Nvidia, after gaining $2.1 trillion YTD through July 10, gave up $418 billion or 12.6% since. Meta -13.6% in 5 days. Tesla should be kicked out of the Mag 7.

By Wolf Richter for WOLF STREET.

These numbers are just crazy when you actually think for one second about it: Since the high on July 10, over those five trading days, the Magnificent 7 – Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla – have lost $1.13 trillion in market capitalization. If that happened in Commercial Real Estate over a 12-month period it’s considered a massacre, calling for bailouts and rate cuts and whatnot. Here it’s just kind of a blip.

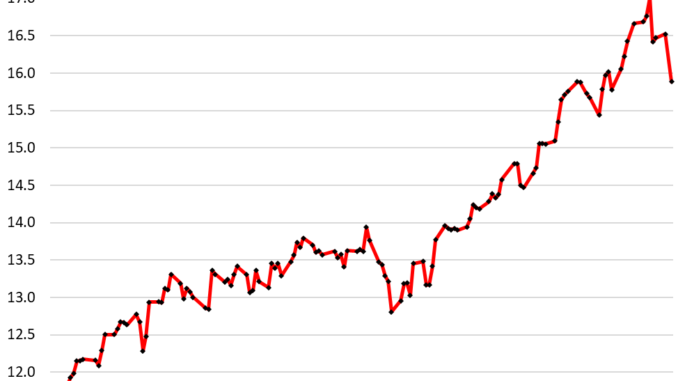

From the beginning of this year through the peak on July 10, the Mag 7 gained $5.0 trillion in market cap, exploding from $12 trillion to $17 trillion in less than seven months. $5 trillion is about the size of the entire debt of US Commercial Real Estate, all sectors of it combined, that’s now causing such headaches. And these seven stocks gained $5 trillion in less than seven months and then gave up $1.13 trillion in five days, and it’s of course no big deal because easy come, easy go, and it’s just a blip, and trillions don’t even matter here anymore.

In percentage terms, the Mag 7 gained 41% from the beginning of 2024 through the high on July 10, and then gave up 6.6% of their market cap in five days, no biggie, including the 3.2% drop today, the biggest so far this year:

Nvidia had gained the most (+172%), or $2.1 trillion YTD through July 10. But then its shares dropped by 12.6% over the past five days, including the 6.6% drop today. Its market cap dropped by $418 billion. In other words, it has given up 20% of that $2.1 trillion gain this year over the past five days. Easy come, easy go. No biggie.

Nvidia was briefly the most valuable stock in the universe. Today, with a market cap of $2.9 trillion, it was kicked out of the $3-trillion club, and has now dropped to third place, below Apple ($3.5 trillion) and Microsoft ($3.3 trillion).

The combined market cap of Apple, Microsoft, and Nvidia dropped by $650 billion in five days, and has now fallen below $10 trillion after the drop today, to $9.7 trillion, from $10.4 trillion on July 10.

Tesla gained the least this year through July 10 (+6.3%). And then, shares dropped 5.6% over the past five days and gave up all their gains of this year and are back where they’d started out the year.

It was kind of a funny year for Tesla. The stock fell hard for the first four months of the year, but since late April turned around and soared by 85% through the peak on June 10, before falling back, and today ending up where it had started the year.

Tesla doesn’t even belong into this lineup: It had been left behind. Its shares today at $248.49 are 40% below its all-time high of $414.50 in November 2021. It should be kicked out of the Mag 7.

Meta was up 49% in 2024 through July 10, but then lost the most of the Mag 7 over the past five days in percentage terms (-13.6%), including 5.7% today. In dollar terms, it lost $184 billion, the second-most behind Nvidia, after having gained $447 billion in 2024 through July 10.

If the Mag 7 combined market cap drops another 25% from today over the next x months, or by another $4 trillion – I mean, what’s a few trillion among friends – it would just bring the market cap back to the beginning of 2024. That kind of $4 trillion drop, after the $1.1 trillion drop over the past five days, would be the hugest loss ever for seven stocks in dollar terms, but it would just unwind six months of gains.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/