In a stunning blow to the UK’s energy sector, 2025 is set to mark the first year since 1964 without any new exploratory oil wells being drilled in the British North Sea. This is yet another example of bad management and energy policies.

According to a Westwood Global Energy survey, no offshore exploration wells have been initiated this year, and none are planned for the remaining months.

This unprecedented halt is being squarely blamed on the Labour government’s aggressive policies, including a punishing 78% windfall tax on oil and gas profits and Energy Secretary Ed Miliband’s ban on new drilling licenses in untapped areas.

Industry leaders are sounding the alarm. Alyson Harding of Westwood Global Energy noted that investor sentiment has hit rock bottom due to the tax regime and policy uncertainties.

Robin Allan, chairman of the Association of British Independent Exploration Companies, called the government’s approach “exceptionally hostile,” arguing it sacrifices UK jobs, communities, tax revenue, and energy security in favor of imported fuels.

Shadow Energy Secretary Claire Coutinho went further, pinning the blame on Miliband and warning that this self-imposed dependency on foreign imports could be “the biggest act of economic self-harm in a generation.”

The contrast with neighboring Norway couldn’t be starker. Sharing similar geology, Norway has drilled 30 exploration wells so far in 2025, with up to nine more expected by year’s end, thanks to a more supportive regulatory environment.

Meanwhile, the UK is hemorrhaging potential: the North Sea holds up to 24 billion barrels of untapped oil and gas, but rapid depletion of existing fields means ongoing exploration is essential to maintain production.

UK imports 43 million tonnes of oil

Instead, Britain imported 43 million tonnes of crude oil and 31 million tonnes of refined products in 2024, while relying on foreign sources for most of its natural gas needs.

This drilling drought is no isolated incident—it’s a symptom of the UK’s headlong rush toward Net Zero, a policy framework that’s accelerating deindustrialization and teetering the nation toward fiscal collapse.

Sky-high energy prices, driven by green levies and the shift away from reliable fossil fuels, are crippling manufacturing and forcing companies to outsource operations abroad.

UK industrial electricity costs remain higher than in the US and much of Europe, making the switch to net zero even harder for businesses already struggling.

As a result, manufacturing output has plummeted, with energy-intensive sectors like chemicals and steel bearing the brunt.

The government’s Energy Profits Levy (EPL), hiked to 78%, exemplifies this “hidden net-zero tax,” deterring investment and hastening the oil and gas industry’s decline.

Offshore Energies UK estimates that reforming the EPL could unlock £137 billion in economic value and create 23,000 jobs by 2050—but current policies prioritize short-term revenue over long-term viability.

Energy prices have surged nearly 50% since 2021, following the cutoff of cheap Russian gas, leaving citizens with “heartbreaking” bills and industries in a death spiral.

Make UK, the manufacturing association, has urged the scrapping of climate levies on industrial energy to stem the bleed.

This pain is self-inflicted, as net-zero policies make energy more expensive and less secure.

Economists warn of years of industrial decline, with Britain gripped by rising factory costs that drive production overseas.

Much of that outsourcing heads to China, where a mix of coal, nuclear, and subsidized renewables keeps energy cheap and manufacturing dominant.

The UK’s reliance on Chinese imports for green tech—solar panels, batteries, and more—poses national security risks, as Labour’s net zero drive effectively hands economic leverage to Beijing.

Experts argue this “bonkers” plan puts Britain at China’s mercy, with investments in everything from nuclear to airports underscoring the vulnerability.

Zooming out, this reflects a growing bifurcation in global energy markets.

On one side, Net Zero adherents like the UK and Germany are deindustrializing, outsourcing to China, and facing economic stagnation—Germany’s GDP contracted 0.2% in 2024 with zero growth forecast for 2025, its industrial output down 21% from pre-2020 peaks.

Europe’s broader push, including regulations like the Carbon Border Adjustment Mechanism, threatens trade deals and widens the wealth gap with fossil-fuel powerhouses.

On the other hand, countries realigning around unsubsidized fossil fuels and nuclear—think the US under its energy dominance agenda, or even China blending coal with nuclear for cheap power—are pursuing “sane energy policies” for growth and financial freedom.

Global disruptions are fueling this divide, with some regions doubling down on fossils while others chase renewables at great cost.

China, ironically, benefits from both: leading in clean tech exports that drive global prices down 60-90% since 2010, while maintaining fossil dominance to undercut competitors.

U.S. Energy Secretary Chris Wright nailed it: Net Zero is a “colossal train wreck” and a path to “monstrous human impoverishment.”

For the UK, unless policies like the EPL are reformed—perhaps in the upcoming Budget—fiscal collapse looms as energy security erodes and manufacturing flees.

The government has floated cuts to industrial energy costs starting in 2027, potentially slashing bills by up to 25% for over 7,000 firms, but critics say it’s too little, too late.

As the world splits into energy realists and green dreamers, the UK’s North Sea fiasco serves as a cautionary tale: chasing Net Zero without a reality check risks not just energy independence, but economic survival.

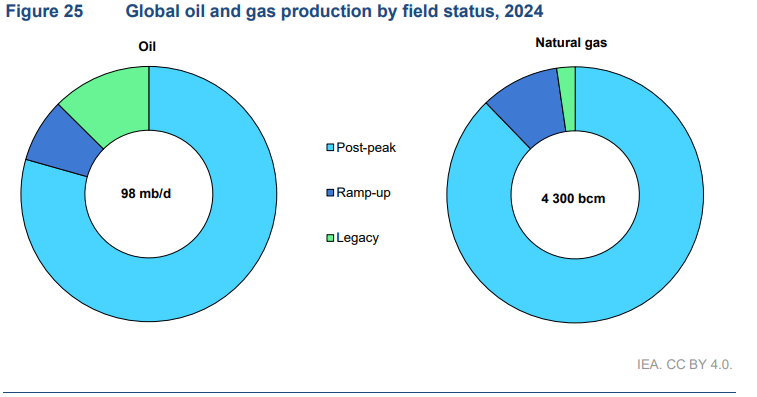

This brings up a bigger question. There are trillions needed in CapEx for new drilling just to meet normal decline curves, and we are not replacing or exploring for new areas. The chart below shows that legacy fields are in post-peak status. Meaning the fields ramping up are few and far between.

Energy Security starts at home, and National Security is the use of all forms of energy that don’t need subsidies to survive.

Got Questions on investing in oil and gas?

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack