In the early weeks of 2026, Japan’s bond market has erupted into turmoil, with yields on government bonds (JGBs) surging to multi-decade highs amid fears of unchecked fiscal spending. As the world’s third-largest economy grapples with one of the highest debt burdens globally, this spike is sending shockwaves through international markets.

For US investors, particularly those attuned to energy sector dynamics via channels like Energy News Beat, the ripple effects could influence everything from Treasury yields to global commodity prices. This article explores Japan’s debt crisis, the bond market meltdown, its implications for the US and other foreign markets, and strategies for US investors to navigate the fallout.

Japan’s Towering Debt Burden

Japan’s public debt stands at a staggering level, estimated at around 230-240% of GDP as of early 2026, among the highest in the world.

While gross debt is immense, net debt (after accounting for government assets) is lower, around 130% of GDP, providing some buffer.

Recent forecasts from ratings agencies like Fitch project a slight downward trend, with consolidated general government debt expected to dip to the mid-190s% of GDP by fiscal year 2029, thanks to entrenched inflation and nominal GDP growth offsetting rising deficits.

Fitch affirmed Japan’s sovereign rating at ‘A’ with a stable outlook in January 2026, citing these factors as mitigating risks despite ongoing monetary tightening.

However, this optimism is tempered by structural challenges. Japan’s aging population and persistent fiscal stimulus have ballooned debt since the 1990s. The Bank of Japan (BOJ) has long suppressed yields through massive bond purchases, but policy normalization—including rate hikes to 0.75% in December 2025—has reduced this support.

Inflation, now above target, is eroding the appeal of low-yield bonds, forcing investors to demand higher returns.

The Bond Market Meltdown: Yields in Freefall

The immediate trigger for the crisis unfolded in mid-January 2026. Prime Minister Sanae Takaichi’s announcement of a snap election on February 8, coupled with pledges to cut sales taxes on food to 0% (potentially costing 0.6% of GDP or more), ignited investor fears of worsening fiscal health without clear revenue offsets.

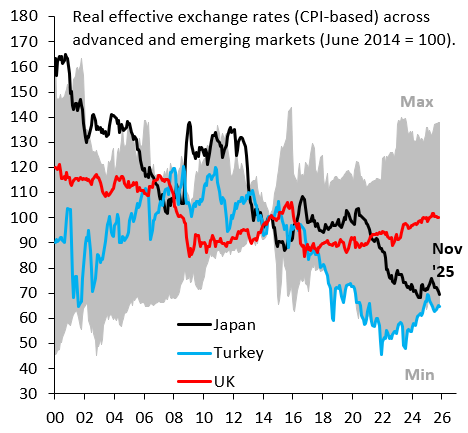

This “Sanaenomics” approach, emphasizing fiscal expansion, defense spending, and middle-class relief, has been met with skepticism, reminiscent of past market rebellions like the 2022 UK gilt crisis.

SCOTT BESSENT: Markets are going down because Japan’s bond market just suffered a six-standard-deviation move in ten-year bonds over the past two days.

This has nothing to do with Greenland; it’s all about the Japanese bond blowout.@SecScottBessent pic.twitter.com/sZqGdsHX3g

— Bannon’s WarRoom (@Bannons_WarRoom) January 20, 2026

Yields have skyrocketed: The 10-year JGB yield hit 2.34% on January 20, 2026, up 0.07 percentage points from the prior session and the highest since 1999.

The 20-year yield jumped to 3.47%, a multi-year peak.

Long-dated bonds fared worse: The 30-year yield breached 3.8%, and the 40-year surpassed 4% for the first time since its 2007 debut, marking the biggest daily jumps in decades.

A poorly received 20-year bond auction on January 20 highlighted waning demand, with foreign investors—who now dominate 65% of monthly JGB transactions—pulling back amid volatility.

The BOJ’s upcoming meeting is under scrutiny, but rates are expected to hold steady, with potential hikes eyed for June.

These spikes reflect a repricing of fiscal risk. Over 40% of Japan’s tax receipts already service debt interest at current low yields; further rises could exacerbate this.

Domestically, higher borrowing costs strain corporations and weaken the yen, impacting exporters.

Ripple Effects on the US Market

Japan’s bond rout is not isolated; its $7.6 trillion market influences global capital flows. As the largest foreign holder of US Treasuries (holding $1.2 trillion as of November 2025), Japanese investors have historically sought higher yields abroad.

Now, with JGB yields rising, capital may “stay home,” reducing demand for US debt and pushing American yields higher.

On January 20, US 30-year Treasury yields climbed 7 basis points to 4.91%, marking the biggest two-day rise since May 2025, partly due to the Japanese spillover.

The 10-year US yield approached 4.30%, levels not seen since September 2025.

This could elevate borrowing costs for US mortgages, corporate loans, and valuations of stocks and real estate.

Analysts warn of headwinds for US equities, with the S&P 500 dropping 1.4% on January 20 amid the turmoil.

In the energy sector, higher US yields might dampen economic growth, softening demand for oil and gas. A weaker yen (down amid fiscal worries) could boost Japanese energy imports, indirectly supporting global prices, but US investors in energy stocks should monitor currency fluctuations affecting multinational firms.

Broader Impacts on Foreign Markets

The contagion is global. European bonds felt the pressure, with German 10-year yields rising 2.8 basis points to 2.870%.

Japan’s 30-year yield now exceeds Germany’s (3.8% vs. 3.5%), signaling a shift in risk perceptions.

In Asia, markets like the Nikkei fell 0.9%, while broader concerns over debt sustainability in high-borrowing nations amplify volatility.

The yen’s depreciation revives carry-trade unwind risks, where investors borrow cheaply in Japan to invest elsewhere.

Overall, the crisis underscores vulnerabilities in debt-laden economies, potentially leading to steeper yield curves worldwide and renewed focus on fiscal discipline.

What US Investors Should Brace For

As this unfolds, US investors face elevated risks. Higher Treasury yields could compress stock multiples, particularly in growth-sensitive sectors like renewables and tech-driven energy solutions. A potential full-blown JGB crisis might force Japanese banks to sell US holdings, exacerbating yield spikes and renewing US-Japan trade tensions.

Strategies to consider: Diversify beyond bonds: Shift toward shorter-duration Treasuries or inflation-protected securities to mitigate rate hikes.

Monitor yen and carry trades: Yen weakness may boost US exporters but hurt importers; energy investors should hedge currency exposure.

Scale back risk: History shows rising yields often precede stock market corrections—position defensively, perhaps favoring value stocks or commodities like oil as a hedge.

Watch policy cues: The BOJ’s January meeting and the US Fed signals on rates will be pivotal. If Japanese capital repatriates, expect upward pressure on US borrowing costs.

Long-term opportunity?: Some analysts see overdone selling in JGBs, suggesting selective buying for yield-hungry portfolios, but caution prevails.

In summary, Japan’s bond spike is a stark reminder of debt’s perils in a post-zero-rate world. For US markets, it means bracing for higher yields and volatility, with energy investors particularly vigilant on global demand shifts. Stay informed as the February election approaches—this story is far from over.

Be the first to comment