ENB Pub Note: Michael and Stu are filming an episode of the ENB Deal Spotlight on this deal and pushing out on the ENB channels. Stay tuned for an evaluation of a public oil company buying private assets. This is critical for other operators and investors out in the market.

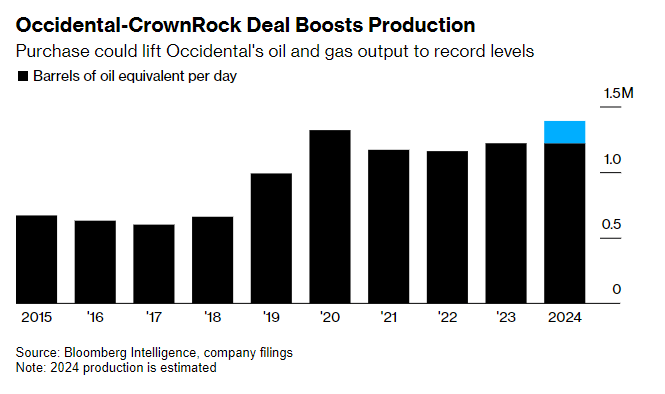

- It’s Occidental’s largest purchase since takeover of Anadarko

- Oil deals come as companies push to line up new drilling sites

Occidental Petroleum Corp. agreed to acquire Texas shale driller CrownRock LP in a cash-and-stock deal valued at about $10.8 billion as consolidation heats up in North America’s most prolific oil basin.

The transaction is expected to close in the first quarter of 2024, subject to regulatory approvals, Occidental said Monday in a statement. The company has lined up $10 billion of committed bridge financing through Bank of America Corp., according to an investor presentation. That’s expected to be replaced with more permanent financing including term loans and bonds.

Occidental, which also plans to issue about $1.7 billion in new shares to fund the deal, rose 0.7% at 9:37 a.m. in New York.

CrownRock, the third-largest closely held oil producer in the Permian Basin, has operations that complement assets Occidental acquired through its massive 2019 takeover of Anadarko Petroleum Corp. To secure that deal, Chief Executive Officer Vicki Hollub secured a $10 billion investment from Warren Buffett’s Berkshire Hathaway Inc., which is now Occidental’s biggest shareholder.

Berkshire is not involved in the CrownRock deal, Occidental Chief Executive Officer Vicki Hollub said in an interview on CNBC.

Occidental’s agreement with CrownRock comes as oil executives face pressure from investors to keep buybacks and dividends flowing even as the North American shale sector matures and growth slows. With many of the best production sites already tapped, companies flush with cash from the post-pandemic run-up in oil prices are increasingly buying rivals to secure new places to drill.

The deal follows Exxon Mobil Corp.’s $60 billion agreement to buy Pioneer Natural Resources Co. and Chevron Corp.’s pending $53 billion takeover of Hess Corp.

The terms calls for Occidental to assume $1.2 billion in debt held by CrownRock, giving the deal an enterprise value of about $12 billion. Occidental also said Monday it was increasing its dividend 22%, to 22 cents per share and initiating a $4.5 billion to $6 billion divestiture program to reduce debt.

The deal offers a clear boost to Occidental’s holdings in the prolific Permian Basin, Bloomberg Intelligence analysts Evan Lee and Vincent G. Piazza said in a research note. “Though the $12 billion price, including the assumption of $1.2 billion in debt, is on the higher end of our analysis, the region’s large acreage blocks offer scarcity value,” the analysts wrote.

Read More: Oil Titan Reshaping Texas GOP Targets a $10 Billion Windfall

CrownRock, based in Midland, Texas, is backed by private equity firm Lime Rock Partners and produces about 170,000 barrels of oil equivalent per day.

CrownQuest Operating LLC — which manages the assets of CrownRock — increased production 15% through the first six months of this year, according to industry data provider Enverus. That’s on top of last year’s 21% output growth and the 36% expansion in 2020, according to CrownQuest.

CrownRock is run by Tim Dunn, an influential Republican donor who has spent more than $20 million over the past decade or so to support conservative politicians.

He is poised to be a potent force in the 2024 election, pushing candidates in Texas further to the right in races up and down the ballot. Dunn has also backed Donald Trump before, contributing $300,000 to the Trump Victory joint fundraising committee in 2020. But so far he hasn’t donated to the former president this year.

In the run-up to the deal, Occidental’s corporate jet flew from Houston, where headquarters are located, to Omaha, Buffett’s home, on Nov. 27 and stayed grounded for about three hours. It was the second time Oxy’s jet visited Omaha in November, having not previously made the trip since May, flight data show.

Occidental’s financial adviser for the deal is BofA Securities, an affiliate of which is providing financing. Occidental’s legal adviser is Latham & Watkins LLP.

CrownRock’s joint-lead financial advisers are Goldman Sachs Group Inc. and TPH&Co, the energy business of Perella Weinberg Partners. The company’s legal adviser is Vinson & Elkins LLP.