Reading the mainstream media’s reaction to today’s payrolls report, one would be left with the impression that it was generally on the goldilocks side and indicative of a possible soft-landing – consider this from Bloomberg: “the US labor market stayed resilient last month while wage gains cooled, raising hopes that the economy may dodge a recession and the Federal Reserve will further slow its aggressive campaign of interest-rate hikes.”

Which is accurate: wage growth indeed slowed down following a major revision to the data (remember that 0.6% M/M jump in average hourly earnings that freaked out the market last month? Well, it was quietly revised to 0.4% today), and as a result – as even Fed mouthpiece Nick Timiraos pointed out earlier – “Revisions to average hourly earnings data paint a marginally less worrisome picture for the Fed on wages than the Nov report. The upturn in wage growth in Nov (originally reported as +0.6%) was revised (to +0.4%). The 4.6% annual wage growth in Dec was the lowest since Aug ’21.”

The drop in wage growth was consistent with the warning from the ADP earlier this week, which found that December ushered in “the largest decline in pay growth for job stayers in the three-year series history” (and even job-changers saw a modest drop in wage growth).

There was more: not only did average hourly earnings drop, but so did average hours worked, which has a major impact on the average wages, and had hours been flat, the decline in average wages would have been even more pronounced.

Ok, so wages are finally starting to reflect reality – and indicating that inflation pressures are clearly easing, which is to be expected for any economy sliding into a recession.

But what about the underlying issues with the jobs data? What about that massive divergence between the employment number (from the Household Survey) and the monthly payrolls change (from the Establishment survey). Recall that it was just last month that we reported that divergence between these two data sets hit a record 2.7 million, a difference which got added focus just a few days later after the Philadelphia Fed reported that its own calculations found that in Q2 the US added just 10,000 jobs, not the 1.1 million reported by the BLS.

The answer is that today, the BLS decided to finally shrink the record difference between the Household and Establishment surveys, and while 223K payrolls were added (a number which was actually down 244K on an seasonally unadjusted basis), the Household survey outdid itself, and its matching Employment number soared by a whopping 717K.

There is a reason for that: we have entered the BLS’s annual revisions season, and to start the year the Bureau revises all of its historical series, starting with the Household Survey, as follows:

Seasonally adjusted household survey data have been revised using updated seasonal adjustment factors, a procedure done at the end of each calendar year. Seasonally, adjusted estimates back to January 2018 were subject to revision. The unemployment rates for January 2022 through November 2022 (as originally published and as revised), appear in table A at the end of this news release, along with additional information about the revisions.

Whatever the specific reason behind the historical adjustment, however, the cumulative record difference between Payrolls and Employment shrank from the all time high 2.7 million hit last month to “only” 2.1 million.

Luckily, unlike the Establishment survey which gives us shotgun job estimates with little to no granularity, the Household survey provides several layers of detail and we can find just how the BLS managed to trim this gaping difference.

The answer, it will come as little surprise to anyone, is that once again the surge in employment was entirely a function of part-time workers and multiple job-holders.

Here are the facts: in December, the number of full-time workers was 132.299 million, down exactly one 1K workers from the month before; at the same time, the number of part-time workers exploded by 679K, from 26.115 million to 26.794 million (source). Finally, adding insult to injury, the number of multiple jobholders, or those workers who need to hold more than 1 job to make ends meet yet who are double-counted for Payroll (establishment survey) purposes, surged by 370K (which means that the 223K payrolls number is really negative if adjusted for how many people actually got new jobs).

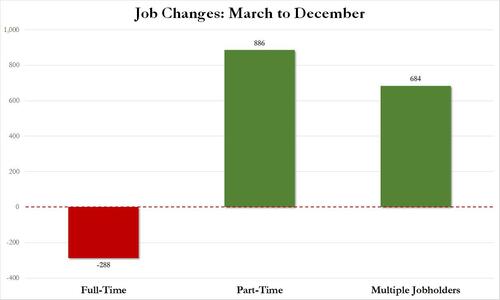

What does this mean on a longer-term basis, i.e., going back to that infamous month of March which we first flagged as the moment when something broke in the jobs data, and extending through Dec 31? Here too we find something striking: the total number of full-time jobs has declined by 288K in the past ten months, which however has been more than offset by the 886K increase in part-time jobs.

And the punchline: multiple jobholders have increased by a massive 684K over this period.

This means that contrary to conventional wisdom, some 684K jobs added in the past 10 months were not the equivalent of 684K workers finding a job, but 684K workers finding more than one job to afford life during this latest episode of soaring inflation.

What does this mean in the grand scheme of things? Well, the Philadelphia Fed’s observations still stand, and while the BLS may claim that payroll prints were accurate (at least until next month’s wholesale Establishment survey revision), digging deeper reveals once again that the quality composition of these jobs was far more dubious. In fact, we know that in December, the entire employment increase was thanks to part-time workers, and we don’t have to tell readers that part-time jobs pay far less, have zero benefits and generally are far worse quality than full-time. It also means that the bulk of job growth since March has been in the multiple jobholder category, and that instead of 684K jobs having been given, what really happened is that 684K workers found more than one job to be able to afford living under the Biden administration.

Loading…