Homebuilders do what it takes to sell homes in this market while sales of existing homes have collapsed.

By Wolf Richter for WOLF STREET.

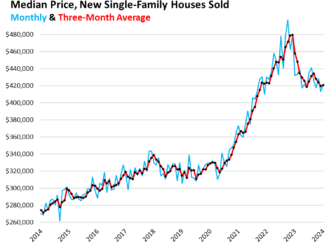

The median price of new single-family houses sold in December dropped to $413,200, down by about 17% from the peak in October 2022, and the lowest since December 2021, according to the Commerce Department today (blue).

The three-month moving average, which irons out the monthly ups and downs, fell to $417,900, the lowest since October 2021, and down 12.8% from the peak in December 2022 (red).

The largest homebuilders have been singing the same song in their earnings calls: This is a tough market where sales of existing homes have collapsed by one-third to just 4 million in 2023, the lowest in the data going back to 1995, from the normal level of around 6 million per year, but we, the homebuilders, know how to deal with this market. We’re building smaller houses with less costly amenities that we sell at lower prices, and we’re buying down mortgage rates at a considerable cost to us, and we’re hedging those buydowns, and when those hedges blow up, that costs us too, and we’re throwing other incentives at buyers, so that we can get the payment down. And now people can buy a new house for a lower mortgage payment than a resale home. And we’re competing with homeowners and taking sales away from them.

D.R. Horton, which reported earnings a couple of days ago, said these trends will continue, that it will continue to build and price homes in a way to take share away from homeowners thinking of selling their own homes, and even though it took a hit to its gross margin, it will continue with the pricing and the mortgage rate buydowns, and it also disclosed some details of its rate-buydown hedges, which malfunctioned in the quarter and led to a $65 million charge, which we discussed here. And all this caused its shares to plunge. But its sales and orders were pretty decent – unlike existing home sales.

For the industry overall, sales of new houses (contract signings) in December rose to 50,000 houses, up 6.4% year-over-year and up by 2% from December 2019. Winter is the slow time of the year, but this was pretty decent.

This was the kind of stuff D.R. Horton said in its earnings call. Their strategies of trying to produce a lower mortgage payment and a lower price to take buyers away from the resale market is working.

For all of 2023, sales rose by 4.2% from 2022, but were down substantially from the boom years 2020 and 2021. They were just a tad lower than in 2019, but up by 8% from 2018. So homebuilders are muddling through this tough market by dealing with reality: getting prices and payments down – while existing home sales have collapsed.

The price difference between new and resale homes.

The median price of resale single-family houses has also declined, but only a little. The record price of existing single-family houses was in June 2022 of $420,900. The year 2023 was the first year since the Housing Bust when the seasonal high in June was lower than a year ago. But the price drops have been small.

Since April, the price difference between new and resale houses was 10% or less, going as low as just 1%. In 2019, the spreads were roughly between 10% and 20%, and in the prior years back to 2012, the difference was roughly between 25% and 45%. You have to go back to the housing bust to see spreads of 10% or less.

In the chart below, the median price of new houses is shown as a 3-month moving average to iron out the month-to-month ups and downs.

And this does not include the costs of the mortgage-rate buydowns. Those buydowns are bridging the reduced gap in prices, and are bringing payments of new houses in the range or below where payments for the median resale home would be. This is the competition that homeowners who want to sell will have to deal with; they’re up against the pros who know how to sell in this market: by making deals.