In a significant shift amid escalating geopolitical tensions, Indian state refiners have temporarily halted purchases of Russian crude oil this week. This decision comes in response to U.S. President Donald Trump’s threats of imposing 25% tariffs on Indian goods and additional penalties for India’s reliance on Russian oil and military equipment, set to take effect on August 1.

The move underscores the vulnerabilities in global energy supply chains as India, the world’s third-largest oil importer, navigates pressures from U.S. sanctions and fluctuating oil discounts.

Are you from California or New York and need a tax break?

Background on India’s Russian Oil Dependence

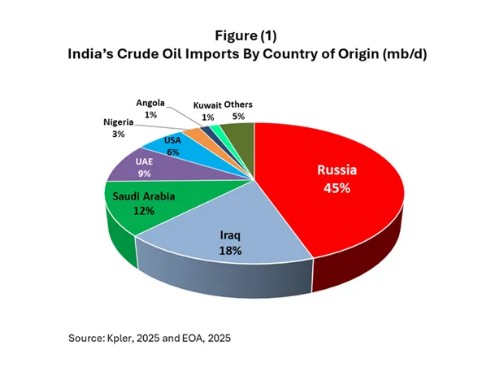

Since Western sanctions were imposed on Russia following its 2022 invasion of Ukraine, India has dramatically increased its imports of discounted Russian crude. What was once a mere 2% of India’s seaborne crude imports has ballooned to approximately 35-40% today, making Russia India’s top supplier.

This surge has saved India billions in import costs, with Russian oil often priced $10-20 per barrel below global benchmarks.

State-controlled refiners, which handle over 60% of India’s refining capacity—including giants like Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL), Hindustan Petroleum Corporation Limited (HPCL), and Mangalore Refinery and Petrochemicals Limited (MRPL)—have been key players in these imports.

However, the narrowing discounts on Russian oil, combined with Trump’s recent announcements, have prompted a pause. In a post on Truth Social, Trump stated: “Indian goods in the U.S. would be taxed with a 25% tariff, and India would also pay a ‘penalty’ for buying the vast majority of its military equipment and oil from Russia, effective August 1.”

This rhetoric echoes broader threats of secondary sanctions, including potential 100% tariffs on countries continuing to buy Russian energy if no Ukraine peace deal is reached within 50 days.

The Current Pause and Immediate Impacts

Industry sources confirm that Indian state refiners have not sought to purchase Russian crude in the past week, opting instead for spot market barrels from the Middle East and West Africa.

Private refiners like Reliance Industries and Nayara Energy, which are larger importers of Russian oil, may face similar pressures, potentially leading to a broader clampdown on Russian imports.

Indian refiners have urgently requested guidance from the oil ministry on handling Russian crude shipments arriving after August 1, highlighting the uncertainty gripping the sector.

While the pause is temporary, it could reduce Russian crude flows to India in the short term, disrupting a supply chain that currently accounts for about a third of the country’s oil needs.

Can India Replace Russian Oil?

Amid these developments, questions arise about India’s ability to pivot away from Russian supplies if secondary sanctions intensify. Petroleum and Natural Gas Minister Hardeep Singh Puri has expressed confidence, noting that India has expanded its supplier base from 27 to 40 countries and could “quickly return to the previous scheme (2%)” reliance on Russia.

He emphasized “no pressure” and ample global options to ensure uninterrupted flows.

Potential alternatives include ramping up imports from Saudi Arabia, Iraq, the UAE, the United States, Guyana, and Brazil. Indian Oil Corporation has already begun rebalancing its purchases in anticipation of tighter enforcement.

However, experts caution that this transition won’t be seamless. Replacing discounted Russian crude with pricier options could inflate India’s import bill by $5-10 billion annually, drive up domestic fuel prices, and exacerbate inflation.

A Bloomberg analysis suggests that strict sanctions could disrupt 1.5-2 million barrels per day of Russian supply globally, pushing Brent crude prices to $90-100 per barrel by mid-2025.

For India, this might erode refining margins and strain infrastructure, as some refineries are optimized for Russian grades. Additionally, sanctions on Russian crude could ripple into refined products, affecting India’s diesel and gasoline exports to Europe, where it supplies up to 40% of diesel needs.

Broader Implications for Global Energy Markets

If implemented, Trump’s sanctions could reshape international trade flows, with Russia potentially redirecting supplies via shadow fleets, though enforcement remains challenging.

Russia stands to lose $10-20 billion in revenue, weakening its war funding, while India faces higher energy costs that could impact food and goods transportation.

Environmentally, longer shipping routes for alternative crudes might increase carbon emissions, though it could accelerate India’s push toward renewables in the long term.

This pause in Russian oil purchases signals a multipolar energy landscape where economic self-interest clashes with geopolitical pressures. We can be hopeful that the pause by the Indian refineries would work as a catalyst, but the biggest motivator to get President Putin to the table will be business deals. He does not want war, and we as Americans do not want to go to war with him.

As India seeks clarity and diversifies, the coming weeks will test the resilience of its energy strategy and the effectiveness of U.S. sanction threats. Stay tuned to Energy News Beat for updates on this evolving story.

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack