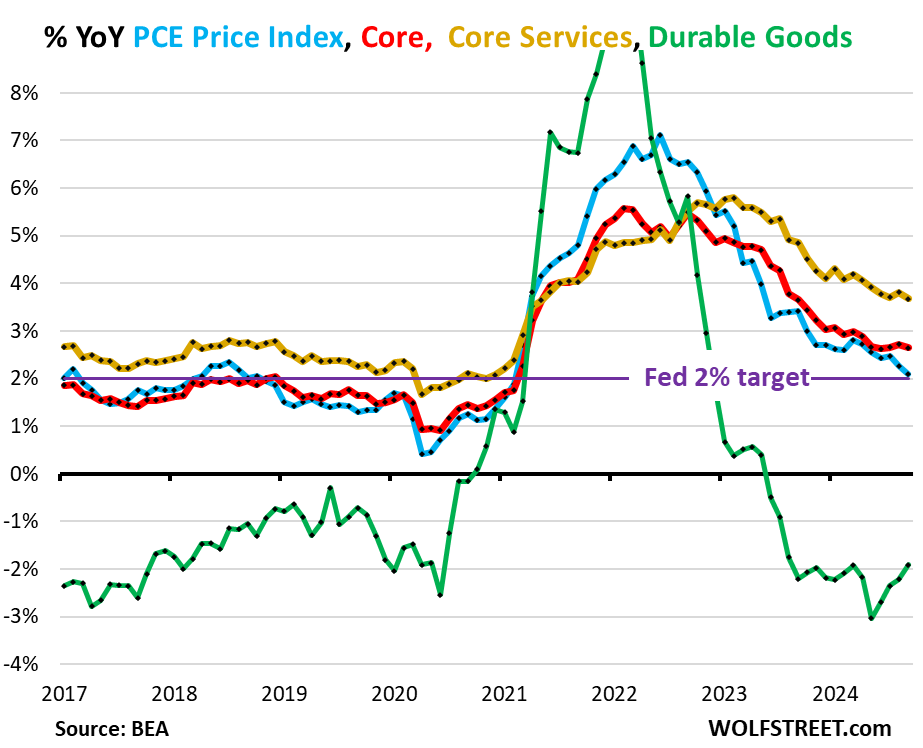

The YoY “core” PCE price index, the Fed’s yardstick for its 2% target, rose 2.65%, with no progress over the past 5 months. But energy prices plunged.

By Wolf Richter for WOLF STREET.

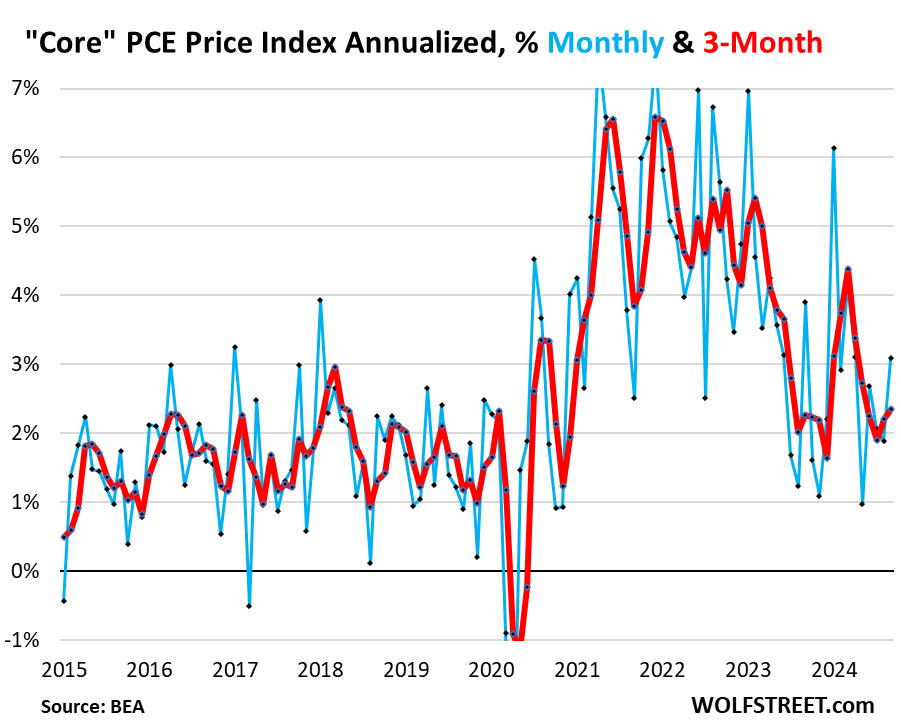

The “core” PCE price index, the Fed’s primary yardstick for its 2% inflation target, rose by 3.1% annualized in September from August (not annualized, +0.254%), the biggest month-to-month increase since April. And August was revised higher (blue in the chart below). This month-to-month acceleration was driven by:

- Core services accelerated to 3.7% annualized (+0.30% not annualized), the biggest increase since April.

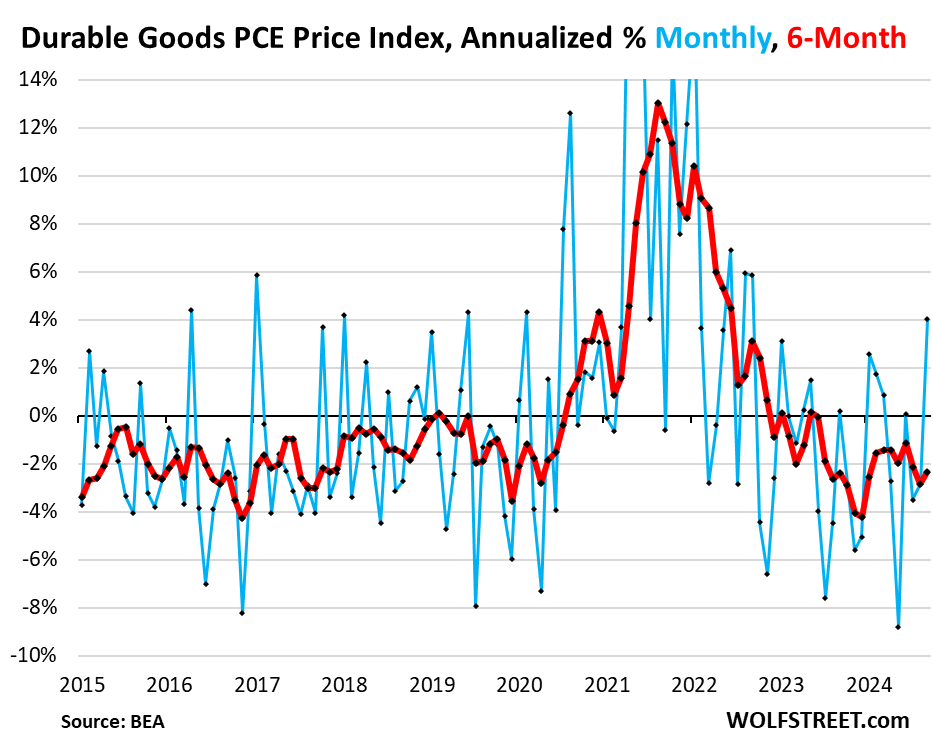

- Durable goods flipped from a series of month-to-month declines (negative readings, deflation) to a positive +4.0% annualized, the biggest month-to-month jump in prices since September 2022.

