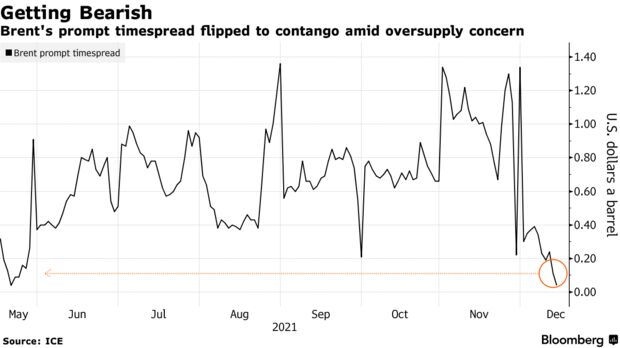

The oil market flashed its biggest bearish signal in months on Tuesday, indicating oversupply could be on the horizon through the first quarter of 2022.

Brent crude for February settlement flipped to trade at a discount to the March contract for the first time since March, excluding the days when the contracts expire.

The so-called prompt spread is actively traded by both physical and financial oil players, making it one of the most liquid parts of the oil futures curve and a gauge of near-term supply and demand balances.

The switch to negative territory – known as contango – could also deter investors who have a neutral view on oil from jumping into the market in the hopes of collecting yield from rolling their positions forward. When a market is in contango, the future price of the oil is above immediate prices, and so the investor will lose money when rolling contracts.

“Does it negatively impact sentiment? It does,” said Greg Sharenow, a portfolio manager focused on energy and commodities at Pacific Investment Management Co.

Longer-term investors are still unlikely to base decisions off moves in one spread since the market is still backwardated over an average 12-month period, he said.

The front-month Brent contract had surged to more than $1 a barrel over the second month in November as inventories across the world declined thanks to a resurgence in demand. But those draws were expected to slow due to seasonal factors and the market was due for a correction, traders said.

“I think it’s a moment for everyone to take a breather,” Sharenow said. “Whether this will be transient or not depends on your view on what OPEC decides to do and what they can do.” – Source: Bloomberg