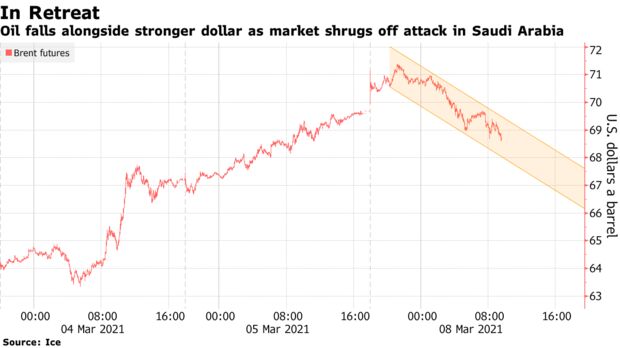

Oil slipped in London as the dollar strengthened and investors shrugged off an attack on the world’s largest crude terminal in Saudi Arabia.

Global benchmark Brent futures earlier surged above $71 a barrel, the highest since January 2020, before falling as much as 1.5%. The assault on a storage tank farm at the Ras Tanura terminal on Sunday was intercepted, Saudi Arabia said, and oil output appeared to be unaffected. Meanwhile, the Bloomberg Dollar Spot Index rose as much as 0.5% on Monday, reducing the appeal of commodities priced in the currency.

A much stronger U.S. dollar is “likely adding pressure to oil prices,” said Ryan Fitzmaurice, commodities strategist at Rabobank. “The recent trend higher in the dominant currency is becoming increasingly difficult to ignore.”

Oil has surged more than 30% this year as OPEC+ keeps a lid on production and demand is seen recovering with economies emerging from the coronavirus crisis. The rally quickened last week after the producer alliance made a surprise pledge to leave output steady in April, prompting a raft of investment banks to raise their price forecasts. Forward oil prices point toward further strength, with the Brent strip for 2022 rising as much as over $62 a barrel Monday to its highest intraday level since April 2019.

| PRICES |

|---|

|

Brent’s rally north of $70 earlier Monday may cause a headache for Asian refiners, which are warning that the rapid surge and spike in volatility will hurt demand and whittle away still-tight processing margins. Saudi Arabia has also boosted its official selling prices to buyers in the region for April.

Mideast Tensions

Saudi Arabia said the Ras Tanura site on the country’s Gulf coast was targeted by a drone from the sea. The terminal is capable of exporting about 6.5 million barrels a day — almost 7% of demand — and, as such, is one of the world’s most protected facilities. It’s the most serious attack on Saudi oil installations since a key processing facility and two oil fields came under fire in September 2019.

2 Trackbacks / Pingbacks

Comments are closed.