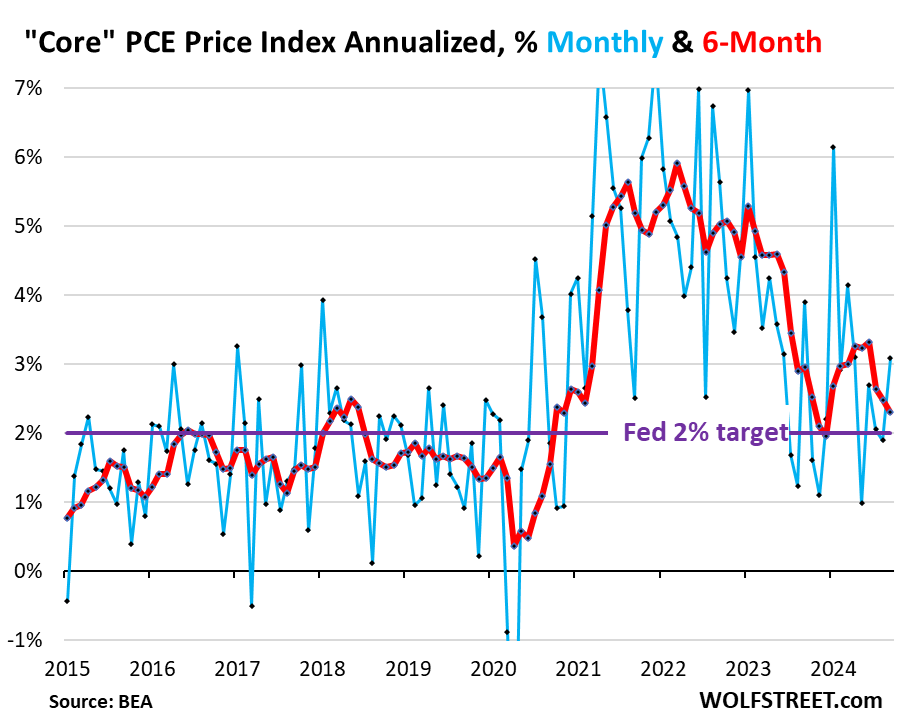

We’re going to look at it on a month-to-month basis (blue), and on a 3-month, 6-month, and 12-month basis (all of them in red) because the developments in recent months get washed out in the 6-month and 12-month indices.

The 3-month core PCE price index accelerated to 2.35% annualized, the second acceleration in a row, and above where it had been in August 2023, with a big spike in the middle (red).

This “core” index attempts to show underlying inflation by excluding the components of food and energy as they can jump and drop with commodity prices. We’ll get to the overall index, which includes food and energy, in a moment.

The 6-month core PCE price index decelerated to 2.3% annualized (red). It remains higher than it had been at the end of last year:

