Last week, ice storms disrupted natural gas supplies to Mexico and so revived an existential question over how energy independent the country can and should be. But because Mexico’s independence is so often defined by its relationship to the United States, what started as an errant power outage quickly became a larger debate over the future of Mexico’s energy sector, infrastructure development and domestic politics as officials clamored for more energy self-sufficiency.

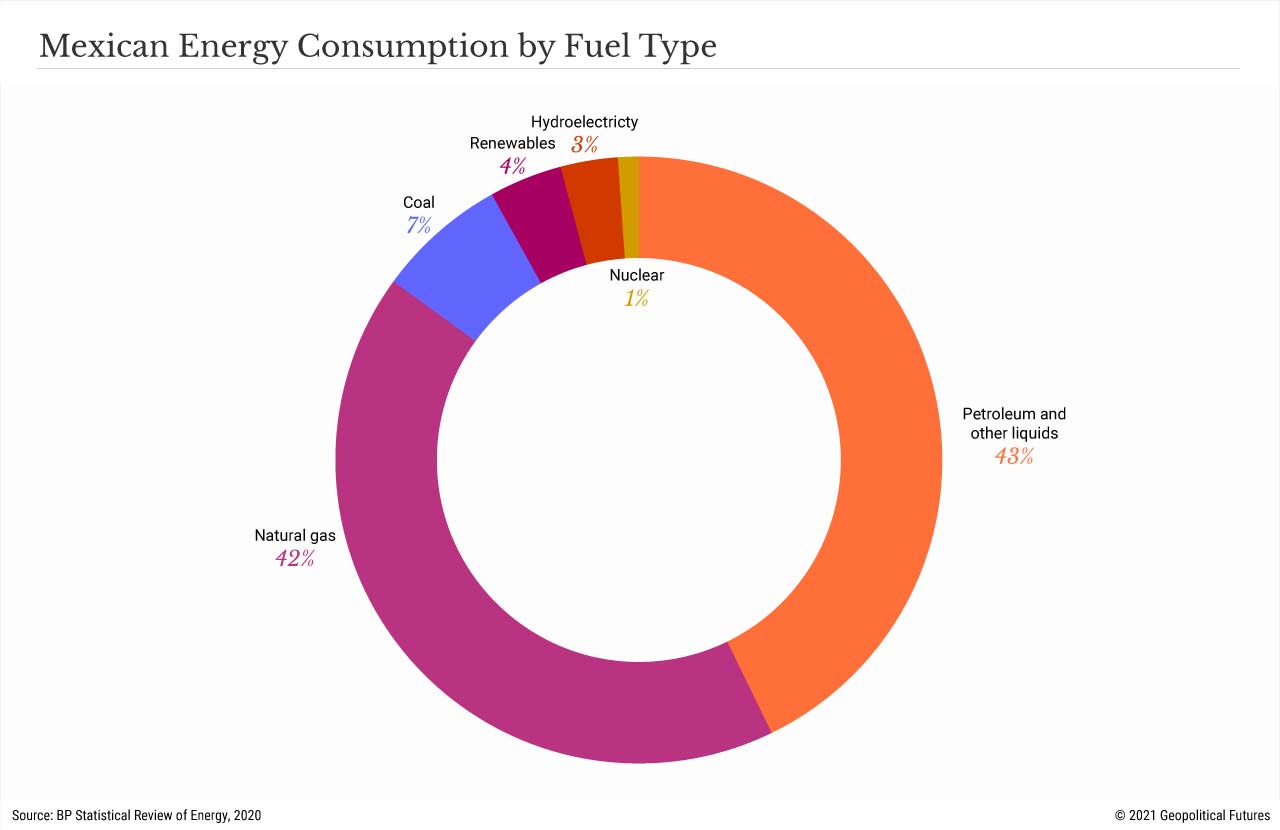

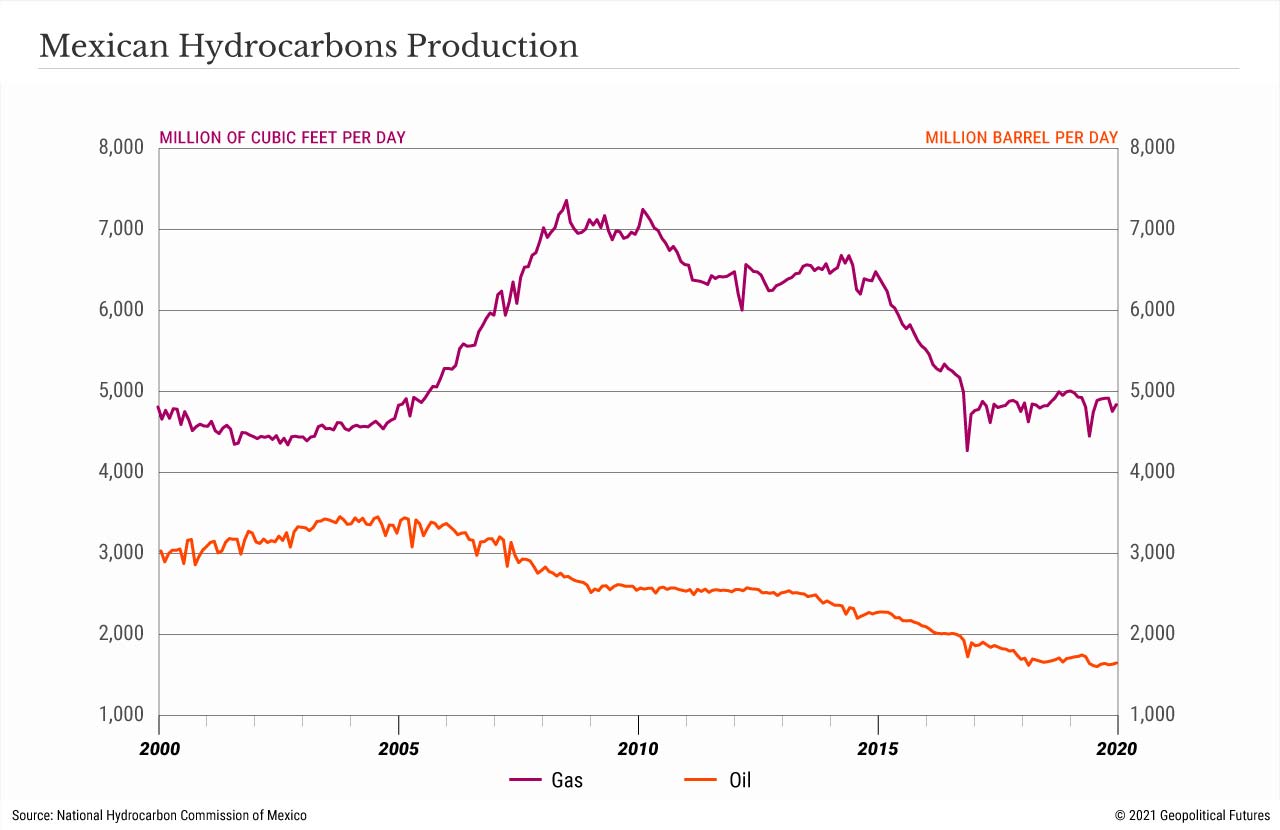

Their calls are hardly misplaced. State-run energy company Pemex has long focused primarily on oil, leaving the natural gas sector in a state of arrested development. What natural gas Mexico does produce is in decline. Modest deregulation has allowed for private investment and infrastructural improvement, but for now the country relies heavily on the U.S. to meet its natural gas needs. In fact, its northern neighbor accounts for about 70 percent of the natural gas consumed in Mexico, and 60 percent of the energy consumed by vital manufacturing hubs in the north is natural gas. Similarly, the U.S. meets nearly 75 percent of Mexico’s gasoline needs. (Though Mexico is an oil-producing country, it does not have the refining efficiency, ability or storage capacity to meet domestic demand with its own crude oil production.) In 2019, Pemex alone spent $14.75 billion on fuel imports; the country total is even higher once private importers have been factored in.

Energy is a historically sensitive issue in Mexico. U.S. and British oil companies dominated the country’s oil industry during its infancy, and were put in check only in 1917, when Mexico’s new constitution stipulated that the national government had ownership over all subsoil – that is, resources. A series of taxes and other regulatory measures favoring Mexico ensued, until finally in 1938 President Lazaro Cardenas simply expropriated the assets of nearly all the foreign oil companies operating in Mexico. The move reflected years of festering discontent among Mexicans with how the oil industry operated in their country – how profits were being sent overseas, how investment was lacking, how production was low, and how poor Mexican industry workers were. Shortly thereafter, the government formed Pemex and has played an influential role in its operations ever since.

