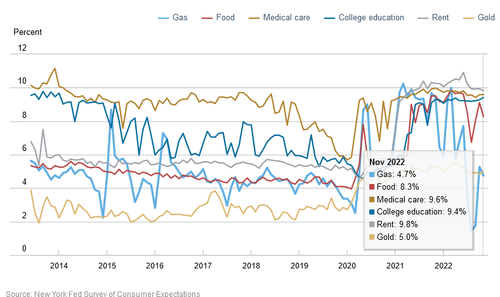

With long-term inflation expectations (those 3-Years ahead or more) peaking more than a year ago, and even shorter inflation expectations – at least according to the NY Fed Survey of consumers – now sliding after hitting a record high 6.8% in June and dropping alongside 2Y breakevens which recently hit the lowest level in 2 years…

… it is hardly a surprise that the latest just released NY Fed survey showed a continued drop in inflation expectations, as median one-, three-, and five-year-ahead inflation expectations decreased to 5.23%, 3.00%, and 2.3%. Of those, the former saw the biggest drop on record, plunging more than 0.7% from October’s 5.94% print, and well on their way to the pre-covid levels around 3.0%

Median inflation uncertainty–or the uncertainty expressed regarding future inflation outcomes–decreased at the short-term and medium-term horizons.

Separately, the median home price growth expectation dropped to 1.0% from 2.0%, the lowest reading since May 2020 a decrease which “was broad-based across education and income groups but most pronounced for respondents from the South” and yet still a 1% increase which is laughable when 30Y mortgages are about 6-7%…

… while labor market expectations paradoxically strengthened (apparently no tech workers were surveyed)…

… and household income growth expectations increased to 4.48%, up from 4.32% and a new series high. Not surprisingly, the increase was driven exclusively by respondents with no more than a high school education.

Amusingly, these improvements in income and labor market expectations are taking place even as a larger percentage of consumers, 11.79% vs 11.56% in prior month, expect to not be able to make minimum debt payment over the next three months.

Remarkably, despite the worst bear market in years, 35.7% of respondents, an increase from 33.9% last month, expect stocks to rise in the next 12 months. Then again, 40% expected higher stock prices one year ago: that didn’t work out too well.

Looking at various prices, over the next year consumers expect gasoline prices to rise 4.75%; food prices to rise 8.27%; medical costs to rise 9.59%; the price of a college education to rise 9.41%; rent prices to rise 9.82%

More in the full NY Fed survey which can be found here.

Loading…