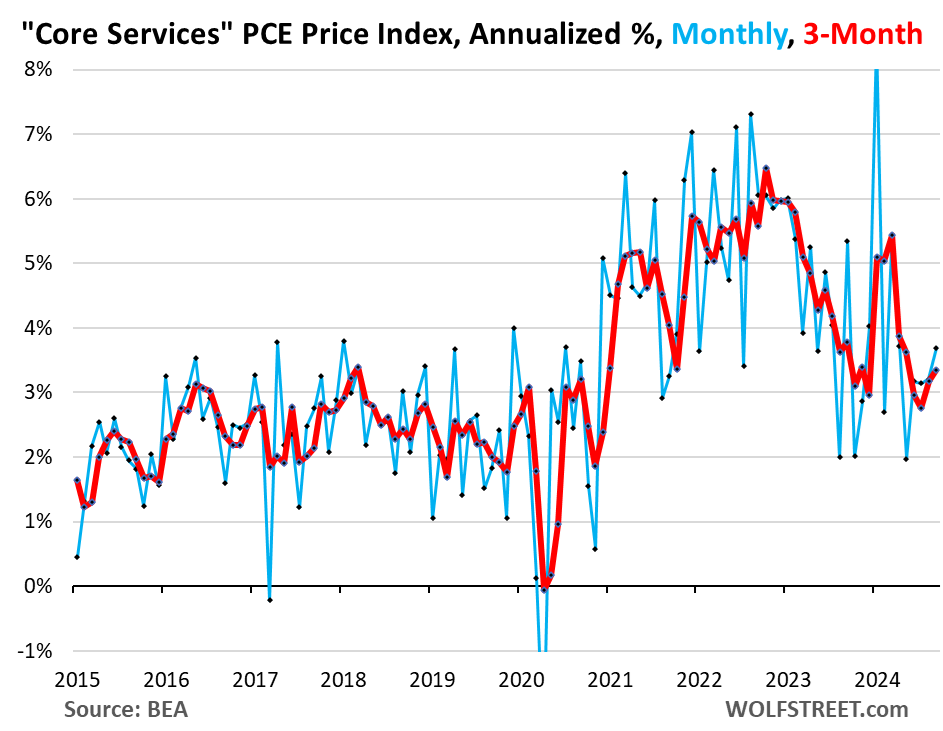

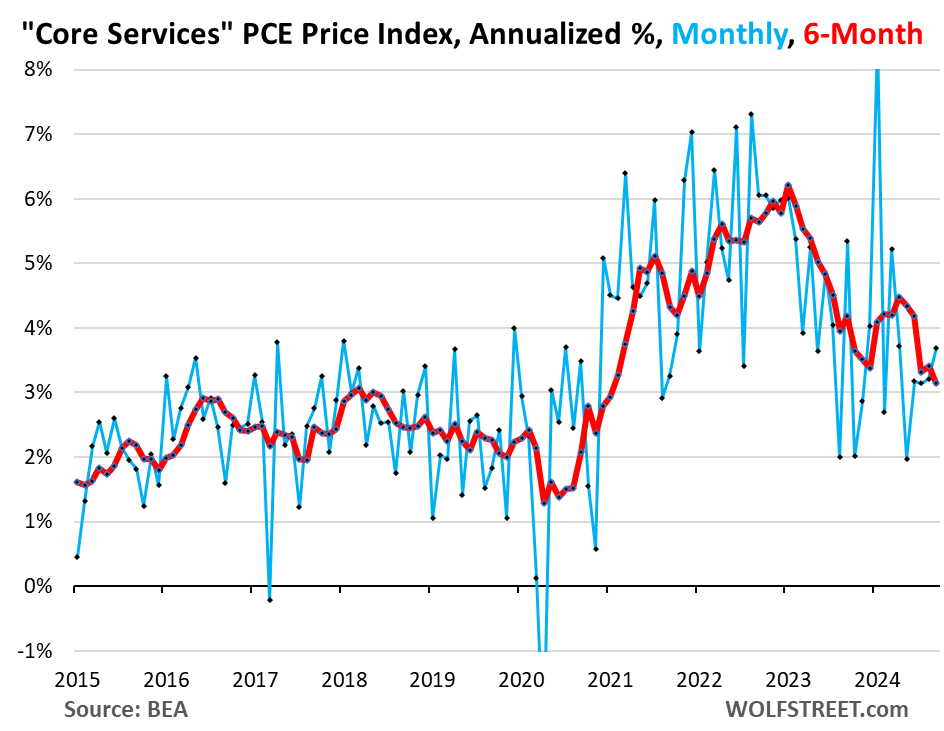

The “core Services” PCE price index accelerated to 3.7% annualized in September from August (+0.30% not annualized), the fastest rise since April. And the prior two months were revised higher (blue in the chart below).

Core services include housing, healthcare, financial services & insurance, transportation services, non-energy utilities, communication services, recreation services, food services & accommodation, and “other” services.

The 3-month “core services” PCE price index rose by 3.35%, the second acceleration in a row, and the fastest increase since May, and higher than it had been in October last year:

The 6-month core services PCE price index rose by 3.15% annualized (+0.26% not annualized), the first acceleration since April.

The durable goods PCE price index jumped by 4.0% annualized (+0.33% not annualized) in September from August, the biggest increase since September 2022, after a series of negative readings (deflation) in a row.

Durable goods include motor vehicles, recreational goods and vehicles, appliances, electronics, furniture, and other durable goods.

This sudden increase was driven by price increases in motor vehicles – we have seen this turnaround in motor vehicle prices from sharp drops to significant increases in other data – household furnishings and appliances, and “other” durable goods.

The 6-month index and the 12-month index became less negative, the 6-month index at -2.4% and the 12-month index at -1.9%.

The index tends to run in a slightly negative range during normal times amid manufacturing efficiencies, technological improvements, and globalization. It’s the services that have been the driving force of inflation for many years. During the pandemic, durable goods prices spiked due to the sudden demand fueled by the stimulus funds that made consumers suddenly willing to pay whatever; and that phenomenon met tangled-up supply chains, all of which gave companies enormous pricing power, and they used it:

12-month core PCE price index: No progress for 5 months.

The “Core” PCE price index, rose by 2.65% from a year ago in September, compared to 2.72% in August, 2.66% in July, 2.63% in June, and 2.67% in May, so rising roughly at the same pace for five months in a row, and well above the Fed’s target (red in the chart below). So no progress over the past five months at all.

The “core services” PCE price index rose by 3.7% year-over-year, a deceleration from 3.8% in August, and roughly the same as in July (yellow).

The durable goods PCE price index declined by 1.9% year-over-year, but that was a smaller decline than in the prior months, and the smallest decline since March (green).

The overall PCE price index, which includes the food and energy components, rose by 2.1% year-over-year in September, a deceleration that was driven by the plunge in energy prices (-15.2% year-over-year) and slower rising food prices (+1.2% year-over-year).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Be the first to comment