacity over the next year.

Valero’s Benicia closure, set for April 2026, follows a 25-year run and has raised alarms about job losses and local economic impacts in the city.

Critics attribute this to regulatory burdens, including California’s unique fuel standards and environmental policies that make operations unprofitable.

For example, a 2015 explosion at the Torrance refinery led to stricter safety rules, which some argue have been overly burdensome, prompting proposals to weaken them in 2025.

The state has lost seven refineries nationwide between 2019 and 2022, including out-of-state ones like Philadelphia Energy Solutions, but California’s share is disproportionate due to its policies.

As refineries close, California increasingly depends on imports, which now account for 70% of its oil needs—up from 5% three decades ago—posing risks to supply stability and prices.

Governor Gavin Newsom’s Energy Regulation Practices: A Push for Green at What Cost?

Governor Gavin Newsom has positioned California as a leader in clean energy, but his regulatory practices have drawn criticism for contributing to the state’s energy woes. Since taking office, Newsom has issued executive orders and signed legislation accelerating the transition away from fossil fuels. In June 2025, he signed an executive order doubling down on clean cars and trucks, noting a 1,900% increase in battery storage to over 15,000 megawatts since his administration began.

This builds on mandates like 100% electric vehicle sales by 2035 and 51% by 2030, though current adoption sits at just 20%.

Newsom’s approach includes reforms to the California Environmental Quality Act (CEQA) to fast-track clean energy projects, as seen in bills like AB 130 and SB 131 signed in June 2025, which exempt critical infrastructure from some reviews.

However, his oil policies are more restrictive: in September 2024, he signed laws enhancing oversight of oil and gas wells and community protections.

Drilling permits have plummeted from 3,000 annually to mere dozens in 2024, mostly for maintenance, not new production.

In a recent shift, Newsom proposed easing permits via a “plug-to-drill” system until 2036, requiring two wells to be plugged before drilling a new one, amid refinery closures.

Critics argue these policies have stifled domestic production, dropping from 1 million barrels per day 40 years ago to under 200,000 today.

Newsom’s 2024 executive order on rising electric bills directed the CPUC to review underperforming programs, while his 2025 budget cut $423 million from grid reliability initiatives.

He paused a plan to cap oil profits in June 2025, recommending more fuel imports and incentives to retain refiners.

Yet, companies like Chevron have relocated headquarters to Houston, citing regulatory hurdles.

California’s Energy Crisis: National Security Risks and the Future of Oil

The refinery intervention underscores broader issues in California’s energy landscape, which some experts view as a self-inflicted crisis with national implications. Once energy-independent alongside Alaska, California now imports 65% of its oil, including from sources such as Russia, Ecuador, Iraq, and Iran, which raises national security concerns.

This dependency affects 34 military bases that rely on diesel and jet fuel, and with 40% of U.S. imports flowing through the state, disruptions could significantly spike national inflation.

The Benicia closure alone threatens 10% of refining capacity, potentially disrupting jet fuel for San Francisco International Airport.

Newsom’s commissioned study recommends stabilizing supplies via imports, but skeptics see it as election-year politics ahead of 2028.

Environmental NGOs, such as Greenpeace, have influenced policies through lawsuits; however, critics argue that regulations often overlook emissions from imports and tankers.

Looking ahead, California’s oil future appears dim without policy reversal. Reserves remain untapped due to permitting barriers, and refinery exits signal a need for federal intervention to restore energy dominance.

As one operator noted, it’s been eight years without a new permit, turning the state from a potential “Texas” in energy production into a cautionary tale.

This rare state intervention may buy time, but without addressing root causes—decades of restrictive regulations—the Golden State’s energy challenges will only deepen, impacting consumers, the economy, and national security. This is also a huge rarity, but a notable admission that the Newsom team acknowledges they have gone too far in their efforts to eliminate oil and gas. They did so by forcing oil and gas companies out of the state. This may be a “too little, too late” ending. I am also hugely concerned about the impact on National Security.

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack