So let’s extend and pretend, please? But industrial still in pristine condition, multifamily limping along.

By Wolf Richter for WOLF STREET.

The delinquency rates of commercial real estate mortgages that have been securitized into commercial mortgage-backed securities (CMBS) – investors on the hook here, not banks – keep getting worse, driven by the not yet fully blooming mayhem in the office sector, and also by the ongoing troubles in mall loans and lodging loans.

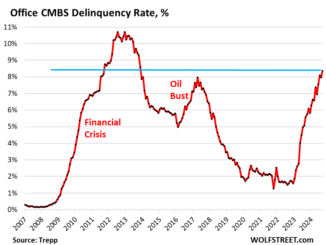

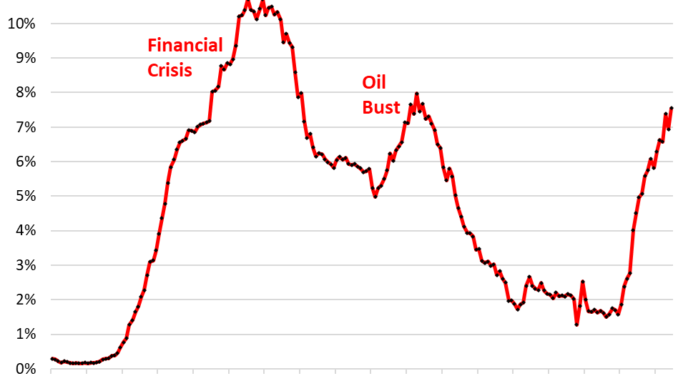

Office CMBS. Delinquency rates of office mortgages backing CMBS spiked to 7.6% in June, according to data by Trepp, which tracks and analyzes CMBS. This was the highest rate since the worst moments of the oil bust that had devastated the Houston office market in 2016. Mortgages are considered delinquent after the 30-day grace period has expired without interest payment.

About $1.87 billion in office loans became newly delinquent in June, but $900 million in formerly delinquent mortgages were no longer delinquent – see our extend-and-pretend section below – producing a net increase in delinquent loans of about $1 billion:

The culprits are three-fold: the structural collapse of demand in the office market, floating-rate mortgages, and loan maturities amid higher interest rates.

According to a prior report by Trepp, the delinquency rate for floating-rate office loans was 20%, while for fixed-rate loans it was 4.7%. In terms of loan maturities, when a 3.5% loan must be refinanced with a 7% loan, the rents, especially in a building with a high vacancy rate, may fall far short of covering the interest and other expenses, and the building no longer makes economic sense.

So, yes, let’s extend and pretend, please.

Loans are pulled off the delinquency list if the interest gets paid, or if the loan is resolved through a foreclosure sale with big losses for the CMBS holders, or if a deal gets worked out between landlord and the special servicer that represents the CMBS holders, such as the mortgage being restructured or modified and extended.

This extend-and-pretend is now all the rage because CMBS holders do not want to end up with a half-empty decades-old office tower, which is the gun the landlord holds to the lender’s head.

And many landlords have already pulled the trigger over the past two years by walking away from the loan and the property, losing whatever equity they had in the building, and letting the lender take the remaining loss.

Even the biggest landlords, such as PE firm Blackstone, have been doing just that, even with huge office towers in the middle of Manhattan, and in Blackstone’s case, even the top-rated tranches of the CMBS had to take losses, while the lower-rated tranches got wiped out. That’s the gun the landlord holds to the lender’s head.

And the lender is threatening the landlord with foreclosure and loss of the equity in the building, which is the gun they hold to the landlord’s head. But collateral values have plunged, and the landlord has the bigger gun.

So increasingly now, they both blink and make a deal, and the mortgage gets restructured or modified and extended past the maturity date. The landlord gets a loan that is economically a little more feasible, and the CMBS holders are just too happy to stick their heads deep into the sand and wait for the Fed to perform a miracle, or whatever. Everyone is now doing that, banks too.

But office properties have a massive structural problem – a huge glut of vacant office space for which there is no demand, and office property values have collapsed in many markets by 50% to 70%. This structural problem is on top of the interest rate problem. Whatever miracles the Fed is hoped to perform with interest rates, it won’t be able to fill that glut of half-empty office towers.

Retail CMBS.

The delinquency rate for mortgages backed by mall properties rose to 6.4%. Retail CMBS have been afflicted with high delinquency rates ever since the Great Recession. Since 2017, we’ve called this phenomenon the Brick-and-Mortar Meltdown. Countless retail chains, from Sears on down, filed for bankruptcy, and many were liquidated. Even the biggest mall landlord, Simon Property Group [SPG] walked away from malls across the US, and that started before the pandemic, such as Independence Center near Kansas City, Missouri, which in 2019 generated the largest loss ever by a retail CMBS loan. Since 2020, there has been a flood of bankruptcies. The more recent retailer bankruptcies include Express in April 2024 and Joann in March 2024. In December 2023, mall REIT PREIT filed for bankruptcy for the 2nd time. In April 2023, Bed, Bath & Beyond went bye-bye. Retailer bankruptcies and liquidations put enormous stress on retail properties.

This is the structural problem of brick-and-mortar malls, brought about by the relentless shift in shopping patterns to ecommerce. No one is going to stop that, not even the Fed. Exempt have been strip malls with big grocery stores as anchors, and service establishments and restaurants among the other tenants.

In June, retail CMBS delinquencies increased on net by $525 million, including four mall loans with balances of over $100 million each, according to Trepp.

Lodging CMBS.

The delinquency rate for mortgages backed by hotel and resort properties rose to 6.3% in June:

On the other hand…

Multifamily CMBS. The delinquencies for mortgages backed by multifamily buildings also rose in June, but at 2.4%, they’re limping along at manageable levels for now. There have been some big mortgages that defaulted over the past two years, but it’s also the biggest CRE sector, with a total of $2.1 trillion in loans spread across all lenders, globally, and only a small portion has been securitized by the private sector.

The US government is on the hook for $1.1 trillion, or 55%, of mortgages backed by multifamily buildings. The remainder is spread across private-sector lenders.

Private-sector CMBS, CDOs (collateralized debt obligations), and ABS (asset backed securities) combined hold only 3.2%, or just $67 billion, of the multifamily mortgages. CMBS alone represent an even smaller portion. Which is why each major delinquency moves the needle up a lot, and each major resolution moves it down a lot.

For example, the plunge of the delinquency rate in January 2016 was caused when one $3-billion delinquent loan was resolved when Blackstone and Ivanhoe Cambridge bought the Stuyvesant Town–Peter Cooper Village residential development in Manhattan (11,250 apartments in 110 buildings) and paid off the delinquent loan.

Industrial CMBS. The delinquencies for mortgages backed by industrial buildings – warehouses, fulfillment centers, etc. – ticked up in June to 0.6%, which is still historically low. The sector is driven by the expansion of the physical infrastructure needed to support the ecommerce boom.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/