With a past like this, it’s easy to see why energy independence means more than just a best-practice of diversification. There’s an inherent wariness between the U.S. and Mexico, which lost a lot of its territory to the U.S. in 1848 and which fell victim to intermittent invasions and occupations by U.S. forces up until the start of World War I. Past energy disputes make Mexico even more uneasy. After the 1938 expropriations, the U.S. threatened to stop buying Mexican silver and its oil companies embargoed Mexican oil. Exports fell to half their volume in a handful of years. The issue was not resolved until Mexico agreed to pay $29 million in compensation to U.S. companies in 1942. Now as then, Mexico’s dependence gives the U.S. a ton of leverage. Current disagreements between the countries are plenty manageable, but this kind of leverage means Mexico has a hard time acting from a position of strength if an unmanageable conflict erupts. Energy security is thus highly politicized.

It’s one thing to want independence, of course, and quite another to have it. Importing energy from other suppliers is simply not a viable option. Its proximity to the U.S. and its existing infrastructure make transport cheaper than from any other supplier. Higher prices on energy imports would drive up Mexico’s own production costs, making domestic markets more expensive and exports potentially less competitive.

In addition, the country’s state-owned oil company is in dire straits. Once the pride and joy of the country’s economy, Pemex is now a drain for the government. Crude oil production has been in decline since peaking in 2003, and the lackluster price of oil globally makes recovery difficult. Tax demands, mismanagement, barriers to reinvestment, pension plans and fuel theft have made Pemex operations inefficient and have left the company in debt to the tune of approximately $110 billion. The Mexican government has been pumping money in to keep the company afloat – and plans to provide another $3.5 billion this year – but has been unable to reverse its course.

The administration of Mexican President Andres Manuel Lopez Obrador is betting heavily on improving Mexico’s refining capacity. Its refineries are currently operating at 36.4 percent capacity, according to the energy office. (Lopez Obrador says Pemex refineries operate closer to 50 percent capacity.) Issues are due partly to supply and partly to the lack of upgrades. The Dos Bocas refinery project, for example, lies at the core of the government’s plans to solve the country’s refining shortcomings. Pemex owns the project, which will cost $31.3 billion over 20 years. The project’s potential value and return remain contested by members of the business community; those opposed believe the benefits are unrealistic. There is also concern over the lack of storage capacity for refined fuels.

for the rest of the story please subscribe to Geopolitical Futures

Geopolitical Futures is a great source of world thought leadership and information. Please subscribe to their services.

Winter storms were just the beginning.