Inventory gluts are resolved by lower prices that boost sales. But that part hasn’t started yet; the glut is still building.

By Wolf Richter for WOLF STREET.

It’s a good thing for new-car and new-truck buyers to go from inventory shortages, the odious addendum stickers we saw during the pandemic, spiking prices, and obscene profit margins by dealers and automakers to an inventory glut.

The inventory glut is starting to take on momentum. Incentive spending by automakers has been ramped up. Ultimately, inventory gluts are resolved by lower selling prices that stimulate higher unit sales as more customers find attractive deals. But that part hasn’t started yet; the glut is still building.

So far in 2024, new-vehicle retail sales are tracking at a seasonally adjusted annual rate of about 15.5 million units, the highest since before the pandemic, but that’s still well below the nearly 17 million new vehicles sold in 2019, which was down from the prior years.

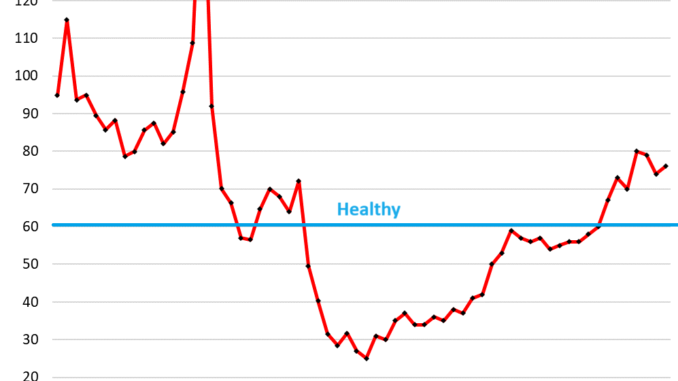

Days’ supply of new vehicles on dealer lots and in transit rose to 76 days for all brands combined, according to Cox Automotive. Sales volume has been recovering slowly, amid way-too-high prices, but inventories have surged to 2.84 million vehicles, which caused the increase in supply. Not included are Tesla and EV startups; they don’t have dealers, and Tesla doesn’t even disclose US inventory or sales.

Supply had hit 80 days in January. Many brands have over 90 days’ supply, and a bunch of them have over 100 days’ supply, and a few over 150 days, that’s where the glut is. We’ll get to them in a moment. Supply of 60 days is considered “healthy.”

Days’ supply by major brand: The brands of Stellantis in red, Ford’s brands in light blue, GM’s brands in green, and foreign brands – though many of the vehicles are manufactured in the US – in dark blue. Stellantis has a mega-inventory glut on its hands; as does Lincoln. A bunch of import brands are chasing them higher. The bold black vertical line marks 60 days supply:

New vehicle inventories are up. Inventories of new vehicles on dealer lots or in transit rose to 2.84 million vehicles as of May 2, up by 51%, or by 961,000 vehicles, from a year ago, and the highest since December 2020, according to data from Cox Automotive. Inventories have now more than tripled from the worst moments of the shortages in the fall of 2021.

By comparison: In 2019, new vehicle inventory averaged 3.66 million vehicles. But dealers were overstocked back then, and sales were about 10% higher than what they’re tracking in 2024 so far, and automakers’ incentive spending as a percent of MSRP was about double the current rate.

Incentives are up — but not nearly high enough. Automakers are now throwing incentives at their dealers and at consumers. And their captive lenders are buying down interest rates. For example, Ford Credit is offering 1.9% financing on F-150s.

Average incentive spending per vehicle sold in April has jumped by 57% year-over-year to $2,633, or about 5.3% of MSRP, according to estimates by J.D. Power.

That’s a big increase from very low levels during the pandemic, but it is still far from reaching the incentives seen in 2018 and 2019 when average incentives reached 10% of MSRP (such as in July of both years). So clearly, manufacturers, other than Stellantis, are not quite panicking just yet, and they’re still just dabbling with incentives. They loathe giving up their big-fat pandemic-era profit margins.

Prices are stuck. MSRPs have gotten raised year after year, and now incentives are designed to stimulate demand, but those incentives are still not high enough to make a visible dent in prices – as measured by both: by the average listing price and by the CPI for new vehicles.

The average listing price of new vehicles in April, at $47,333, was up a hair from a year ago, despite the increase in incentives, according to data from Cox Automotive. In other words, all those incentives are doing for now is papering over the average increase in MSRPs.

The average listing price had soared by 26% during the pandemic. The spikes in the chart are the Decembers, a big month for new vehicle sales, when Americans buy each other cars for Christmas, or whatever (always followed by a plunge in sales in January and February).

A lot of sales can come out of the woodwork if automakers throw enough incentives at buyers, but they’re still not doing it enough just yet:

The new-vehicle CPI inched down for the fourth month in a row and was down a hair year-over-year, also testimony of just how sticky new vehicle prices are, even as the used-vehicle CPI sagged in a historic way, giving up nearly half of the pandemic spike. The new vehicle CPI has barely changed since March 2023 after the 20% price surge during the pandemic.