Sales of new houses in 2024 were decent, while massive demand destruction crushed sales of existing houses because prices are way too high.

By Wolf Richter for WOLF STREET.

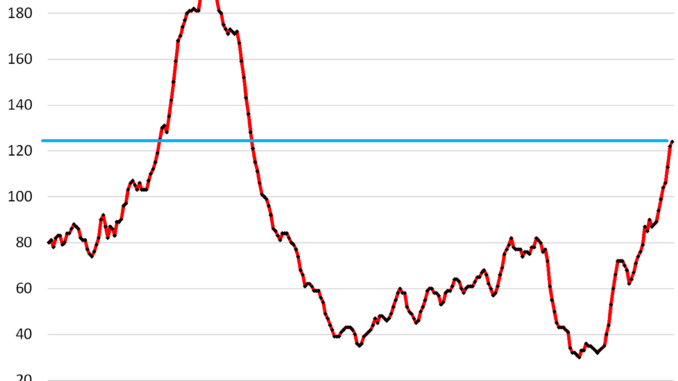

Bring on the supply of new houses: Unsold inventory for sale of completed new single-family houses has spiked by about 50% from the peaks of 2018 and 2019, and by nearly 50% year-over-year to 124,000 houses in December, the highest since June 2009, according to Census Bureau data today.

Homebuilders need to sell this inventory of “spec houses” quickly because they’ve sunk a lot of capital into it, and because they’re continuing to build at a faster clip than they’re selling them because they want to run growth-businesses and please Wall Street, thereby adding to the pile on a monthly basis.

But they’re also selling them at a robust pace by motivating buyers with lower prices and huge incentives, including very costly mortgage-rate buydowns, that eat into their still fat profit margins. They obviously haven’t done nearly enough to trim their inventories that continue to balloon, and they’ll have to bring prices and payments down further to stimulate more demand.

The current surge of completed, move-in ready inventory of spec houses for sale is good news for the overall housing market, whose biggest problem is that existing homes are now way overpriced, after the 50% price explosion between 2020 and 2022, on top of being already overpriced before.

This surge of completed inventory for sale should help brush aside the zombie-like undying real-estate hype about the “housing shortage,” that has been spread for eons by the real estate industry and its trolls in an effort to keep driving up prices.

And that lack of “affordable” existing homes, after the ridiculous run-up in prices, can be fixed by the collapsed demand for existing homes, whose sales in 2024 plunged to the lowest levels since 1995. There is a buyers’ strike in effect because prices are way too high. And lower prices will bring out the buyers.

Unsold inventories for sale at all stages of construction – from not yet started to completed – rose by 10% from the already bloated levels a year ago, to 496,000 houses, the highest since December 2007. Supply jumped to 9.4 months.

Stimulate demand with lower prices, bigger incentives, smaller houses.

Big publicly traded homebuilders have to build and sell homes regardless of the market because they have to keep their businesses intact and growing, and they have to please Wall Street to keep their shares from tanking.

So they’re building smaller, less costly homes, and they’re cutting prices, and they’re making deals, they’re buying down mortgage rates, and they’re throwing in other incentives at a substantial expense to them to maintain sales volume by taking share away from the resale market.

The costs of the mortgage-rate buydowns and some other incentives are included in the gross profit margins of the home builders, and are therefore reflected on homebuilders’ financial statements.

D.R. Horton, the largest homebuilder in the US, in its Q4 quarterly filing with the SEC on January 23, lined out its strategy in dealing with this market: higher incentives (including the costs of mortgage rate buydowns), lower prices, and smaller houses. As a result, its operating margin and net income dropped, but sales remained solid, down just a hair from a year ago, in this market where demand for existing homes has withered.

Its strategy of reduced prices, bigger incentives, and smaller houses:

“We remain focused on managing the pricing, incentives and sales pace in each of our communities to optimize the returns on our inventory investments and adjust to local market conditions and new home demand. To adjust to changes in market conditions during recent years, we have used a higher level of incentives and reduced home prices and sizes of our home offerings where necessary to provide better affordability to homebuyers. We expect our incentive levels to remain elevated, assuming similar market conditions and no significant changes in mortgage interest rates.”

So operating margins dropped:

“Our pre-tax operating margin was 14.6% compared to 16.1% [a year ago].

Net income dropped:

“Net income was $851.9 million in the three months ended December 31, 2024 compared to $955.7 million in the prior year period.”

And incentives were “elevated” and are expected to stay that way:

“We expect our incentive levels to remain elevated, assuming similar market conditions and no significant changes in mortgage interest rates.”

Total incentives that builders are offering on unsold houses for sale has reached 10% of the selling price in Florida and Texas, and 7% for the US overall, according to the most recent Burns Homebuilder Survey, of which Rick Palacios Jr., Director of Research at John Burns Research & Consulting, posted this chart on X:

But incentives are not reflected in the “Contract Price” of the house.

The costs of the mortgage-rate buydowns and incentives, such as free upgrades, are not reflected in the prices written into the sales contracts when customers buy these homes, though they’re included in the profit margins of the homebuilders, and discussed in their financial disclosures, as in the Q4 filing by D.R. Horton above.

The Census Bureau tracks these contract prices, and while they have fallen quite a bit from the peak in late 2022, they do not include these incentives that effectively reduce the price of these homes, and with these incentives included, the median contract price would have fallen quite a bit further.

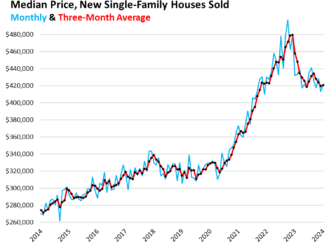

The median contract price of new single-family houses sold at all stages of construction – a super-volatile figure that jumps randomly up and down and is often revised sharply – jumped to $427,000 in December, after the plunge in November, and is down by over 7% from its peak in October 2022 (blue in the chart below).

The six-month average, which irons out most of the month-to-month zigzags and includes the revisions, ticked up to $418,450, down by nearly 5% from its peak in October 2022.

The six-month average shows the multi-year trend. But again, these contract prices do not include the substantial costs to homebuilders of mortgage rate buydowns and other incentives, though they do include price cuts.

Sales have been solid thanks to reduced prices & higher incentives.

Sales of completed houses – propped up by incentives, mortgage rate buydowns, and lower prices – rose by 12% year-over-year in December, to 28,000 houses, up by 22% from December 2022, and up by 40% from December 2019.

Sales of new houses at all stages of construction, from not started to completed, rose by 6.1% year-over-year in December, to 52,000 houses, up by 12% from December 2019.

For the whole year 2024, sales of new houses have been decent, rising by 2.6% year-over-year to 683,000 houses, the same as in 2019, unlike sales of existing single-family houses:

By contrast, sales of existing single-family houses in 2024 and 2023 plunged to 2008 levels, the worst since 1995 because prices were way too high, which triggered this enormous demand destruction.

Prices of new houses versus existing houses.

Over the past four decades, the median contract price (six-month average) of new houses exceeded the median price of existing houses (six-month average) all of the time, with new houses being usually 5-30% more expensive than existing houses. This scenario changed when the median price of new houses began to decline.

And for new houses, these contract prices do not include the incentives and costs of mortgage rate buydowns. With them included, effective prices are substantially lower than those of equivalent existing houses, which explains why homebuilders’ sales have been solid, while sales of existing homes have plunged, as some buyers shifted from buying existing homes to new homes.

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack